Unlocking Futures Trading Insights: TradingView's Latest Enhancements

TradingView, the renowned financial data and analysis platform, has recently announced a series of improvements to its futures data offerings. These updates are designed to enhance data visibility, accuracy, and the overall trading experience for users, particularly those interested in contracts from the Singapore Exchange (SGX) and Intercontinental Exchange (ICE Futures Singapore).Empowering Traders with Customizable Closing Prices

One of the key updates introduced by TradingView allows users to choose between the settlement price and the last price as the closing value on their charts. The settlement price, calculated at the end of the trading day by averaging the final bid/ask prices and other relevant values, provides traders with a more stable reference point for evaluating their gains or losses. This feature gives traders greater flexibility and control over the data they use to make informed trading decisions.To switch between the settlement price and the last price, users can simply click the "SET" button at the bottom of their chart or enable the "Use settlement as close on daily interval" option from the chart settings menu. It's important to note that settlement prices will only be available on daily intervals, not during intraday periods.Smoothing Out Contract Transitions with Back-Adjusting Continuous Futures

Another powerful feature introduced by TradingView is the ability to back-adjust contracts in continuous futures. This functionality helps to smooth out price differences that occur when switching between futures contracts, effectively eliminating any roll gaps. When the chart shifts to a new contract, the system calculates a coefficient based on the price difference between the old and new contracts, ensuring that previous contracts align better and offering a more consistent historical view.To enable this feature, users can click the "B-ADJ" button at the bottom of the chart or select the "Adjust for contract changes" option from the chart settings menu.Gaining Insights from Open Interest Data

