Unlocking Lucrative Opportunities Amidst Shifting Economic Tides

The Basis Trade Comeback

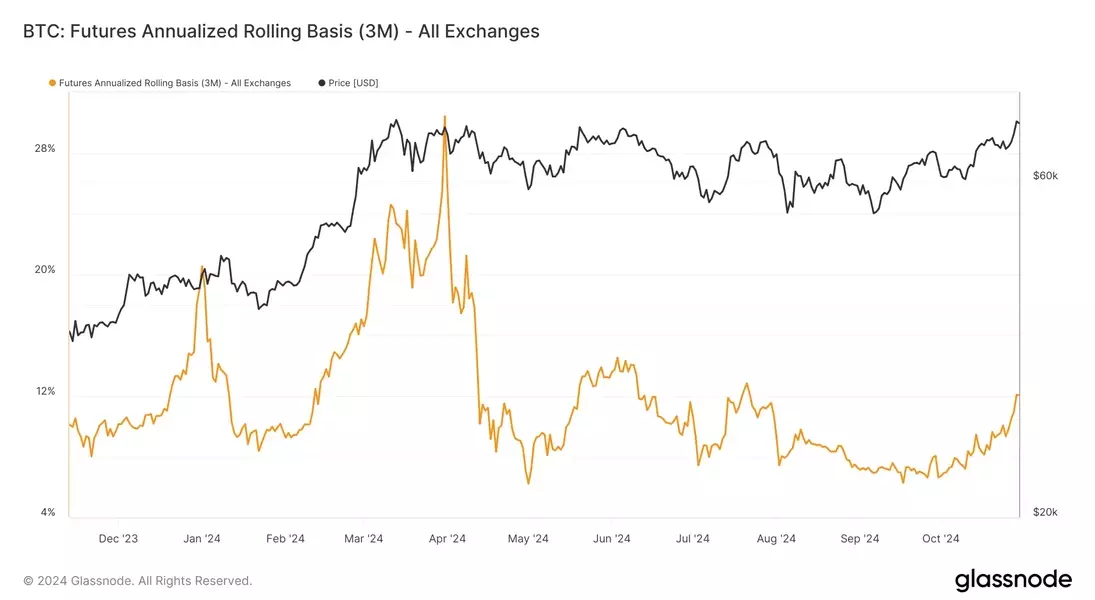

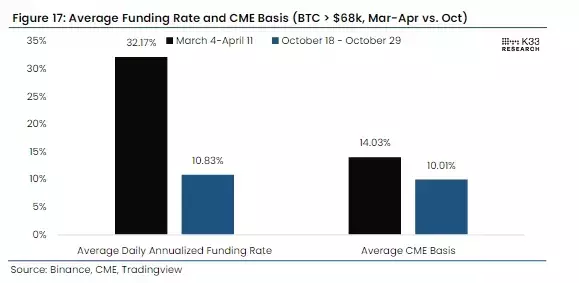

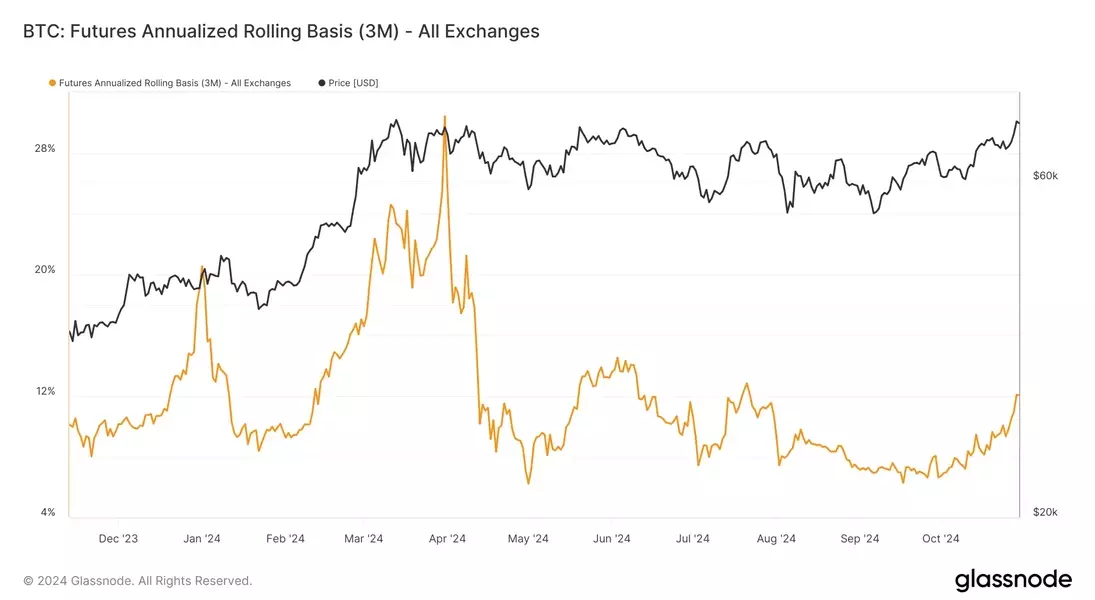

The Bitcoin basis trade, a strategy typically favored by hedge funds and asset managers, has made a strong comeback in recent weeks. The basis premium, which measures the difference between the spot price of BTC and the price of BTC futures contracts, has more than doubled in October, reaching 12% as of October 31st. This surge in the basis premium can be attributed to the increasing participation of hedge funds in the market.During the peak of the market frenzy in March, when Bitcoin reached its all-time high of $73,700, the basis premium had topped 14%, accompanied by funding rates soaring above 30%. However, the current market environment presents a different picture. According to Mathew Sigel, the head of digital assets research at VanEck, the euphoria that characterized the previous market peak is not present today. "Past BTC peaks have coincided with surging perp premiums, hardly the environment today," Sigel noted, adding that the current spot trading volumes are only half of what they were in March/April, indicating a more measured approach from retail participants.

The Fed's Influence on the Basis Trade

The rising Bitcoin basis trade has been linked to the ongoing Federal Reserve rate cuts, according to James Van Straten, a Bitcoin analyst. Van Straten explained that the lower interest rates have made the Bitcoin basis trade a more attractive option, offering higher returns compared to traditional investment opportunities."This is over double the current Fed Funds effective rate of 5%, in addition to the Fed cutting further in the next 3 months. I would assume the use of the 'basis trade' will only increase," Van Straten stated, highlighting the potential for continued growth in this trading strategy as the Fed maintains its accommodative monetary policy.

