As the cost of higher education continues to soar, middle-income families are finding themselves caught in a financial squeeze. Earning too much to qualify for need-based aid, yet unable to simply write a check for tuition, these families are increasingly feeling the strain. However, a growing number of colleges are stepping up to address this challenge, offering targeted financial assistance to help make their institutions more accessible to this crucial demographic.

Bridging the Gap: Colleges Cater to Middle-Income Families

Tackling the Tuition Tightrope

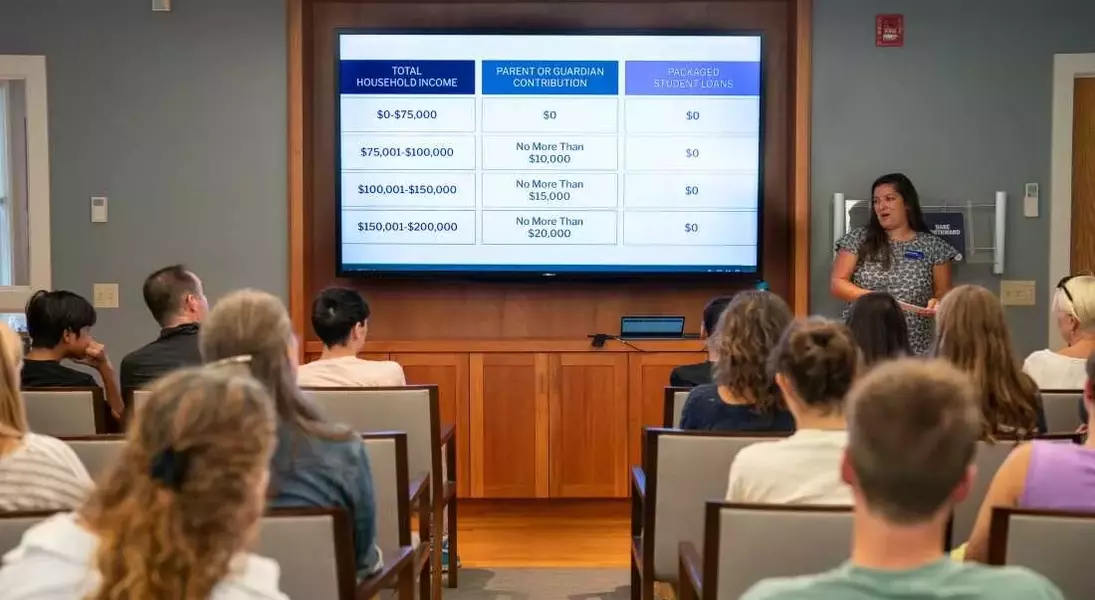

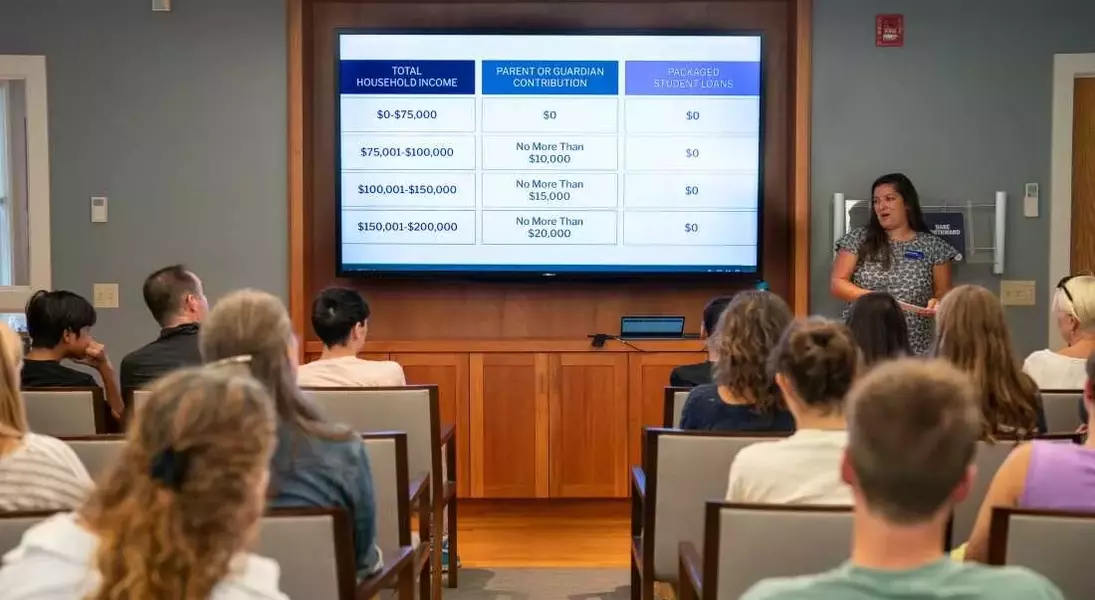

For families like the Kaysers, the prospect of covering college costs on a teacher's salary is a daunting one. Emily Kayser, a New York resident, contemplates what she might need to sell to afford her son Matt's education at Colby College in Maine. This dilemma is not unique, as middle-income Americans have borne a disproportionate share of college price increases in recent years. The net cost of a degree has risen by 12 to 22 percent for this group since 2009, compared to just 1 percent for lower-income families.Recognizing the financial strain on middle-income households, a handful of colleges are taking action. Colby College, for instance, has announced a program that will cap the cost of tuition, room, and board at $10,000 per year for families earning up to $100,000, and $15,000 for those with incomes between $100,000 and $150,000. This represents a significant discount from the current net price of up to $53,000 per year for these income brackets.Easing the Anxiety of College Costs

The anxiety surrounding college affordability is palpable among middle-income families, and it's having a tangible impact on enrollment. The proportion of students from these households on U.S. campuses has declined from 45 percent in 1996 to 37 percent in 2016, even as they make up 52 percent of the population. Colleges are keenly aware of this trend and the need to appeal to this crucial demographic.Colby's president, David Greene, acknowledges the "extraordinary discontent" among middle-income families about the value proposition of higher education relative to its cost. The college's new program aims to provide a "sense of relief and calm" for families like the Kaysers, who were previously overwhelmed by the prospect of financing their child's education.Simplifying the Financial Aid Maze

