AGNC Investment's eye-catching 14% dividend yield is a major draw for many, yet the true nature of this mortgage REIT's investment proposition lies beyond just its dividend payouts. Unlike traditional real estate investment trusts that prioritize predictable income, AGNC focuses on generating total shareholder returns, a strategy that incorporates both dividends and capital appreciation, but may lead to dividend volatility. Investors should carefully consider their financial goals and risk tolerance before committing to this unique high-yield opportunity.

Understanding AGNC Investment: A Deep Dive into its Business Model and Investment Implications

AGNC Investment, a mortgage real estate investment trust (mREIT), has consistently captured investor interest due to its exceptionally high dividend yield, which currently stands at an impressive 14%. This figure dwarfs the S&P 500's average yield of around 1.2% and even exceeds the typical REIT yield of 3.9%. However, discerning investors understand that a high dividend yield doesn't always translate to a suitable investment for every portfolio, especially for those primarily seeking consistent income.

Headquartered in the United States, AGNC Investment operates by acquiring mortgage-backed securities, which are essentially bundles of residential mortgages transformed into tradable financial instruments. The company strategically employs leverage to amplify its returns, a common practice in the mREIT sector. Unlike traditional REITs that own and manage physical properties, AGNC's value is intrinsically linked to its portfolio of mortgage securities, a metric it transparently reports quarterly as tangible net book value per share. This operational distinction makes AGNC more akin to a mutual fund specializing in mortgage securities than a conventional real estate holder.

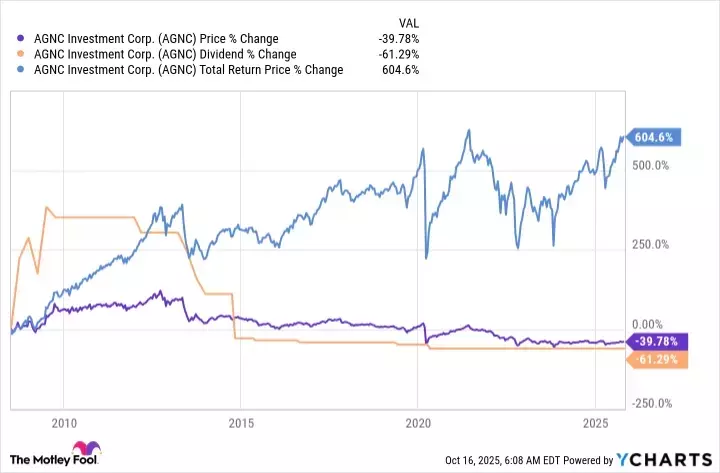

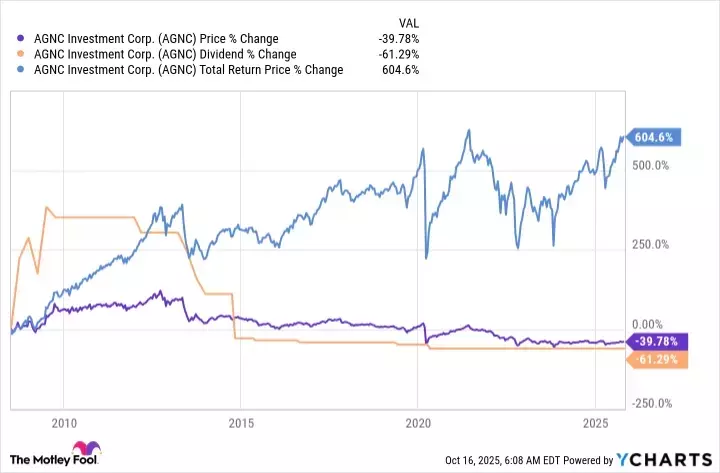

A critical nuance lies in AGNC Investment's stated objective: to deliver "favorable long-term stockholder returns with a substantial yield component." This goal diverges from many traditional REITs, such as Realty Income, which explicitly aim to provide "dependable monthly dividends." While both involve dividends, AGNC's emphasis on 'total return' implies that reinvesting dividends is often necessary to realize the full benefit of the investment. For individuals relying on dividend income for living expenses, this distinction is paramount. Historical data reveals that while AGNC has generally succeeded in generating total returns, its dividend payments and stock price have experienced significant fluctuations and a gradual decline over time. Consequently, an investor who merely collects dividends without reinvesting might find themselves with both reduced income and diminished capital over the long term.

Therefore, AGNC Investment is not inherently a 'bad' company, but its suitability depends heavily on the investor's profile and objectives. It is less ideal for those seeking a stable, predictable income stream. Instead, it might appeal more to sophisticated investors who prioritize total return and are comfortable with a strategy that involves active asset allocation and managing potential volatility. The complexity of its business model, despite its REIT classification designed for tax-efficient income distribution, underscores the importance of thorough due diligence. Relying solely on the allure of a large yield without understanding the underlying mechanics and strategic objectives of AGNC Investment could lead to disappointment for income-focused investors.

This case vividly illustrates the importance of understanding the core business model and stated objectives of any investment, particularly when high yields are involved. While AGNC Investment offers an attractive yield, it serves as a powerful reminder that "yield" alone does not define an investment's value or suitability. Diligent research into a company's operational structure, financial goals, and historical performance is essential to align investment choices with personal financial objectives and avoid potential pitfalls. For income-seeking investors, a stable dividend history and explicit commitment to consistent payouts should be prioritized over merely the magnitude of the yield.