Institutional Dominance in the Futures Market

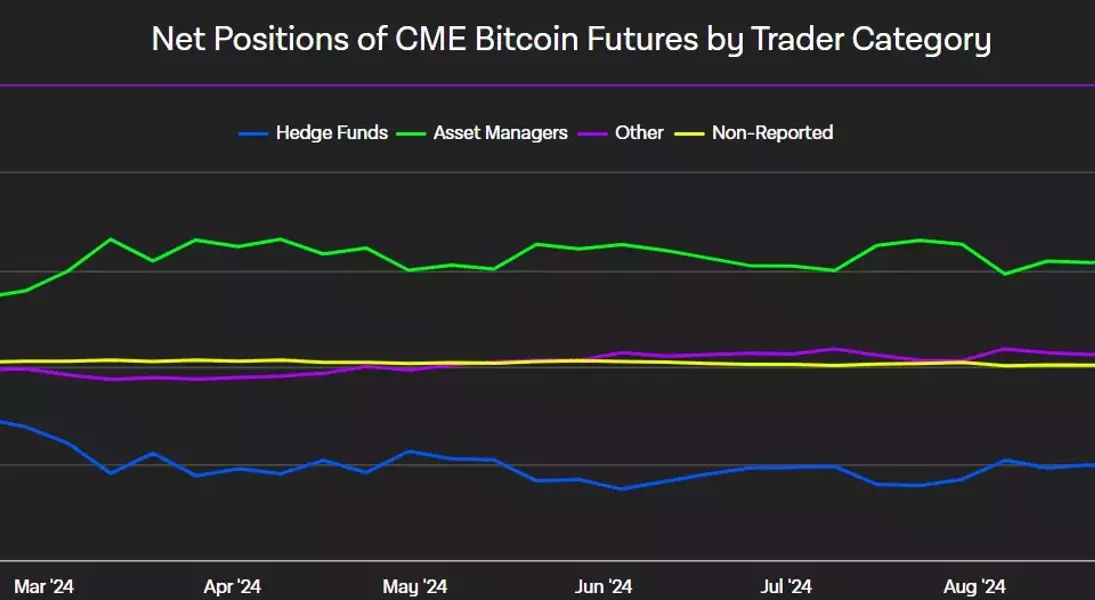

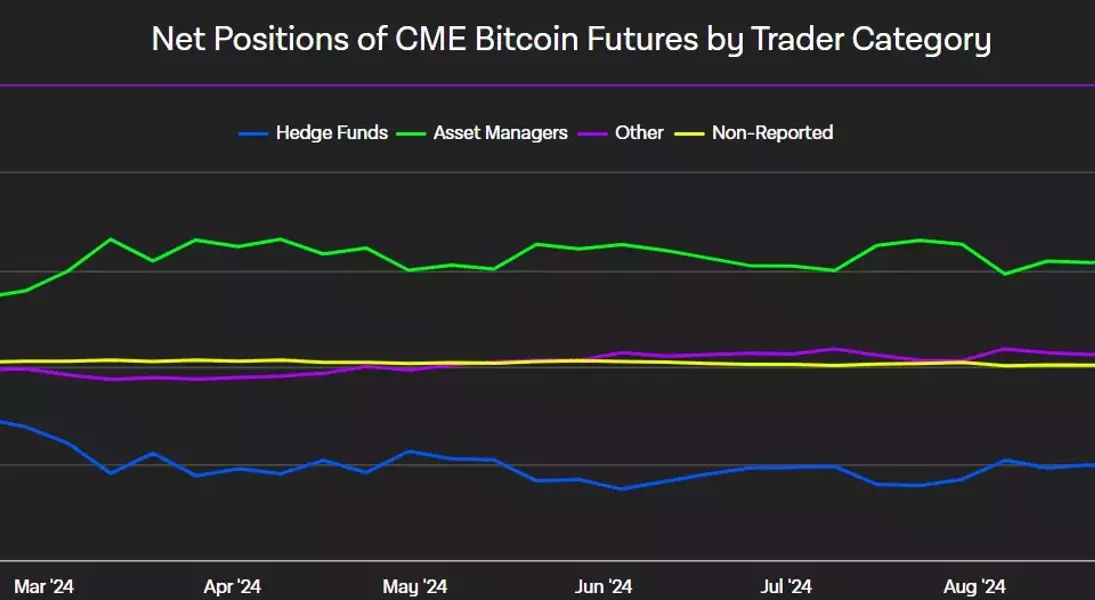

The surge in the Bitcoin basis trade has been accompanied by a significant increase in the overall Bitcoin Open Interest (OI), which has reached a new all-time high of $43 billion. This OI is dominated by the CME futures market, which accounts for $12.69 billion, indicating a strong institutional presence in the cryptocurrency derivatives space.Further analysis of the CME Futures market positioning reveals that hedge funds (represented by the blue line) have taken a net short position of $6.84 billion, suggesting they are actively hedging against potential Bitcoin price declines. This hedging activity by hedge funds is a key driver behind the widening basis trade premium, as they seek to lock in profits by selling futures contracts at higher prices.

Potential Implications and Cautionary Signals

The growing basis trade activity and the institutional dominance in the Bitcoin futures market could have broader implications for the cryptocurrency market. On the one hand, the increased participation of hedge funds and other institutional players could signal a maturing and more sophisticated market, with greater liquidity and price stability.However, a sharp drop in the basis premium could also serve as a cautionary signal, potentially indicating a shift in market sentiment and a potential Bitcoin pullback. As James Van Straten noted, "a sharp drop in the premium might signal bearish sentiment and a potential BTC pullback." Investors and market participants will need to closely monitor the evolution of the basis trade and the broader market dynamics to navigate the evolving landscape effectively.

At the time of writing, Bitcoin was valued at $72,200, up 13% in October, underscoring the continued strength and resilience of the cryptocurrency market. As the basis trade continues to gain traction, it will be crucial for market participants to stay informed and adapt their strategies accordingly, capitalizing on the opportunities while remaining vigilant of the potential risks.