Recent market movements have highlighted significant volatility within the high-yield sector, particularly affecting mortgage REITs and Business Development Companies. A widespread sell-off, exacerbated by disappointing earnings from a key industry player and broader macroeconomic indicators, has led to a re-evaluation of investment strategies. This shift has underscored the consistent, superior performance of preferred shares and baby bonds, prompting a strategic reallocation of portfolios towards these more stable, yet still high-yielding, instruments. This analysis delves into the reasons behind the recent market turbulence and the rationale for favoring these alternative investment vehicles.

The market's knee-jerk reaction to a single company's underperformance, coupled with macro concerns, created an environment where fundamental valuations were often overlooked. This presents both challenges and opportunities for investors. While common shares of mREITs and BDCs faced downward pressure, the resilience and steady returns of preferred shares and baby bonds have proven to be a valuable safeguard. Understanding these dynamics is crucial for navigating high-yield markets effectively, emphasizing the importance of a diversified and risk-conscious approach to investment.

Market Turmoil and the Mortgage REIT Sector

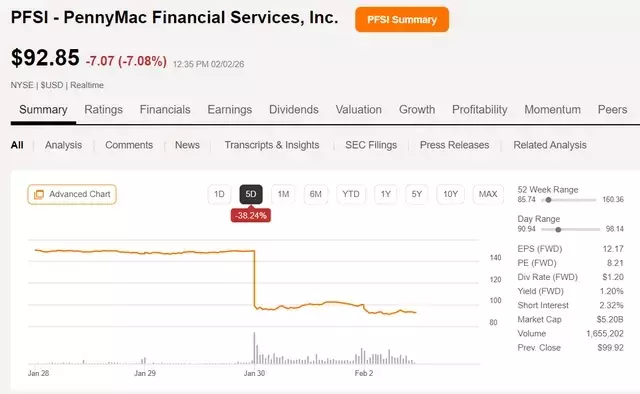

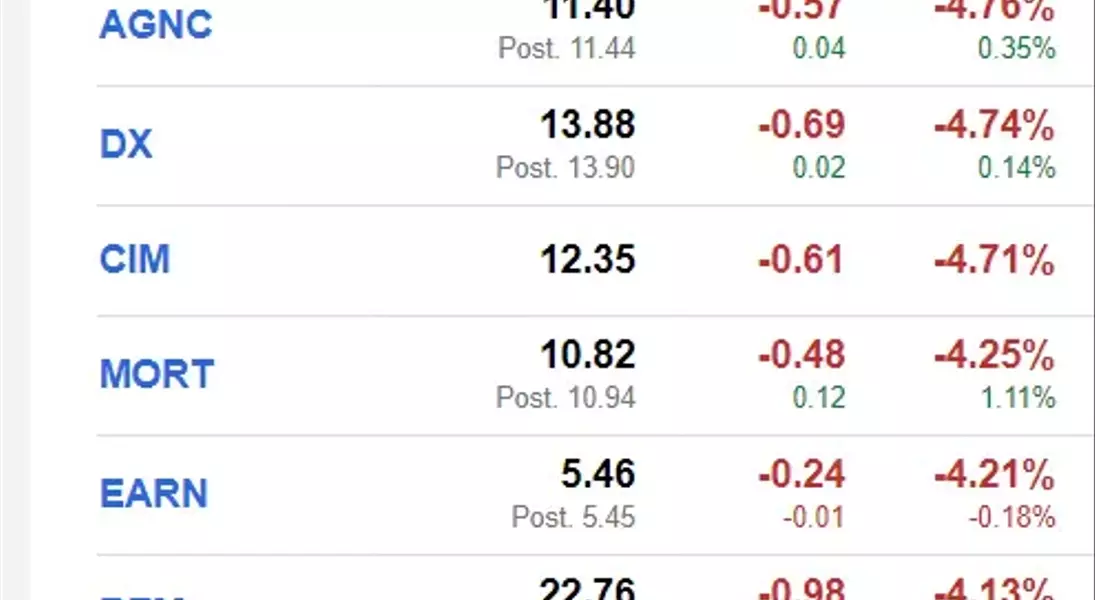

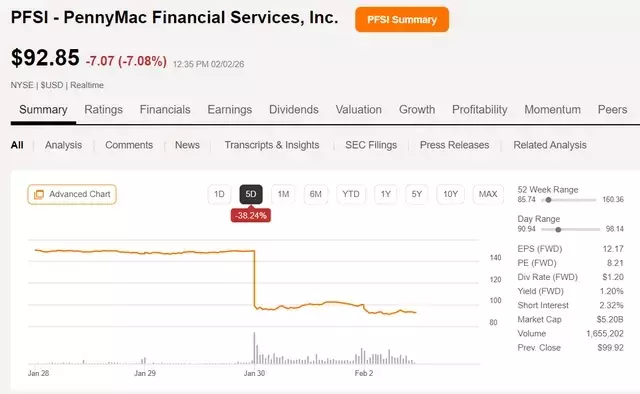

The high-yield investment landscape recently witnessed considerable upheaval, with numerous mortgage REITs experiencing declines exceeding 10% in a single day. This downturn was largely attributed to the precipitous 33% fall of PennyMac Financial Services (PFSI), a non-REIT originator