Navigating the Evolving Finance and HR Software Landscape: Insights from Q2 Earnings

The end of the earnings season is a prime opportunity to take a step back and assess the performance of finance and HR software stocks. This article delves into the key trends and standout players in this dynamic sector, offering a comprehensive analysis that goes beyond the surface-level numbers.Unlocking Organizational Efficiency: The Rise of Cloud-Based Finance and HR Solutions

Organizations across the globe are constantly seeking ways to enhance their operational efficiency, whether it's through streamlining financial planning, optimizing tax management, or streamlining payroll processes. The finance and HR software industry has emerged as a crucial enabler in this pursuit, benefiting from the widespread adoption of cloud-based, subscription-based software solutions that offer greater flexibility and ease of use compared to traditional on-premise enterprise software.Weathering Economic Shifts: Finance and HR Software Stocks Demonstrate Resilience

The 15 finance and HR software stocks tracked in this analysis reported a satisfactory Q2, with revenues beating analysts' consensus estimates by 1.6%. However, next quarter's revenue guidance fell slightly short by 0.5%. This performance comes against the backdrop of the Federal Reserve's decision to cut its policy rate by 50 basis points in September 2024, marking the end of its most aggressive inflation-fighting campaign since the 1980s.Despite the economic uncertainties, finance and HR software stocks have demonstrated remarkable resilience, with share prices rising by an average of 5.7% since the latest earnings results. This resilience underscores the sector's ability to weather macroeconomic challenges and continue delivering value to customers.Flywire: Navigating the Complexities of Cross-Border Payments

