Navigating the foreclosure market presents a unique opportunity for real estate professionals. It demands a blend of strategic lead acquisition and a deeply empathetic approach to engage with homeowners facing significant financial distress. While the path may seem daunting, understanding the nuances of this niche and employing effective strategies can yield substantial rewards, not just in transactions but in building meaningful relationships and providing much-needed assistance during challenging times.

Success in this sector hinges on more than just identifying potential properties; it requires a commitment to ethical engagement, offering comprehensive solutions, and demonstrating unwavering support. By prioritizing the homeowner's needs and leveraging specialized tools, agents can transform complex situations into mutually beneficial outcomes, distinguishing themselves in a competitive landscape and fostering trust within their communities.

Strategies for Identifying Foreclosure Opportunities

Identifying potential foreclosure leads requires a multifaceted approach, combining technological tools with traditional boots-on-the-ground methods. Modern lead generation platforms are indispensable for accessing accurate, up-to-date data, while direct engagement with public records and networking with legal professionals can uncover opportunities often missed by others. These varied channels ensure a steady flow of potential leads, catering to different preferences for prospecting.

Furthermore, staying vigilant for properties showing signs of distress and actively participating in local real estate circles can reveal additional avenues. Observing market trends, attending auctions, and targeting absentee owners through direct outreach complement these efforts, creating a comprehensive lead generation strategy. This blend of digital and physical prospecting maximizes the chances of uncovering valuable foreclosure opportunities.

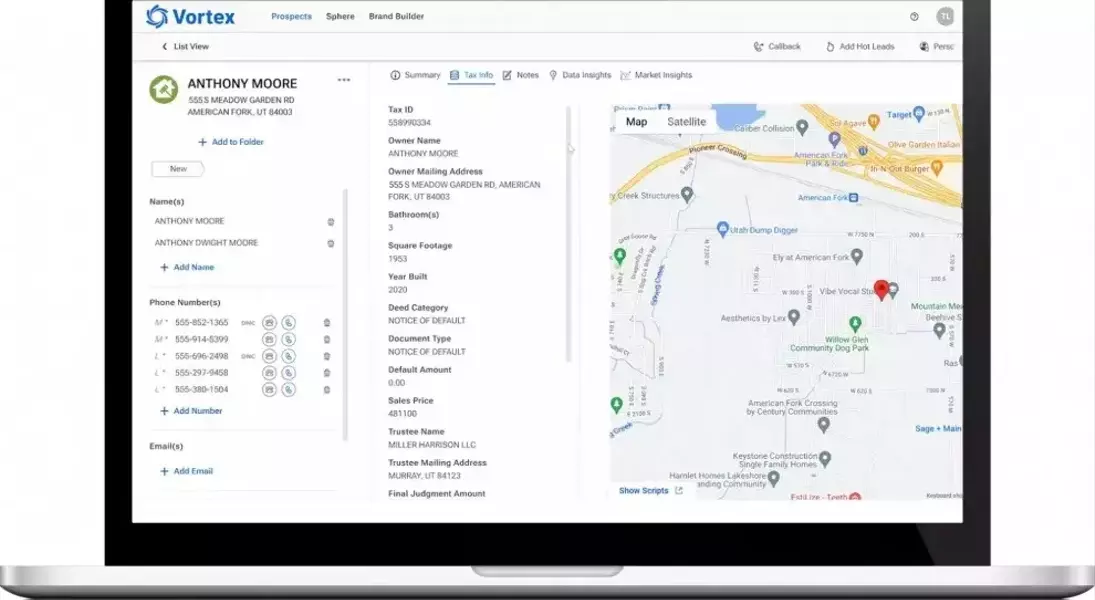

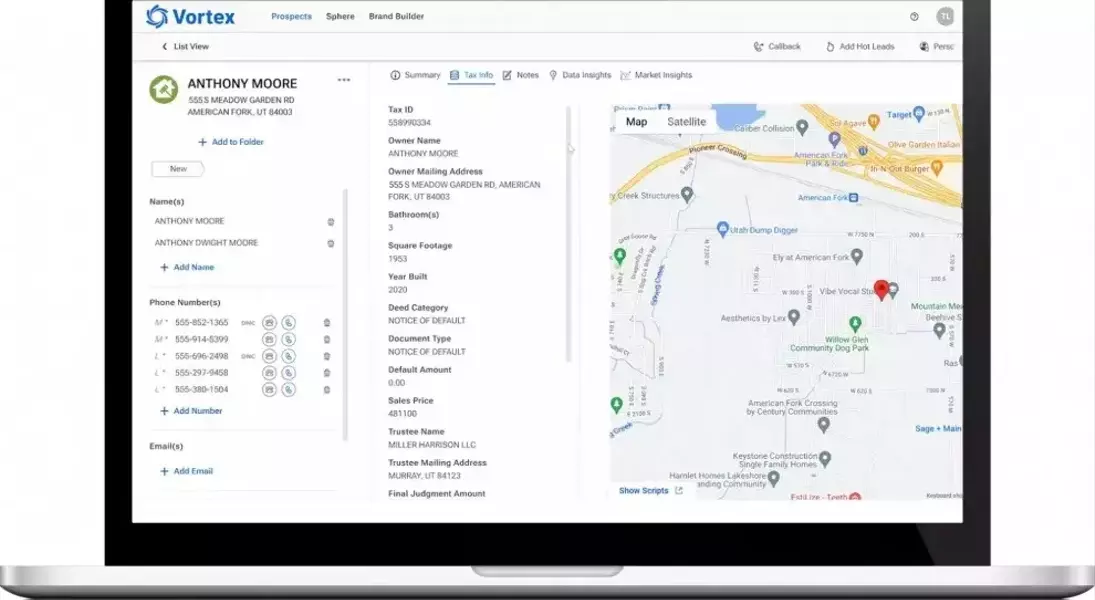

For real estate professionals seeking to efficiently identify potential foreclosure leads, leveraging specialized lead generation platforms is a highly effective strategy. These digital solutions compile extensive data from various official sources, including county records and legal filings, offering comprehensive insights into properties at different stages of foreclosure—from pre-foreclosure to bank-owned. Platforms like REDX provide user-friendly interfaces that allow agents to filter leads by specific criteria, such as zip code, and access detailed property information, including the timeline of the foreclosure process. This streamlines what would otherwise be a laborious research task, providing a centralized and organized system for managing potential opportunities. The investment in such tools is often justified by the time savings and the quality of leads obtained, enabling agents to focus more on engagement and less on initial discovery.

