Unlock the Secrets of the Nasdaq Futures with this Insightful Analysis

Tracing the Rally from the 10.1.2024 Low

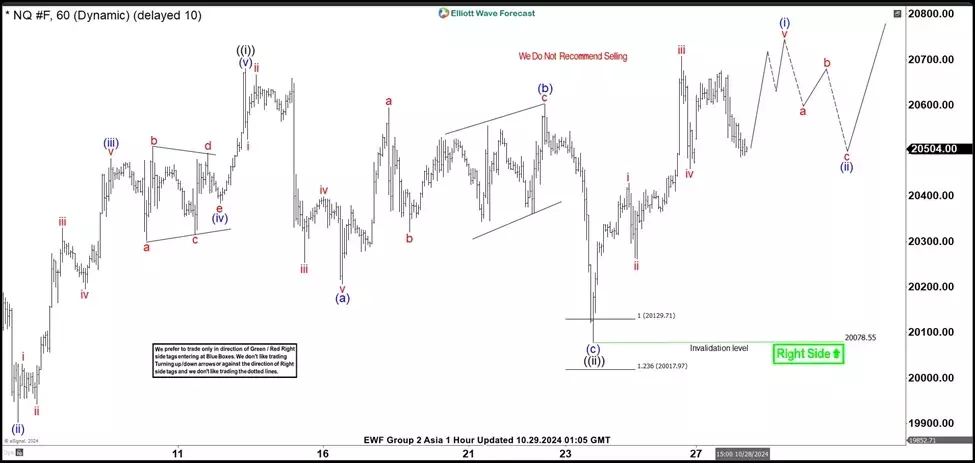

The rally from the 10.1.2024 low in the Nasdaq Futures (NQ) is unfolding as a five-wave Elliott Wave structure. The first wave, wave ((i)), reached a high of 20680, as shown on the 1-hour chart. The subsequent dips in wave ((ii)) have followed a classic zigzag Elliott Wave pattern, with wave i ending at 20525, wave ii at 20666.75, wave iii lower at 20254, and wave iv rally at 20398.50. The final leg, wave v, concluded at 20206.25, completing wave (a).The market has now resumed its upward trajectory in wave ((iii)), with an internal subdivision forming an impulse pattern. From the wave ((ii)) low, wave i reached 20428.5, wave ii retraced to 20261.75, and wave iii higher ended at 20707.25. The current wave iv pullback is proposed to be complete at 20460. As long as the pivot at 20078.55 remains intact, dips are expected to find support in the 3, 7, or 11 swing, paving the way for further upside potential.

Uncovering the Fibonacci Extensions

The potential target for the ongoing rally is the 100% to 161.8% Fibonacci extension of wave ((i)), which comes in the 20942.3 to 21473.1 area. This suggests that the market may have significant upside potential, provided the current wave structure continues to unfold as anticipated.By closely monitoring the Nasdaq Futures (NQ) and the underlying Elliott Wave patterns, investors can gain a deeper understanding of the market's dynamics and make more informed trading decisions. The ability to identify the various wave structures and their potential targets can provide a valuable edge in navigating the often-volatile world of futures trading.

Leveraging the Elliott Wave Approach

The Elliott Wave theory is a powerful tool that can help traders and investors anticipate market movements and capitalize on emerging trends. By analyzing the wave patterns and their underlying structures, market participants can gain insights into the market's psychology and the potential direction of future price movements.In the case of the Nasdaq Futures (NQ), the short-term Elliott Wave view suggests that the market is currently in the midst of a larger upward trend, with the potential for further gains. By understanding the wave structure and the key support and resistance levels, traders can position themselves to take advantage of the market's fluctuations and potentially achieve their investment objectives.

Navigating the Nasdaq Futures with Confidence

The Nasdaq Futures (NQ) market is a dynamic and complex environment, but by leveraging the power of Elliott Wave analysis, investors can navigate it with greater confidence and precision. This comprehensive analysis provides a roadmap for understanding the current market conditions and identifying potential opportunities for growth.Whether you're a seasoned trader or a newcomer to the futures market, this in-depth exploration of the Nasdaq Futures (NQ) and its Elliott Wave patterns can serve as a valuable resource in your investment journey. By staying informed and adapting your strategies to the evolving market landscape, you can position yourself for success in the ever-changing world of financial markets.