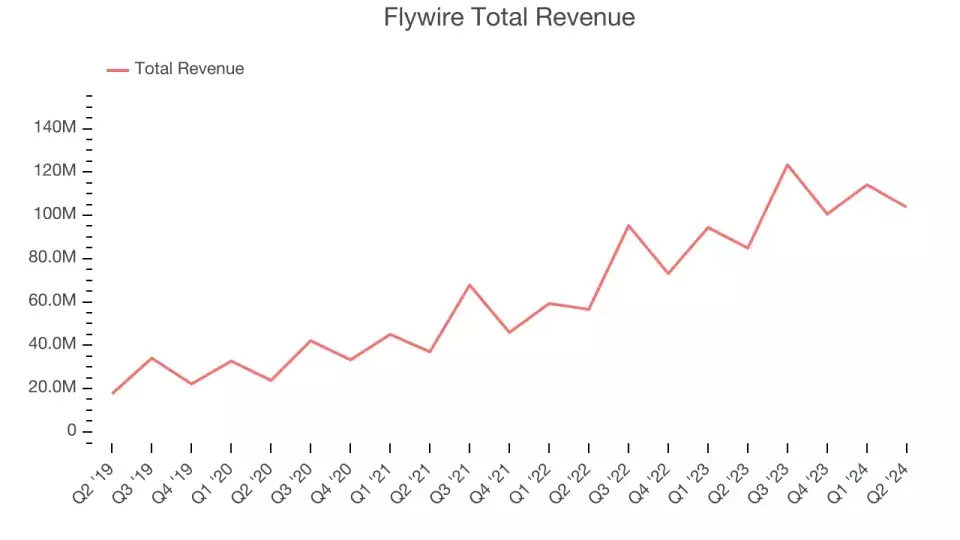

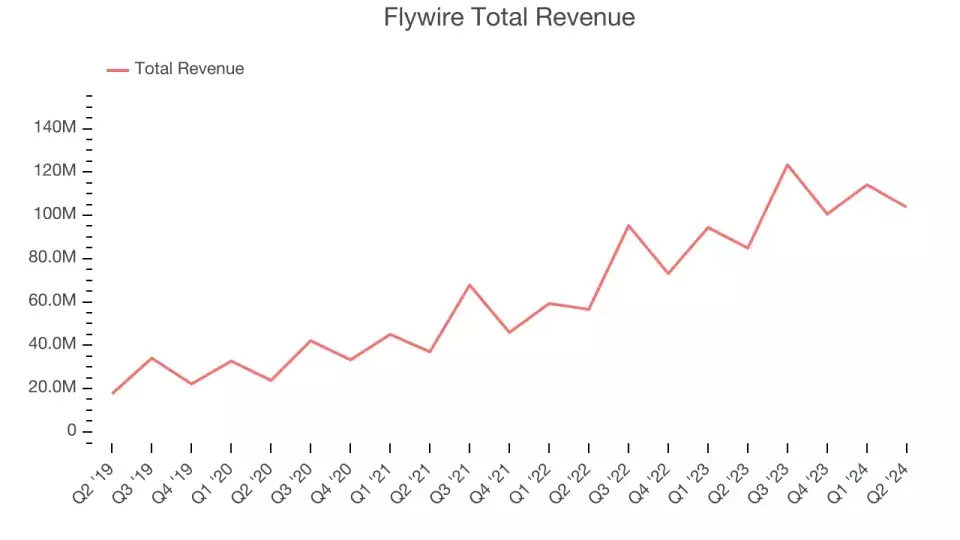

Flywire (NASDAQ:FLYW) is a standout performer in the finance and HR software space, having reported revenues of $103.7 million, a 22.2% year-over-year increase that exceeded analysts' expectations by 3.3%. Originally created to process international tuition payments for universities, Flywire has evolved into a cross-border payments processor and software platform focused on complex, high-value transactions in sectors like education, healthcare, and B2B payments."Our second quarter results demonstrate resilient performance across the business where we signed more than 200 new clients and grew revenue by 22% and revenue less ancillary services by 26% year-over-year, despite revenue headwinds related to the ongoing Canadian government actions involving student study permits," said Mike Massaro, CEO of Flywire.Flywire's impressive revenue growth outpaced the broader group, but investor expectations may have been even higher, leading to a 7.3% decline in the stock price since the earnings report. The company's ability to navigate the complexities of cross-border payments and continue expanding its client base positions it well for future growth, making it a stock worth considering for investors seeking exposure to the finance and HR software sector.Zuora: Powering the Subscription Economy