Another challenge facing middle-income families is the disconnect between the sticker price of colleges and the actual cost they can expect to pay. Many prospective students and their parents are frustrated by the "overly byzantine and complex system" of financial aid, as Colby's president puts it. Colleges are now making efforts to simplify the process and provide more transparency.Institutions like Colby are working to clearly communicate the maximum amount a student will be charged based on their family's income, rather than relying on the often-confusing calculations of the Free Application for Federal Student Aid (FAFSA). This approach aims to alleviate the misconception that financial aid is only available to lower-income students, when in reality, middle-income families can also qualify for various forms of assistance.Targeted Scholarships and Initiatives

In addition to Colby's program, other colleges are also stepping up to support middle-income families. Rice University in Houston is seeking to raise $150 million to continue a scholarship program that provides full-tuition coverage for undergraduates from families earning between $75,000 and $140,000. Liberty University in Virginia has introduced a "Middle America Scholarship" offering up to $6,395 per year to families with incomes between $35,000 and $95,000.Grinnell College in Iowa is taking a different approach, offering scholarships to address the "felt" financial need of middle-income families, recognizing that the FAFSA calculations may not accurately reflect their true ability to pay. Colorado College has also found success in limiting the cost of room and board for Colorado families with annual incomes between $60,000 and $125,000.Balancing Priorities and Preserving Access

While the focus on supporting middle-income families is understandable, some advocates caution that colleges should not neglect their commitment to low-income students. The Institute for Higher Education Policy calculates that a typical middle-income family must devote 35% of their annual household income to sending a child to college for a year, while for the lowest-income Americans, the cost is equivalent to nearly one-and-a-half times their annual income.Institutions must strike a delicate balance, ensuring that their efforts to attract middle-income students do not come at the expense of maintaining access and support for their most financially vulnerable applicants. As colleges continue to explore innovative ways to address the affordability crisis, it will be crucial to prioritize equity and preserve opportunities for students from all socioeconomic backgrounds.