and servicer, whose disappointing earnings report signaled compressed loan margins and elevated mortgage servicing rights (MSR) amortization costs. The market's reaction was swift and broad, impacting the entire mREIT sector, irrespective of individual company fundamentals. Further complicating the scenario were macroeconomic factors such as higher-than-anticipated CPI and PPI data, along with news concerning the Federal Reserve Chair, which collectively contributed to an atmosphere of uncertainty. However, many analysts believe the sell-off in the broader mREIT sector was overdone, as the underlying fundamentals of most companies did not warrant such severe contractions.

A detailed examination reveals that PFSI's stock was trading at an unsustainable 80% premium to its book value prior to its earnings announcement, with a meager dividend yield of 1.2%. This valuation positioned it precariously, making it highly vulnerable to any misstep in performance. In stark contrast, PennyMac Mortgage Investment Trust (PMT), a true mortgage REIT with a similar business model, was trading at a 13% discount to its book value. This significant valuation gap, coupled with PFSI's high weighted average coupon (WAC) on its MSR sub-portfolio (5.0% compared to PMT's 3.9%), meant PFSI faced more severe MSR amortization costs. Despite both companies experiencing negative hedging results and slight increases in book value, the market indiscriminately punished the entire sector. This highlights a common market phenomenon where analysis often follows reaction, leading to unjustified sell-offs in fundamentally sound entities. Consequently, investors are now keenly observing the sector for potential rebound opportunities in undervalued assets.