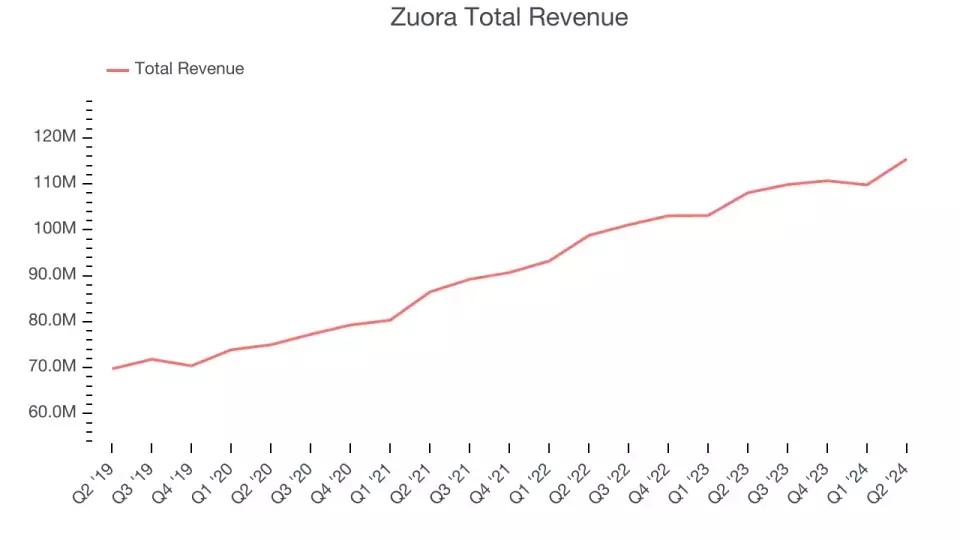

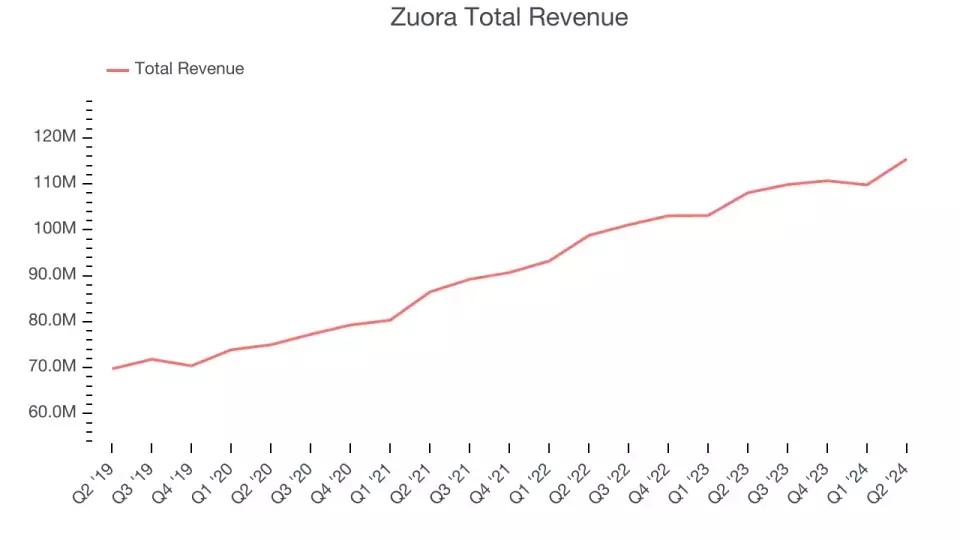

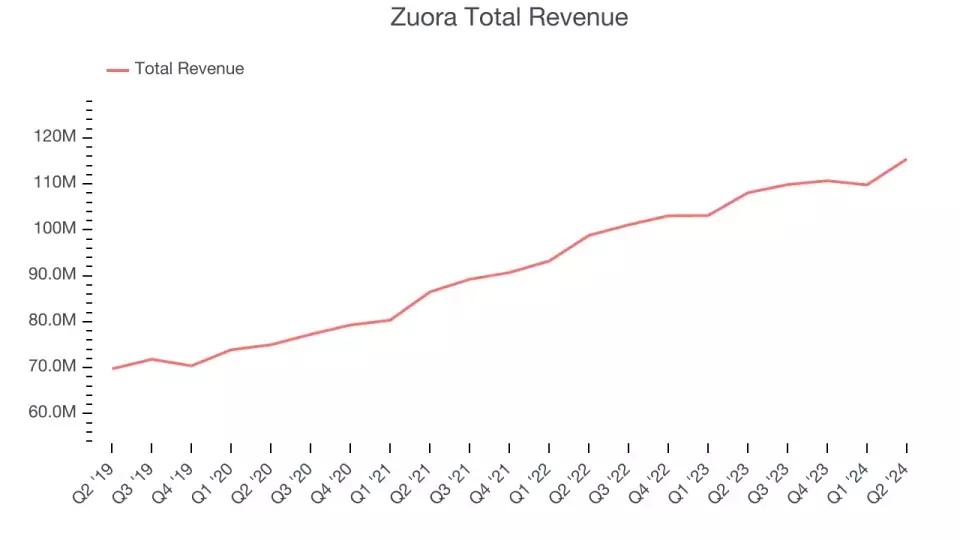

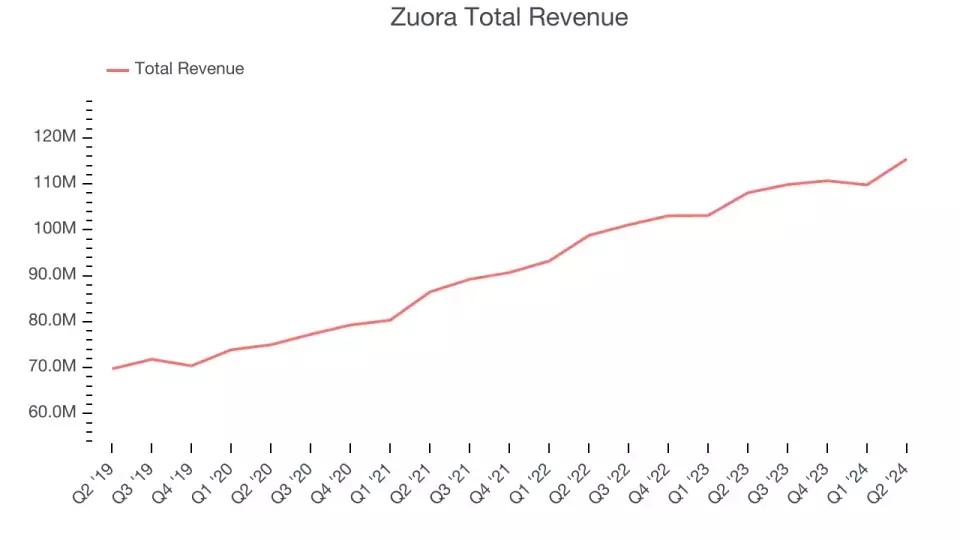

Zuora (NYSE:ZUO), founded in 2007, offers a software-as-a-service platform that enables companies to bill and accept payments for recurring subscription products. In Q2, Zuora reported revenues of $115.4 million, a 6.8% year-over-year increase that outperformed analysts' expectations by 2.5%. The company's strong performance, including an impressive beat of analysts' billings estimates and full-year revenue guidance exceeding expectations, has been well-received by the market, with the stock up 3.6% since the earnings release.Zuora's success in the subscription economy, a rapidly growing segment of the business landscape, underscores the increasing demand for flexible, cloud-based billing and payment solutions. As more companies embrace the subscription model, Zuora's platform is poised to continue playing a crucial role in enabling these businesses to manage their recurring revenue streams effectively.Global Business Travel: Navigating the Post-Pandemic Recovery

Global Business Travel (NYSE:GBTG), with close ties to American Express, is a comprehensive travel and expense management services provider to corporations worldwide. In Q2, the company reported revenues of $625 million, a 5.6% year-over-year increase that fell short of analysts' expectations by 1.1%. Despite the mixed results, the stock has surged 25.4% since the earnings release, indicating that investors are optimistic about the company's ability to navigate the post-pandemic recovery in the corporate travel sector.The resilience of Global Business Travel's stock performance underscores the market's confidence in the company's long-term prospects. As businesses resume their travel activities and seek efficient ways to manage their corporate travel expenses, Global Business Travel's comprehensive services and strong industry relationships could position it for continued growth in the coming quarters.Marqeta: Innovating in the Card Issuing Space

