Despite economists' generally optimistic views on the current economic state, public perception paints a starkly different picture. Consumer sentiment has plummeted to levels not witnessed since 2014, reflecting deep-seated concerns about personal finances and the broader economic outlook. This divergence is attributed to factors like persistent inflation eroding purchasing power for many households, particularly those with lower and middle incomes, and a widening wealth gap where high earners disproportionately benefit from economic growth.

This disparity creates a 'K-shaped' economic recovery, where different segments of the population experience vastly different financial realities. While official economic data, such as robust GDP growth and sustained consumer spending by high-income individuals, suggest a healthy economy, the everyday experiences of average citizens burdened by rising costs and stagnant wages tell a story of struggle and uncertainty. Understanding this gap between macroeconomic indicators and individual financial well-being is crucial for grasping the true complexity of the contemporary economic environment.

The Paradox of Economic Indicators and Public Perception

Economists frequently highlight strong economic fundamentals, such as a robust gross domestic product (GDP) growth rate and resilient consumer spending, as evidence of a healthy economy. These indicators typically suggest a period of prosperity and stability. For instance, recent reports indicate that the economy is expanding at an annualized rate of 5.4% in the fourth quarter, a rapid pace reminiscent of the post-pandemic recovery. Such data points lead many economic experts to dismiss concerns about a looming recession, attributing the economy's ability to withstand shocks from tariffs, government shutdowns, and labor market fluctuations to underlying strength. This confidence among economic analysts is rooted in traditional metrics that measure overall production and aggregate spending, portraying a vibrant economic landscape that, on paper, should foster widespread optimism.

However, despite these positive macroeconomic signals, public sentiment has remained stubbornly low, reaching its most pessimistic point in over a decade, according to surveys like those conducted by The Conference Board. This significant disconnect suggests that the economic reality experienced by the average individual does not align with the narrative presented by headline economic figures. Factors such as persistent inflation, which erodes the purchasing power of wages, and the disproportionate impact of rising costs on lower and middle-income households contribute to this widespread dissatisfaction. While high-income earners may continue to spend robustly, many other households face increasing pressure to make ends meet as essential goods and services become more expensive. This disparity highlights that aggregate economic growth does not necessarily translate into a broadly shared sense of financial well-being, leading to a palpable sense of unease among the populace.