Strategic Shift Towards Preferred Shares and Baby Bonds

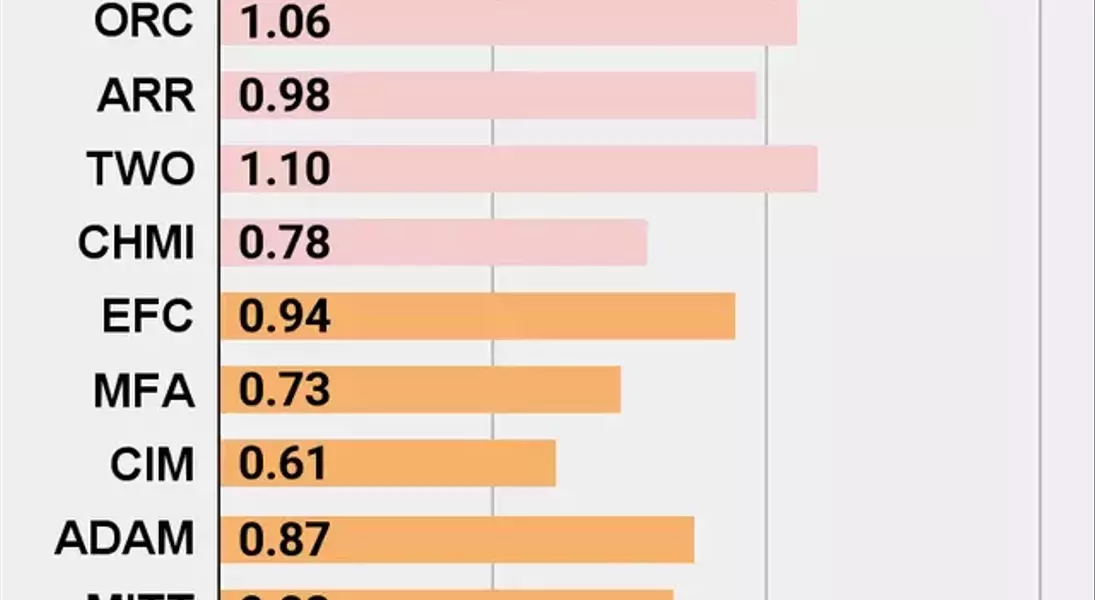

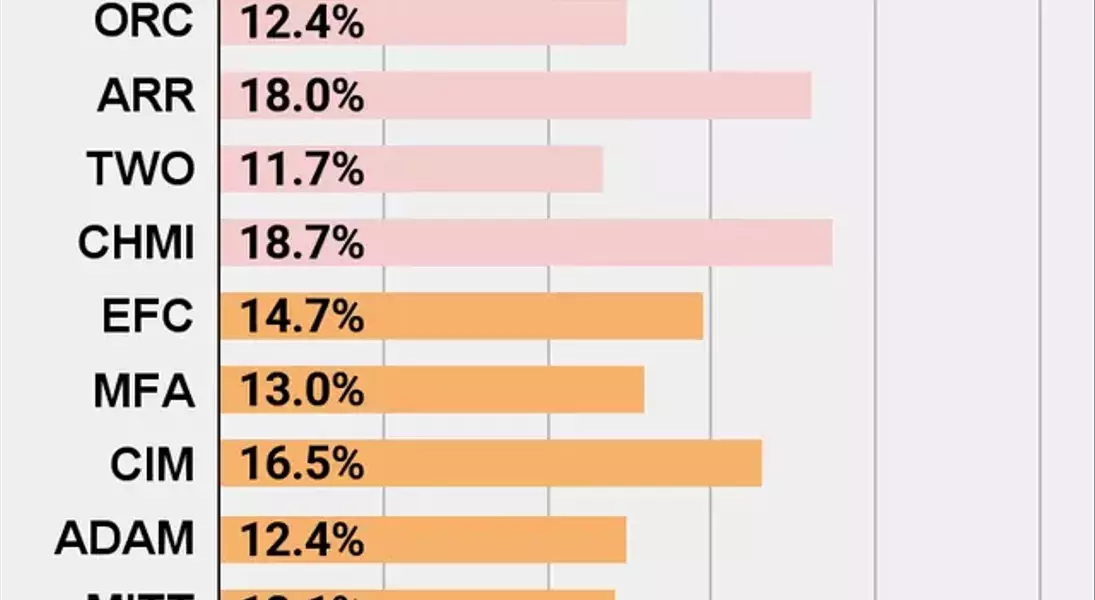

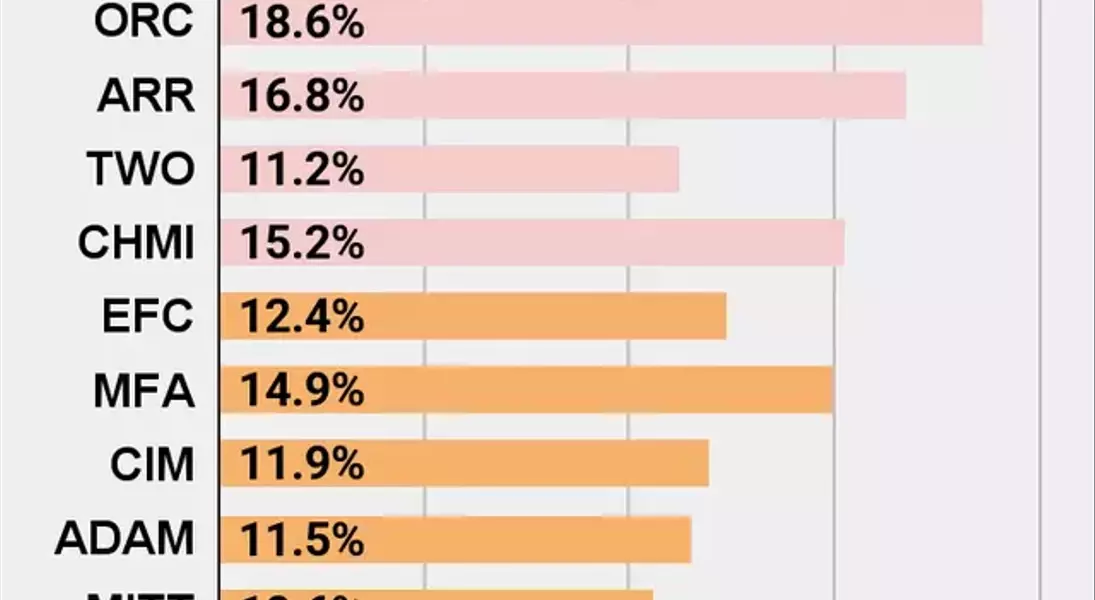

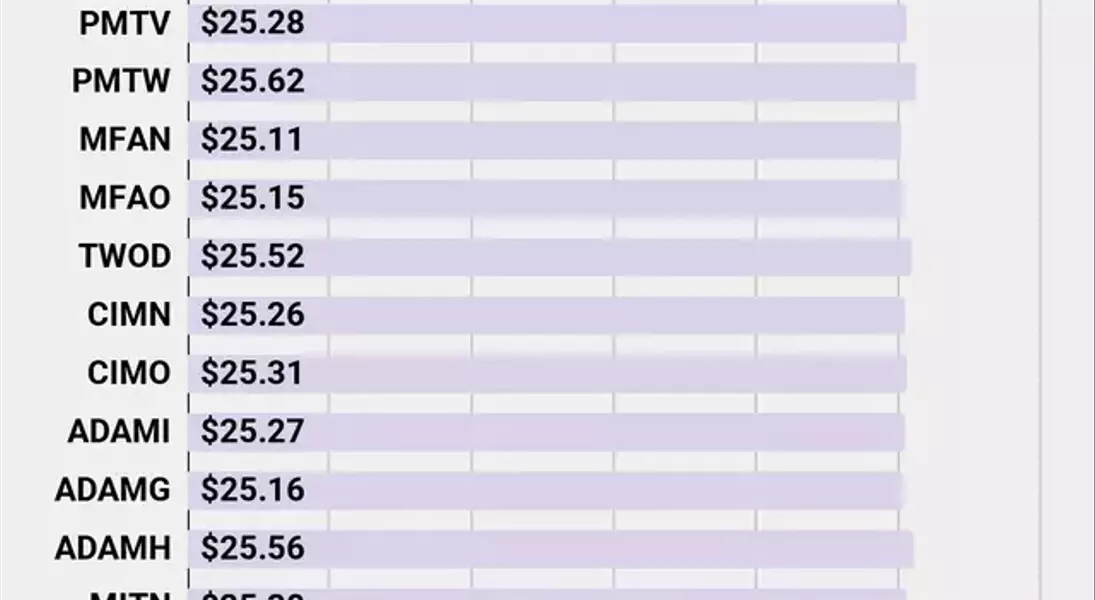

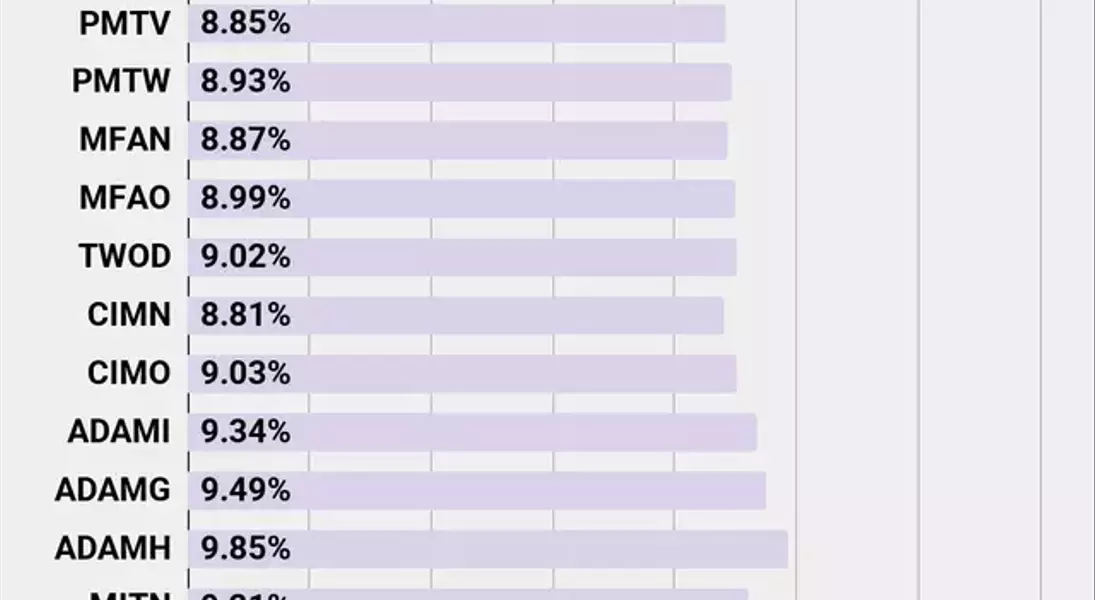

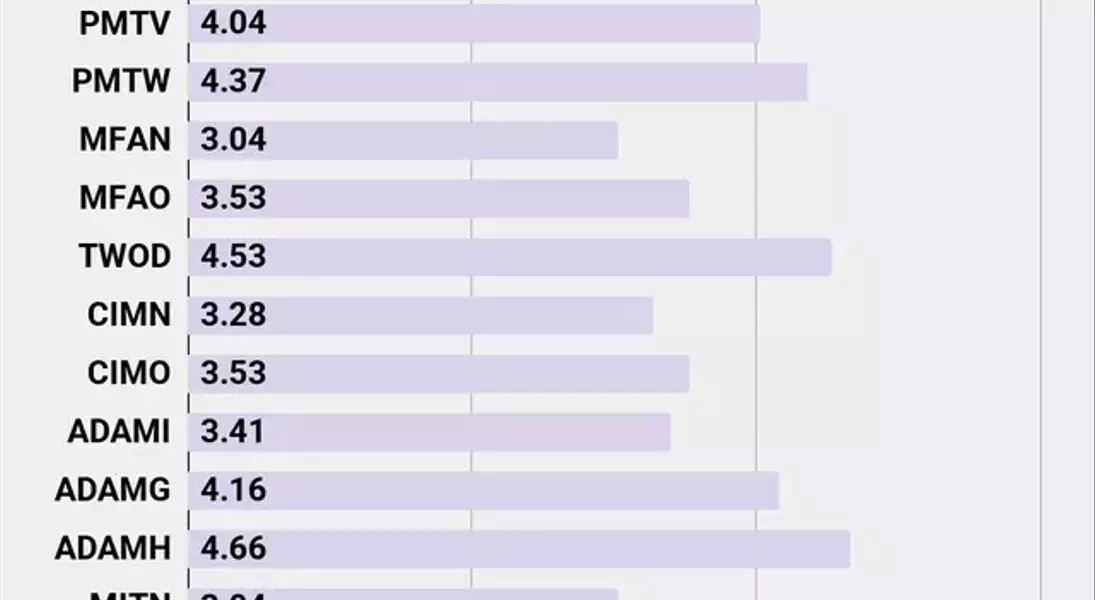

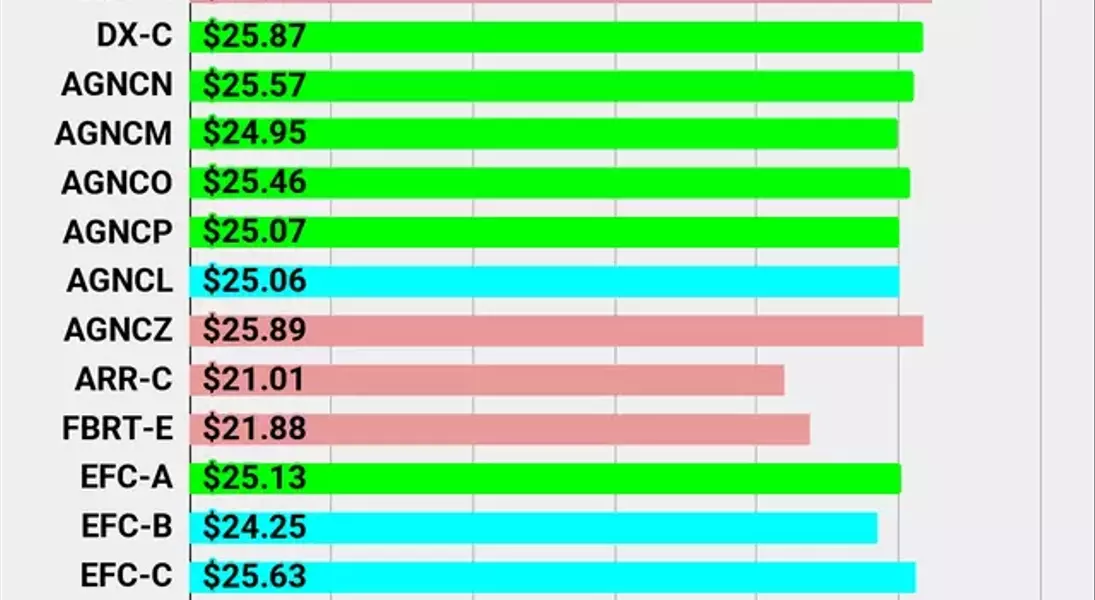

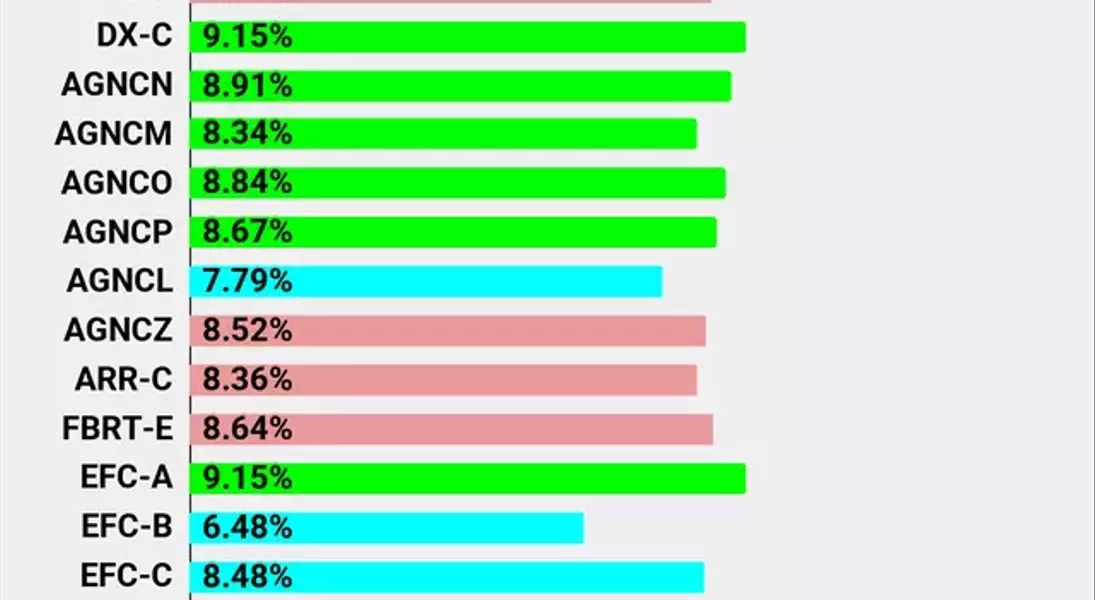

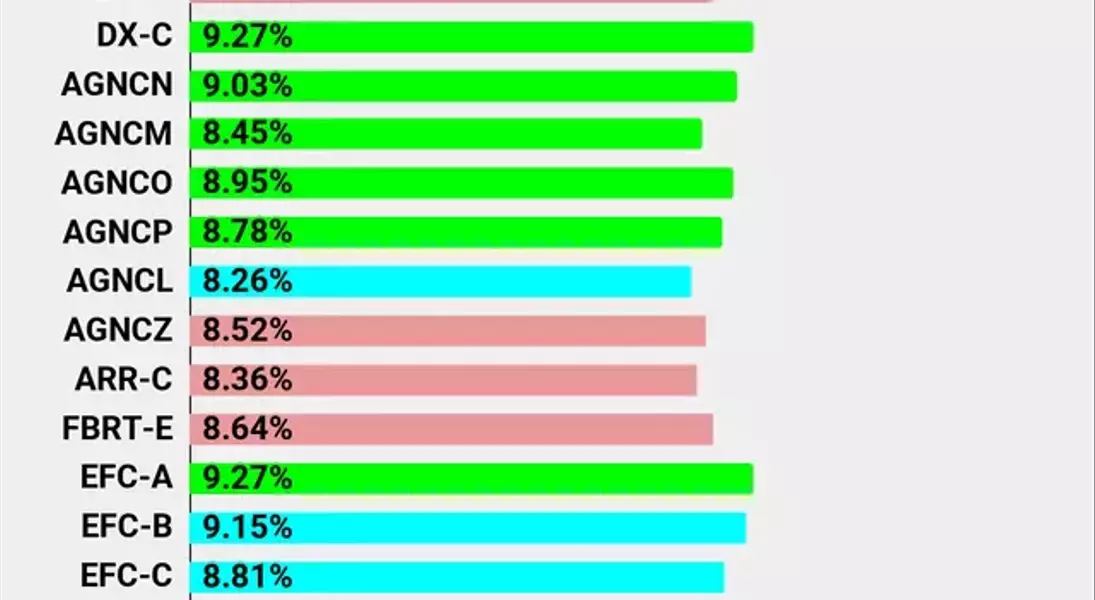