Marqeta (NASDAQ:MQ), founded by CEO Jason Gardner in 2009, is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards. In Q2, the company reported revenues of $125.3 million, a 45.8% year-over-year decline that nonetheless topped analysts' expectations by 3.1%.While Marqeta had the slowest revenue growth among its peers, the company's innovative card issuing solutions continue to attract attention from the market. The stock is up 2% since the earnings report, indicating that investors see potential in Marqeta's ability to disrupt the traditional card issuing landscape and provide businesses with more flexible and customized payment solutions.BlackLine: Automating Accounting and Finance Tasks

BlackLine (NASDAQ:BL), founded in 2001 by software engineer Therese Tucker, one of the few women founders to take their companies public, provides software for organizations to automate accounting and finance tasks. In Q2, the company reported revenues of $160.5 million, a 11% year-over-year increase that surpassed analysts' expectations by 1.4%.BlackLine's strong performance, which included accelerating customer growth and full-year revenue guidance exceeding analysts' expectations, has been well-received by the market, with the stock up 26% since the earnings release. The company's ability to help organizations streamline their accounting and finance processes through automation is a key driver of its success, as businesses continue to seek ways to improve efficiency and reduce manual, error-prone tasks.As the finance and HR software landscape continues to evolve, the standout performers in this analysis demonstrate the sector's ability to adapt to changing market conditions and deliver value to their customers. From Flywire's expertise in cross-border payments to Zuora's leadership in the subscription economy, these companies are at the forefront of driving innovation and efficiency in the finance and HR software space.