As the crypto market maintains its bullish momentum, a closer examination of Bitcoin's key metrics reveals a series of optimistic trends that could positively impact the asset's price performance in the coming days. From a surge in futures premium to a spike in open interest, the data suggests a promising outlook for BTC.

Unlocking the Power of Bitcoin's Futures Premium

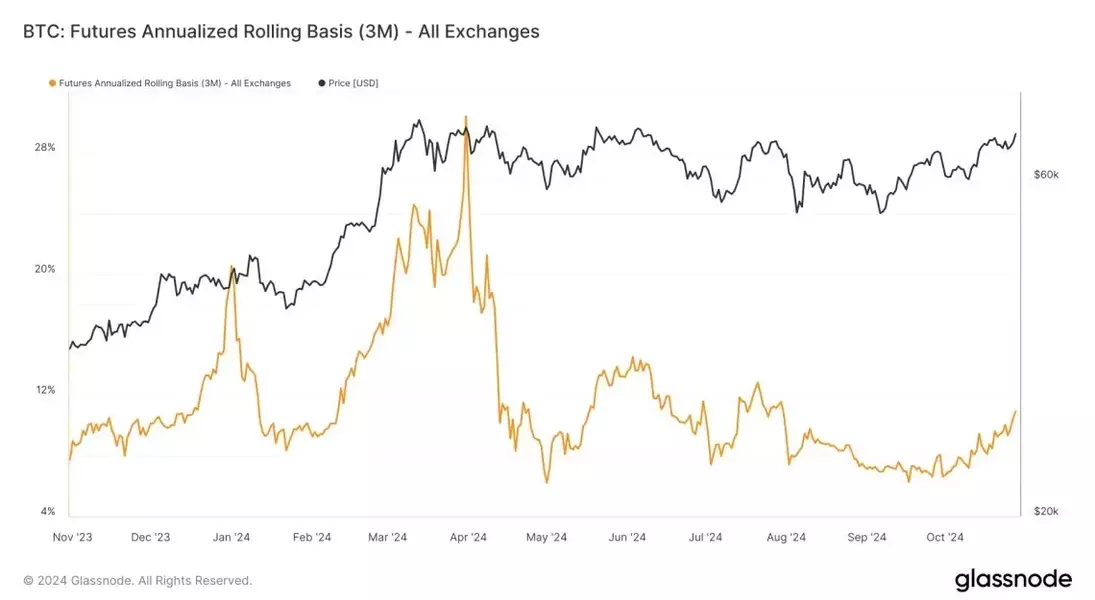

Bitcoin's futures annualized premium, a crucial indicator that often signals bullish sentiment, has witnessed a remarkable surge in recent weeks. Crypto enthusiast and analyst James Van Straten shared the positive development on the social media platform X, capturing the attention of the crypto community.The increase in this crucial metric coincides with rising market trends, indicating a shift in investor sentiment and a growing confidence in Bitcoin's future price performance, both in the short and long term. This spike in the indicator often suggests a growing demand, with traders expecting further price increases.According to the expert, the annualized premium for purchasing spot Bitcoin Exchange-Traded Funds (ETFs) and selling short Chicago Mercantile Exchange (CME) futures has nearly doubled in the past month, rising from around 6% to 11%. Notably, this increase is more than twice the current Federal Reserve (Fed) funds effective rate of 5%, and the analyst believes the "basis trade" will only become more prevalent as the Fed continues to cut rates over the next three months.Surging Open Interest and Directional Positioning

In addition to the impressive growth in Bitcoin's futures premium, the analyst also pointed out a rise in Bitcoin's Futures' Open Interest (OI). In the last 24 hours, Bitcoin's futures open interest saw a sharp increase of 20,000 BTC, marking the biggest spike in open interest since June of this year, accompanied by a surge in net non-commercial short positioning.While the inflows into Bitcoin spot ETFs, totaling $2.7 billion, and the recent acquisition from Emory University in the United States support a pick-up in directional long bias by about $15 million, the analyst notes that CME open interest has declined more than 6% since its all-time high in mid-October. However, he believes that directional long positioning, regardless of the current state, will ultimately increase liquidity, if not now, then in the future.Approaching the All-Time High: A Promising Outlook for Bitcoin

The market is brimming with optimism as Bitcoin continues to demonstrate promising upward movement, inching closer to its all-time high price of $73,000 set in March. Given the strong investor sentiment towards the crypto asset, there is a strong possibility that BTC could reach this crucial level in the coming days.At the time of writing, Bitcoin was trading at $72,412, just inches away from its peak, indicating a nearly 2% surge in the past day. Several upcoming key events, such as the US Presidential election, are believed to drive the price even higher, potentially leading to BTC setting a new all-time high in the near future.The combination of a surging futures premium, rising open interest, and a bullish market sentiment suggests a promising outlook for Bitcoin's price performance in the upcoming days. As the crypto market continues to evolve, these positive indicators provide a glimpse into the growing confidence and enthusiasm surrounding the leading digital asset.