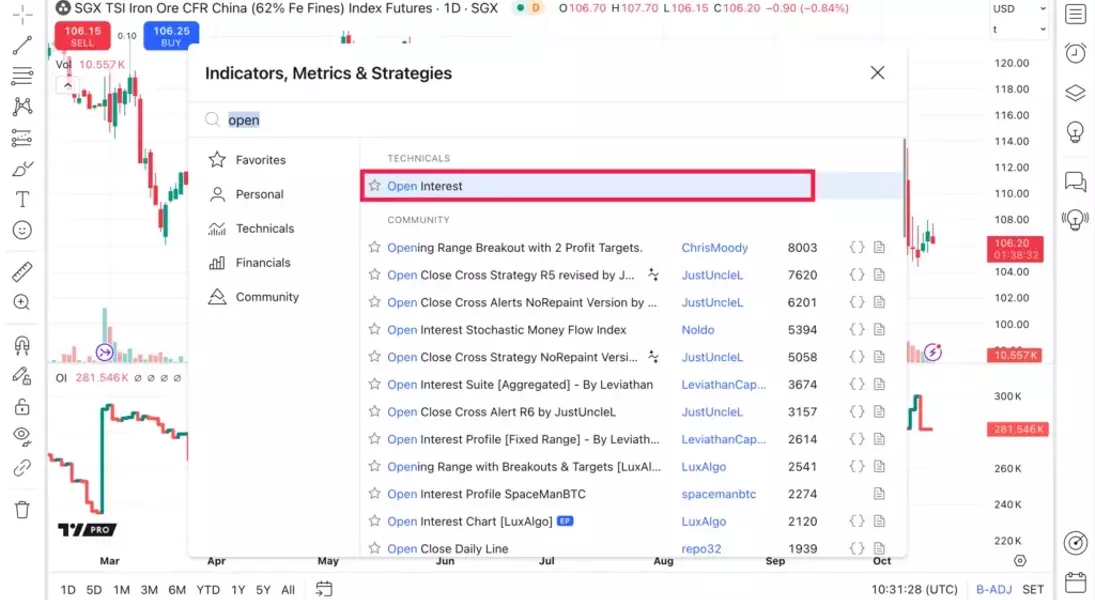

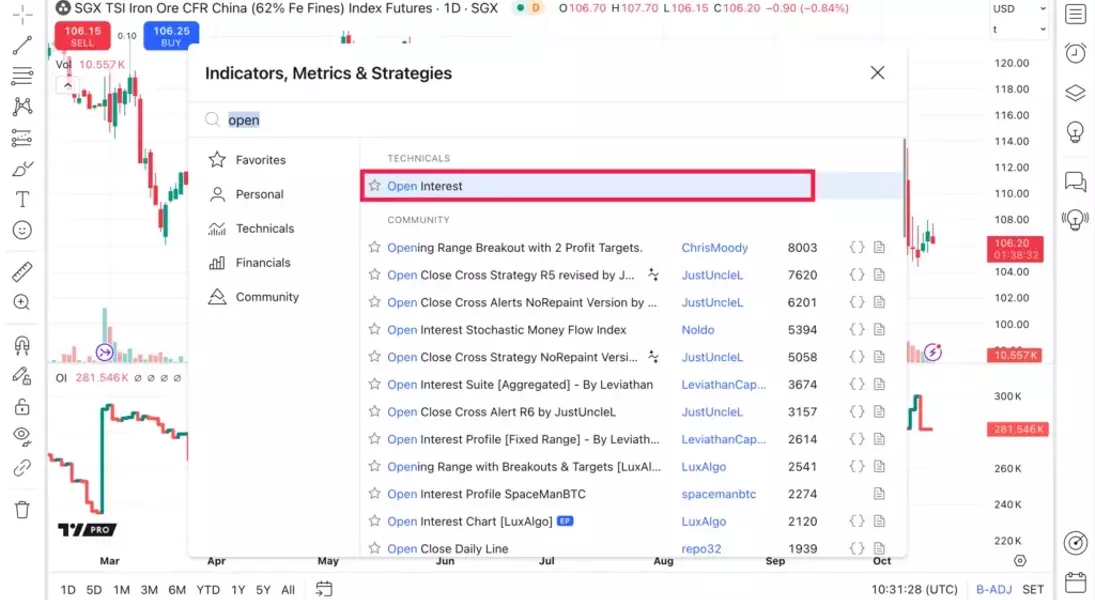

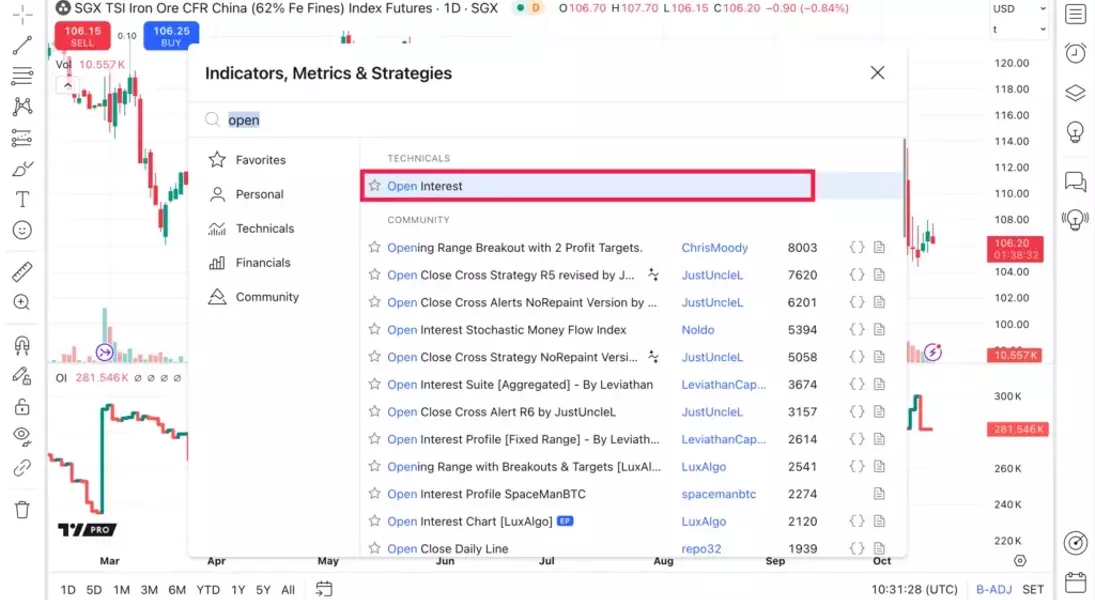

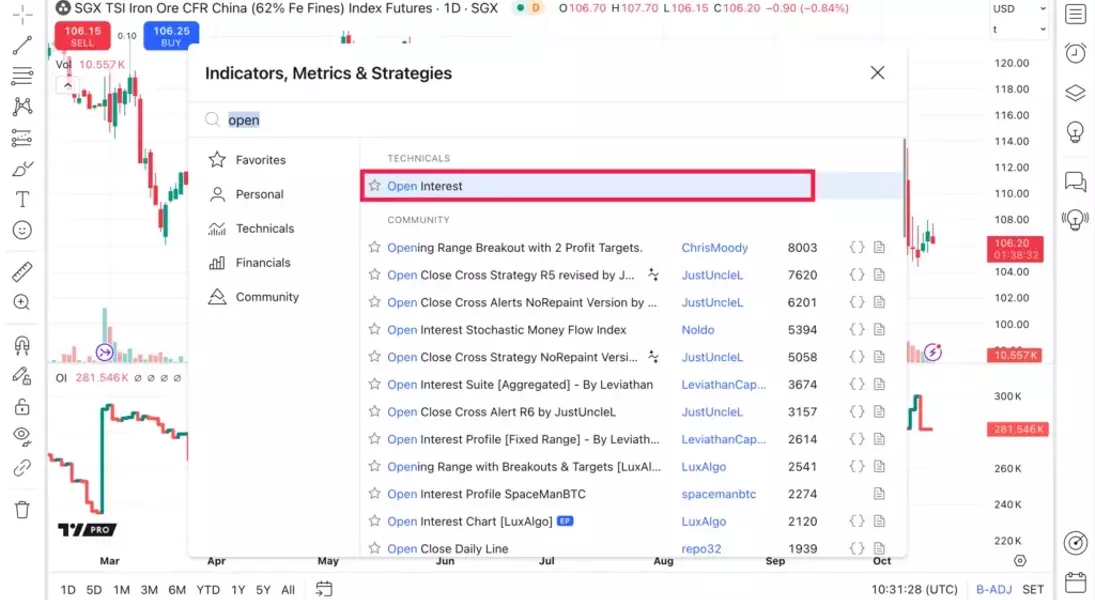

Lastly, TradingView has introduced the ability to view the open interest value for Singapore futures. Open interest represents the total number of active contracts that haven't been settled, and it's an important metric for gauging market activity. To access this data, users can navigate to the "Indicators, Metrics & Strategies" menu and search for the Open Interest indicator.Connecting to a Vast Data Universe

The TradingView platform is renowned for its reliable connectivity to hundreds of data feeds, providing direct access to 2,019,615 instruments from around the world. This extensive data coverage allows traders to explore a wide range of financial instruments and make informed decisions based on comprehensive market information.Empowering Traders with Unparalleled Insights

The latest enhancements to TradingView's futures data offerings are a testament to the platform's commitment to providing traders with the tools and insights they need to navigate the complex world of financial markets. By offering customizable closing prices, back-adjusting continuous futures, and access to open interest data, TradingView is empowering traders to make more informed and strategic decisions, ultimately enhancing their trading performance and success.You May Like