Beyond digital platforms, a proactive and diverse approach to lead generation yields significant results. Visiting local courthouses to review public notices, such as Notices of Default or Lis Pendens, offers direct access to information, often before it becomes widely available. While this method requires more effort, it provides raw, unfiltered data straight from the source. Additionally, browsing online foreclosure listing sites like Zillow and Auction.com, though sometimes offering less current data, can provide a preliminary overview of the market and help new entrants understand the landscape. Building relationships with real estate attorneys and bankruptcy professionals is another powerful strategy, as these individuals are often the first point of contact for homeowners in financial distress. These professional networks can provide warm referrals, which are often more receptive than cold outreach. Lastly, actively scouting distressed neighborhoods for properties exhibiting clear signs of neglect, such as overgrown yards or accumulated mail, can uncover off-market deals. These varied techniques, from technological solutions to personal networking and field observation, collectively form a robust strategy for identifying a wide range of foreclosure leads.

Cultivating Relationships and Converting Leads

Converting foreclosure leads into successful client relationships goes beyond transactional interests; it demands a deep understanding of the emotional and financial turmoil homeowners are experiencing. Adopting an empathetic and patient approach is paramount, as trust is the cornerstone of these interactions. Offering a spectrum of solutions, not just quick sales, demonstrates a genuine desire to assist, building credibility and fostering long-term relationships.

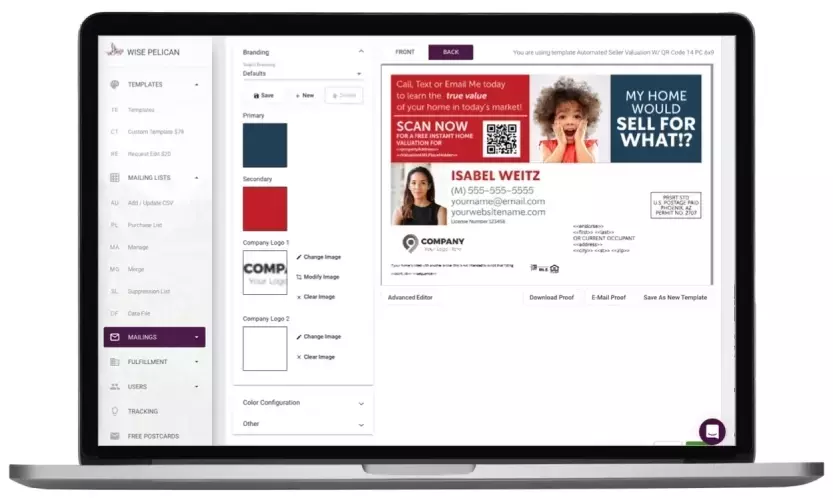

Consistent and respectful follow-up is critical, ensuring homeowners feel supported without being pressured. Building a strong reputation through testimonials and helpful content further reinforces your expertise and compassionate approach. Lastly, leveraging CRM tools to systematically manage communications and track progress ensures no lead is overlooked, facilitating organized and effective engagement throughout the often-protracted process of foreclosure resolution.

The path to converting foreclosure leads into clients begins with a profound understanding of the homeowner's emotional landscape. Individuals facing foreclosure are often grappling with fear, embarrassment, and overwhelming stress. Recognizing this delicate state is crucial; an aggressive or overly transactional approach will likely deter them. Instead, lead with empathy, actively listen to their concerns, and prioritize their well-being. Your initial interactions should focus on understanding their situation and offering support, rather than immediately pushing for a sale. By demonstrating genuine care and a willingness to listen without judgment, you can begin to build the trust necessary for them to feel comfortable sharing their challenges and considering your assistance. This foundational step sets the tone for a collaborative relationship, positioning you as a trusted advisor rather than just another agent.

Beyond initial empathy, successful conversion hinges on offering diverse and practical solutions tailored to each homeowner's unique circumstances. Not all distressed homeowners are seeking an immediate sale; some may benefit from options like short sales, loan modifications, or assistance with relocation. Being knowledgeable about these various avenues and capable of connecting them with relevant resources, even if it doesn't directly lead to a commissionable transaction, reinforces your commitment to their best interests. This holistic approach builds significant goodwill and can lead to referrals or future business. Furthermore, consistent and respectful follow-up is essential; homeowners in distress often need time to process information and make decisions. Avoid daily calls, but maintain periodic, thoughtful check-ins that offer additional value or simply reiterate your availability. Establishing credibility through sharing success stories or providing educational content that demystifies the foreclosure process can also empower homeowners and make them more likely to engage. Finally, leveraging a robust Client Relationship Management (CRM) system is indispensable for managing these complex, often long-term leads. A CRM allows you to track every interaction, set reminders for follow-ups, and keep detailed notes on each case, ensuring no critical information is lost and that your engagement remains timely and personalized. Tools like Market Leader, which integrate lead generation with comprehensive CRM functionalities, are invaluable for maintaining organized communication and nurturing relationships from initial contact through to successful resolution.