Understanding the dynamics of Exchange-Traded Funds (ETFs), especially those tracking cryptocurrencies, can be complex. Key metrics like inflows and outflows often grab headlines, yet their true significance extends beyond simple asset performance. This article delves into how these indicators function, particularly differentiating between money entering or leaving an ETF versus the actual value fluctuations of the underlying digital currency. It aims to demystify these concepts, providing clarity on why investor movements within the ETF landscape might not always align with the broader market's sentiment for cryptocurrencies.

When discussing ETFs, particularly in the innovative realm of crypto, terms such as 'inflows' and 'outflows' frequently appear in financial news. It is crucial to distinguish that these terms quantify the capital flows into or out of a specific fund, serving more as a gauge of the fund's appeal and comparative standing among its peers, rather than a direct measure of the investment's return. While a fund's asset base can indirectly influence the market of its underlying holdings, for the most part, a typical ETF possesses limited capacity to single-handedly sway market prices. These metrics are thus indicative of the ETF's own health and investor confidence in its management or structure.

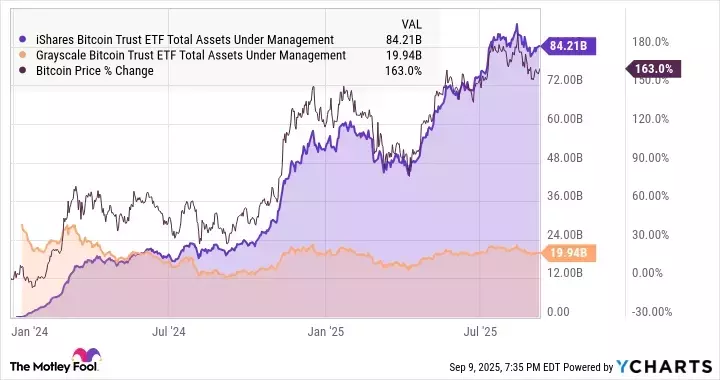

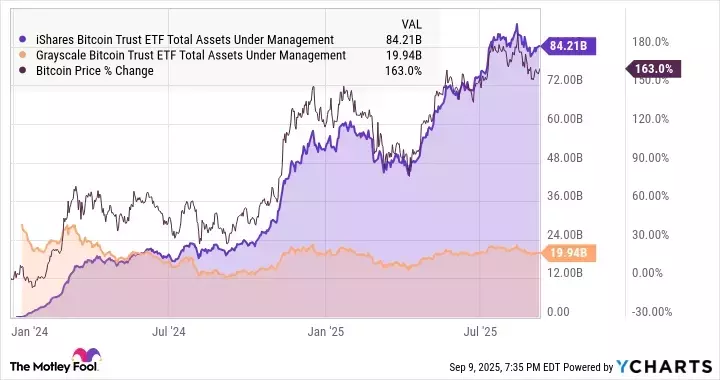

A compelling case study illustrating this distinction involves two prominent Bitcoin ETFs: the iShares Bitcoin Trust and the Grayscale Bitcoin Trust. Despite Bitcoin's substantial gains, the Grayscale fund has experienced considerable asset reductions, whereas the iShares fund has seen record increases in its managed assets. Grayscale's fund, established in 2015 as a traditional mutual fund before its conversion to an ETF, initially commanded a significant market presence. However, BlackRock's iShares Bitcoin Trust, launched much later in January 2024 following regulatory approval, quickly became a dominant player. Immediately after its introduction, a discernible shift occurred, with Grayscale’s assets under management (AUM) declining and iShares’ AUM rapidly expanding. This divergence in fund flows, even amidst similar performance from Bitcoin itself, underscores how distinct investor preferences can drive capital movements.

A primary factor contributing to this asset migration is the fee structure. The iShares fund boasts a competitive annual expense ratio of 0.25%, with an initial marketing incentive waiving fees entirely for a period. In stark contrast, Grayscale maintains a 1.5% expense ratio. For institutional investors, this 1.25% difference translates into substantial savings over time. For example, a $100,000 investment would incur $1,500 in annual fees with Grayscale versus just $250 with iShares, offering identical Bitcoin exposure at a much lower cost. This significant fee disparity has prompted a mass exodus from Grayscale to iShares, reflecting investors' pragmatic choice for cost efficiency. Both funds delivered comparable returns (around 140-141%) over the past year, yet iShares emerged as the clear favorite due to its lower fees, the robust backing of BlackRock, and a well-recognized brand. Consequently, fund flows serve as a robust indicator of an ETF's market acceptance and competitive edge.