The "K-Shaped" Economic Reality: Unequal Prosperity

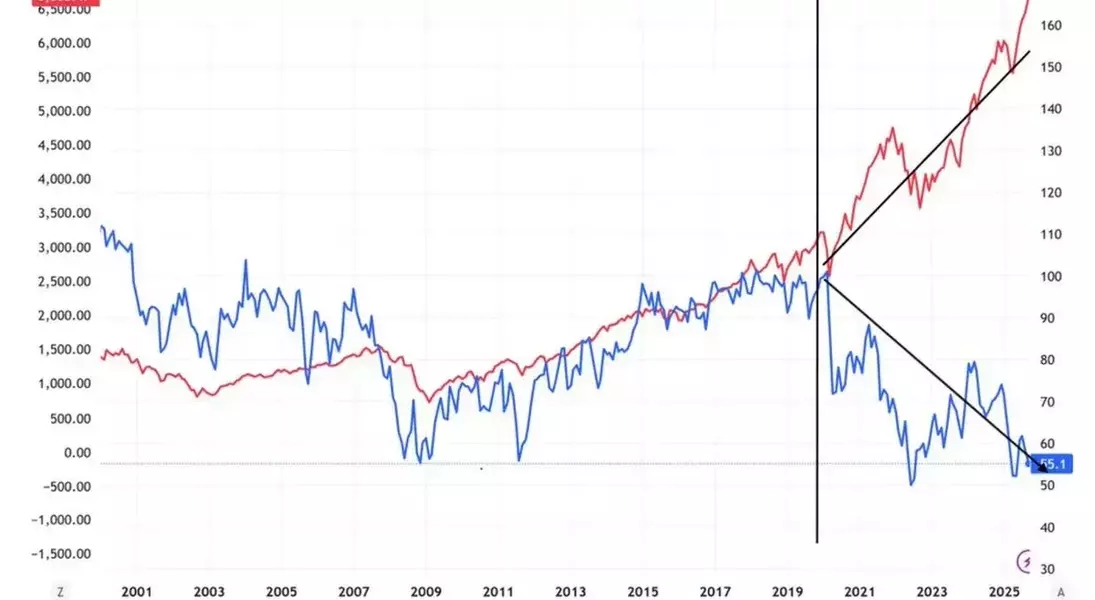

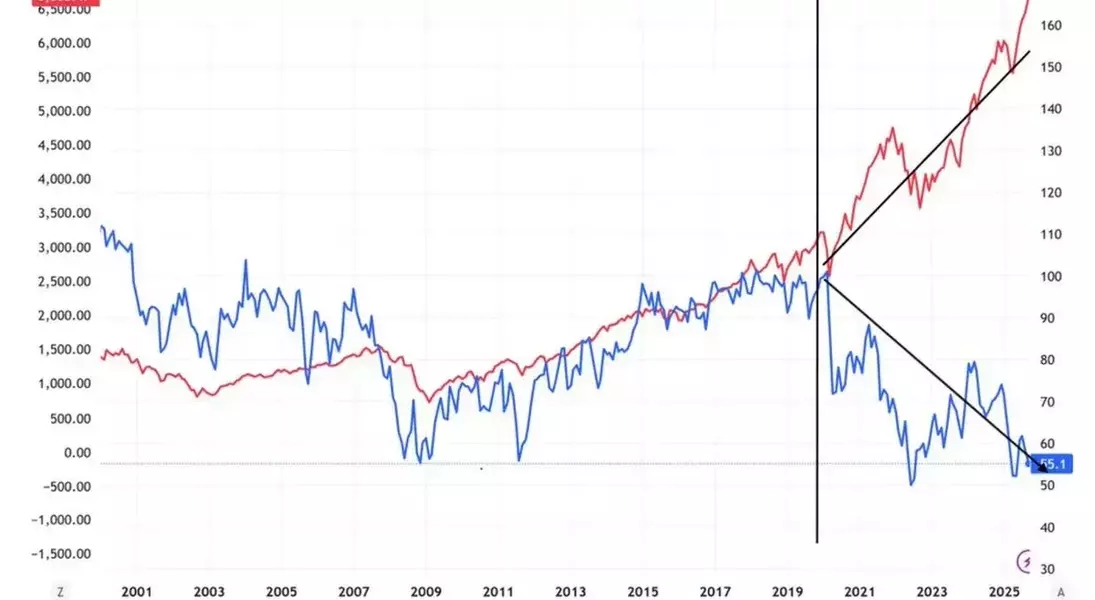

A closer examination of consumer spending patterns reveals a key driver behind the public's pessimism: the stark divergence in financial experiences between different income groups. High-income households are largely responsible for sustaining overall consumer spending, driving economic growth even as a significant portion of the population struggles. This phenomenon creates what economists refer to as a "K-shaped" economic recovery, where the financial fortunes of the wealthy ascend sharply, while those of lower and middle-income individuals either stagnate or decline. Data from institutions like the Federal Reserve Bank of Dallas underscore this trend, showing that wealthier segments of society now control a larger share of national wealth, income, and consumption compared to previous decades. This concentration of economic benefits means that the benefits of a strong economy are not uniformly distributed, leading to an uneven sense of prosperity across different socio-economic strata.

The impact of this K-shaped recovery is particularly evident in the aftermath of the pandemic, where sustained inflation has significantly diminished the real purchasing power of wages for many. Households whose incomes have not kept pace with the rising cost of living find their financial situations deteriorating, making it increasingly difficult to afford basic necessities. This struggle is exacerbated by the fact that wealthier individuals, who often hold significant stock market investments, have benefited disproportionately from recent market booms, such as those fueled by advancements in artificial intelligence. Consequently, while stock portfolios swell for some, average households, relying primarily on their wages, perceive their financial outlook as worsening. This stark contrast between the booming assets of the rich and the shrinking budgets of others contributes to a pervasive feeling of economic insecurity and unfairness, directly impacting consumer confidence and their overall assessment of the economy's health, irrespective of favorable macroeconomic statistics.