A recent proposal to loosen mortgage lending restrictions, enabling borrowing up to six times an individual's salary, represents a contentious shift in financial policy. This decision, aimed at increasing access to homeownership, paradoxically risks exacerbating the very issue it purports to address: escalating property values. The potential consequences for household financial stability and the wider economic landscape warrant careful consideration, as past experiences suggest that an abundance of credit often translates into inflated asset prices rather than improved affordability.

In late 2006, a notable lender, Abbey, made headlines by allowing first-time buyers and those seeking new homes to secure mortgages up to five times their combined income. This bold move was presented as a necessary response to the then-soaring property market. Other financial institutions, including RBS and Cheltenham & Gloucester, also embraced this trend of extending generous credit limits. The logic was simple: if house prices were rising, so too should the available credit to match them. However, this approach, as history would soon demonstrate, contributed to an unsustainable market environment that ultimately preceded the 2008 financial crisis.

Fast forward nearly two decades, and the current Chancellor, Rachel Reeves, is advocating for a similar policy. The intention is to remove post-financial crisis safeguards that limited mortgage lending to 4.5 times income for most borrowers. This deregulation would permit banks and building societies to offer loans up to six times a borrower's earnings. For instance, a couple earning a combined £80,000 could see their potential borrowing capacity jump from £360,000 to £480,000. This significant increase in accessible credit raises serious concerns about the potential for individuals to overextend their financial commitments, especially when faced with fluctuating interest rates or unforeseen household expenses. While current lending practices consider affordability more rigorously than in the past, the sheer volume of potential borrowing could still lead to precarious situations for many.

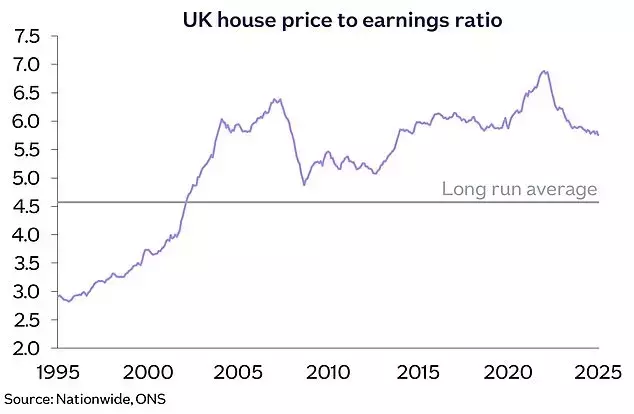

Critics argue that injecting more borrowing power into the housing market will inevitably lead to higher home prices. Economic principles suggest that increasing demand without a corresponding increase in supply will drive up costs. Although the house price-to-earnings ratio has seen some recent improvement, with wages growing faster than home values, it still remains significantly above long-term averages. Relying on expanded mortgage availability to solve housing affordability issues is akin to pouring fuel on a fire. A more sustainable solution would involve a sustained period where wage growth outpaces property appreciation, coupled with initiatives that genuinely boost housing supply. The underlying causes of high property prices, rather than merely their symptoms, must be addressed to foster a stable and accessible housing market.

Ultimately, while the policy might initially appear to ease entry into homeownership, it risks creating a cycle of dependency on ever-larger loans, further inflating house prices and potentially undermining the financial stability of countless households. True progress in housing affordability necessitates a holistic approach that prioritizes long-term economic balance over short-term market stimulation.