Each year, the Internal Revenue Service revises various financial thresholds, including the standard deduction, to account for inflation. Recently, the figures for the 2026 tax year were released, providing clarity on how these adjustments will impact taxpayers. This analysis aims to shed light on these modifications, particularly for individuals earning around $100,000 annually.

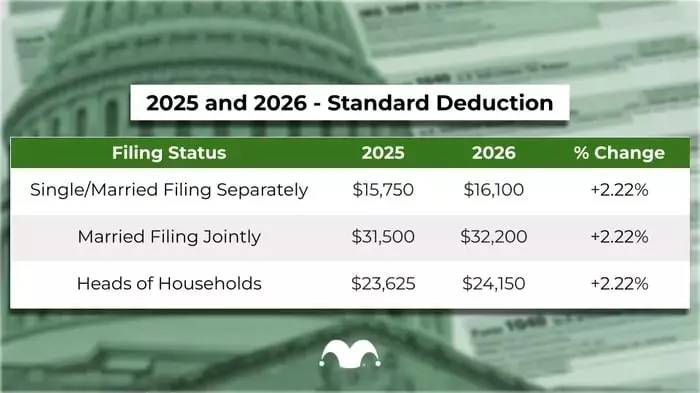

The standard deduction is set to increase for the 2026 tax year, which applies to income earned in 2026 and reported in 2027. For single individuals, the standard deduction will climb from $15,750 to $16,100, representing a $350 increase. Married couples filing jointly will experience a more significant rise, with their standard deduction increasing from $31,500 to $32,200, a $700 adjustment. While many taxpayers opt for the standard deduction, those with substantial mortgage interest, healthcare costs, or other itemizable expenses may still find itemizing more advantageous. For a single person earning $100,000, the higher standard deduction would reduce their taxable income to $83,900 in 2026 from $84,250 in 2025. Similarly, a married couple with the same income would see their taxable income decrease from $68,500 to $67,800. These calculations assume stable income levels, meaning any increase in earnings could offset the benefits of the higher deduction.

Beyond the standard deduction, the IRS has also made slight adjustments to the tax brackets for 2026, which further influence an individual's tax liability. For instance, the 10% marginal tax rate for married couples will apply to the first $24,800 of taxable income, an increase from $23,850 in 2025. The 12% bracket will then cover income up to $100,800, up from $96,950. These bracket shifts, combined with the increased standard deduction, are designed to slightly lessen the tax burden. For example, a married couple earning $100,000, and utilizing the standard deduction, could pay approximately $100 less in taxes in 2026 compared to 2025, resulting in a marginally lower effective tax rate. Furthermore, other legislative changes, such as new deductions for auto loan interest or for those aged 65 and older designed to mitigate Social Security benefit taxation, could also significantly alter one's overall tax picture. While the tax landscape can appear complex, understanding these fundamental changes provides a valuable foundation for anticipating future tax obligations.

Navigating personal finances effectively requires staying informed about tax policy changes. The proactive adjustments by the IRS, reflecting inflationary pressures, underscore a commitment to maintaining fairness and balance within the tax system. By understanding how these changes impact individual financial situations, taxpayers can plan more strategically, ensuring they are well-prepared for their future tax responsibilities. This continuous evolution of tax laws also highlights the dynamic nature of economic policy and its direct influence on the financial well-being of citizens.