As a former school teacher, I was thrilled to join the Tax Justice Network and delve into the profound impact of tax injustice on students and educators worldwide. This is a topic that, surprisingly, remains largely unexplored, despite its far-reaching consequences. It's a subject that those in power often try to obscure, hoping to maintain their influence without accountability. But no more – it's time to shed light on this critical issue and empower the people it affects most.

Uncovering the Hidden Cost of Inequality

The Intersection of Tax Justice and Education

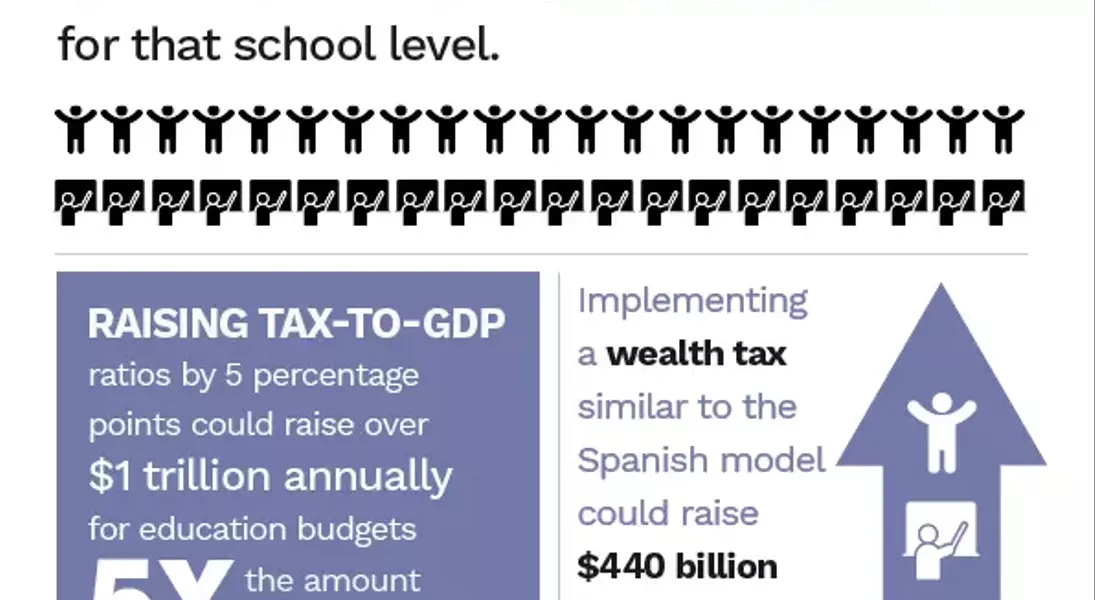

Navigating the complex interplay between tax justice and education financing can be daunting, but it's a crucial step in understanding the systemic barriers that deny millions of children access to quality education. By exploring this intersection, we can uncover the root causes of educational inequity and chart a path towards a more just and prosperous future.Modeling a Brighter Future

What if our public education systems were built upon fair and equitable tax policies that prioritize human rights and address societal disparities? This report models such a scenario, painting a vivid picture of the transformative potential of tax justice in education. From improved learning outcomes to enhanced teacher support and student opportunities, the possibilities are both inspiring and attainable.Demanding Accountability

The findings of this report are undoubtedly enraging – the rights of countless children have been denied due to political choices that favor the wealthy few over the common good. But this anger is a necessary catalyst for change. By channeling this outrage into collective action, we can compel our governments to fulfill their obligations and secure the educational futures of students and teachers worldwide.Collaborative Solutions

Tackling the intersection of tax justice and education requires a multifaceted approach. This report highlights the importance of intersectoral collaboration, bringing together experts and advocates from both the tax justice and education policy movements. Only by working in concert can we elevate this critical issue and drive the policy changes needed to create a more equitable and prosperous world.A Roadmap for Change

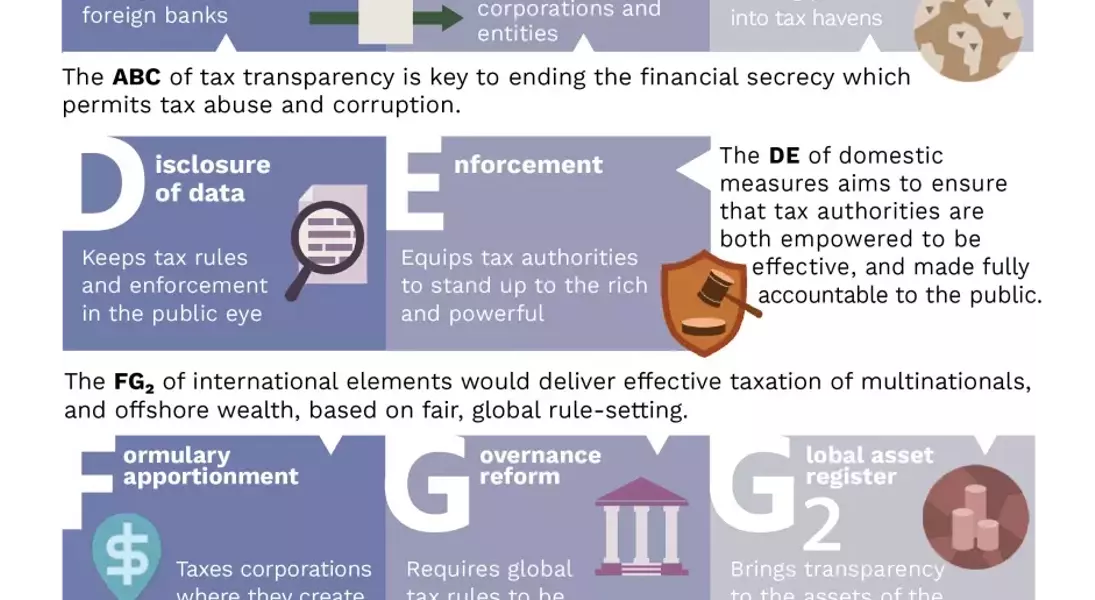

The report delves into a comprehensive set of policy solutions, from the national to the international level, that can empower communities to demand immediate action from their governments. From the ABCs of tax justice to innovative financing mechanisms, these practical recommendations provide a clear path forward for those seeking to secure a brighter future for students and teachers alike.Inspiration Amidst Injustice

Discussing the harsh realities of educational inequity and tax injustice can understandably evoke feelings of anger and frustration. But it's crucial to hold onto the inspiration that drives us to create change. This report illuminates the exciting possibilities that await us when we secure just tax policies – a future where the rights and opportunities of all children are protected and celebrated.You May Like