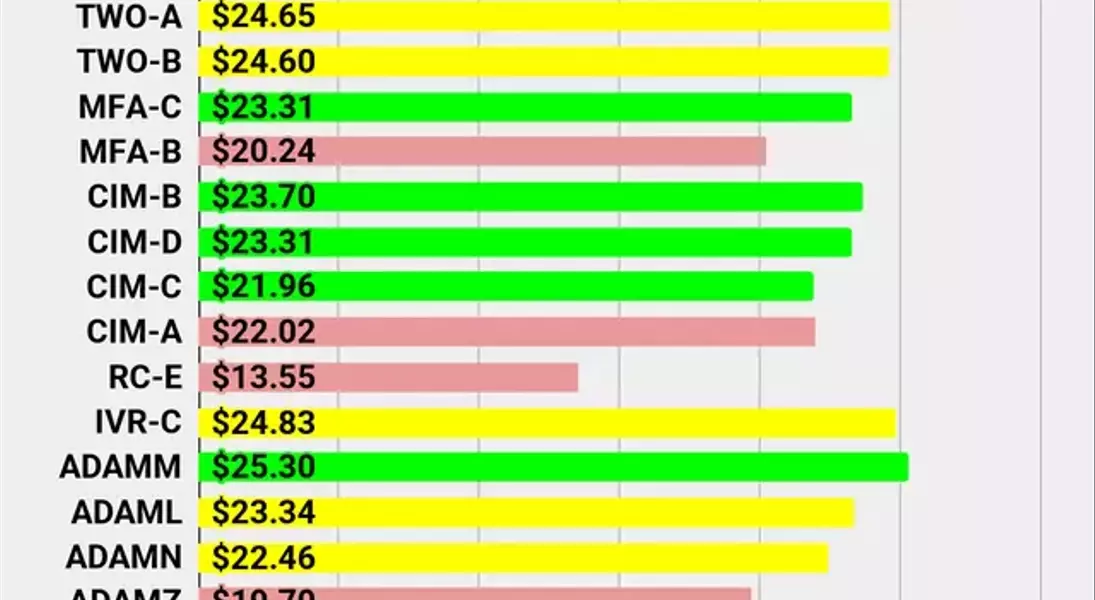

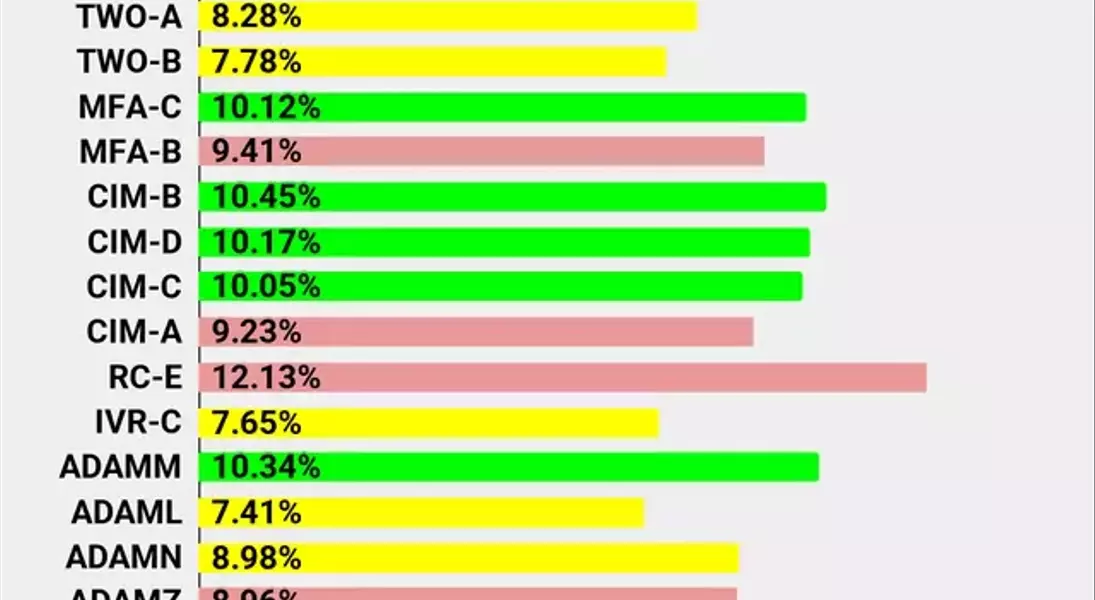

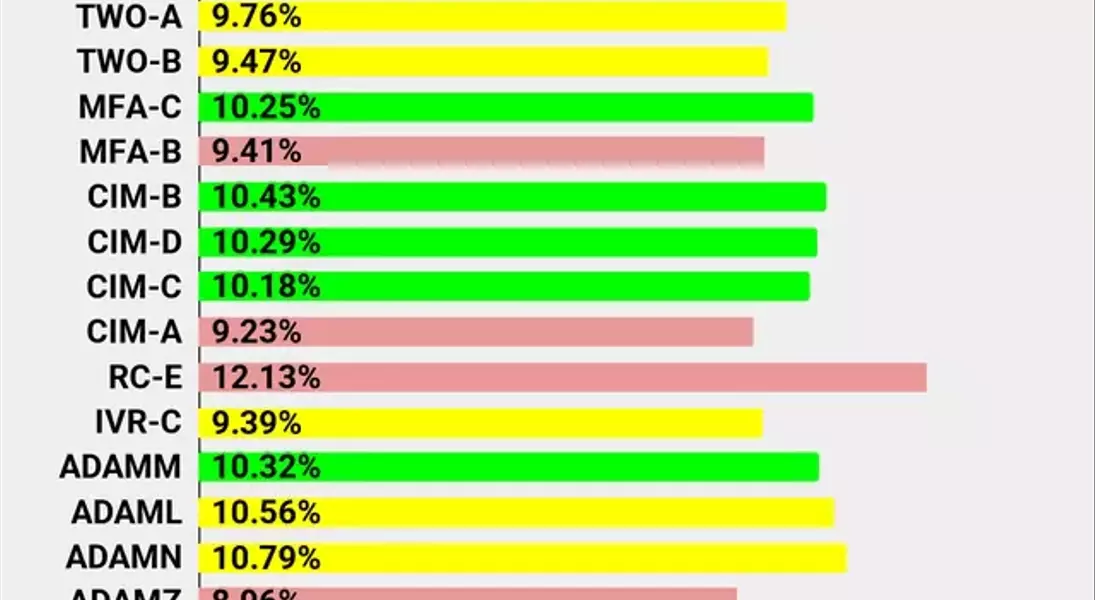

In light of the recent market volatility and the disproportionate impact on common shares of mortgage REITs and BDCs, a significant strategic adjustment is underway, focusing on increasing portfolio allocations to preferred shares and baby bonds. This shift is predicated on the historical performance of these instruments, which have consistently demonstrated superior risk-adjusted returns. Unlike common shares that are subject to rapid and often emotional market reactions, preferred shares and baby bonds offer a more stable investment profile, characterized by predictable income streams and a higher position in the capital structure. This inherent stability has allowed them to not only withstand market downturns more effectively but also to frequently outperform their common stock counterparts over extended periods. The consistent outperformance stems from their ability to provide substantial yields while minimizing exposure to the sharp price fluctuations seen in common equities.

The rationale for this heightened focus on preferred shares and baby bonds is further strengthened by their attractive total returns, which often combine a robust yield with modest capital appreciation. Many positions in these securities have concluded with a slightly higher price than their initial purchase, amplifying the already generous dividend or interest payments. This cumulative effect leads to returns that frequently surpass those generated by high-yield common shares, even those offering initially appealing dividends. The reliability of income and the reduced susceptibility to market whims make them an ideal choice for investors prioritizing stability and consistent returns in a volatile environment. As a result, recent investment activities have predominantly channeled funds into these resilient segments of the market, signaling a long-term commitment to a more conservative yet highly rewarding investment strategy within the high-yield sector.