The recent surge in futures open interest across several stocks in the NSE F&O pack has sparked significant interest among market participants. This uptrend reflects a growing number of investors either initiating new positions or expanding their existing ones within the futures market, signaling a shift in market sentiment and potential opportunities for savvy traders.

Unlocking the Potential of Futures Open Interest Trends

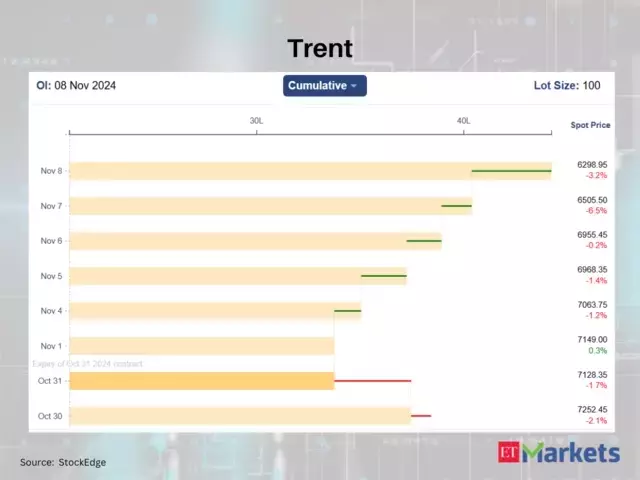

Aarti Industries: A Standout in the Surge

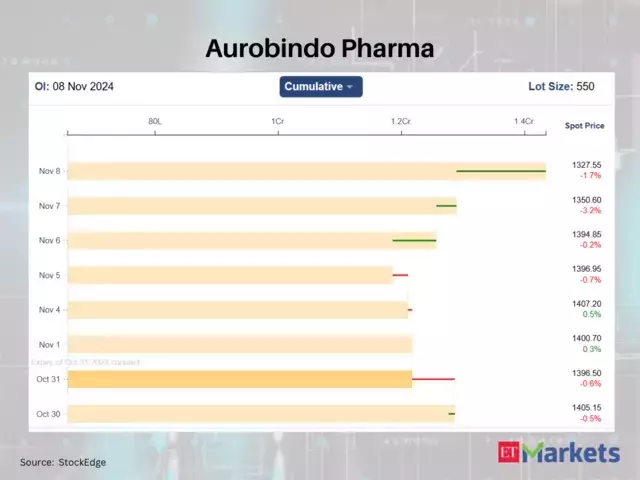

Aarti Industries, a leading player in the chemical industry, has witnessed a remarkable 24.7% increase in its futures open interest, reaching a staggering 1,92,30,000 contracts. This surge suggests a heightened level of investor interest and confidence in the company's future prospects. As a diversified chemical manufacturer with a strong presence in specialty chemicals, Aarti Industries has been able to capitalize on the growing demand for its products, both domestically and globally. The surge in open interest could indicate that investors are positioning themselves to capitalize on the company's potential growth opportunities, potentially driven by factors such as new product launches, capacity expansions, or strategic partnerships.Aurobindo Pharma: Riding the Wave of Investor Confidence

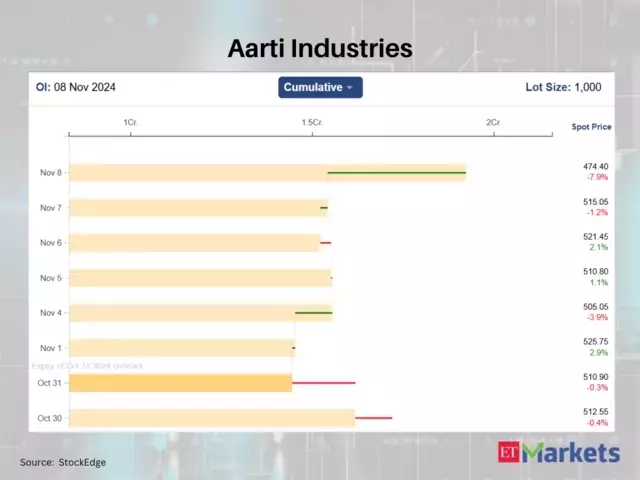

Aurobindo Pharma, a prominent player in the pharmaceutical industry, has also experienced a significant increase in its futures open interest, rising by 11.27% to 1,43,46,200 contracts. This uptick reflects the market's confidence in the company's ability to navigate the dynamic pharmaceutical landscape. Aurobindo Pharma's diversified product portfolio, which spans generics, active pharmaceutical ingredients, and biosimilars, has positioned it as a key player in the global pharmaceutical market. The surge in open interest could indicate that investors are anticipating the company's continued growth, driven by factors such as successful product launches, regulatory approvals, or strategic acquisitions.Manappuram Finance: A Surge in Investor Appetite

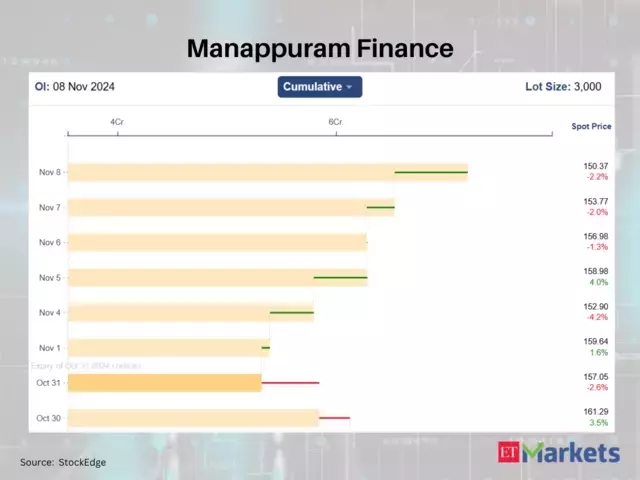

Manappuram Finance, a leading non-banking financial company (NBFC) in India, has witnessed a 10.25% increase in its futures open interest, reaching 7,20,45,000 contracts. This surge suggests that investors are closely monitoring the company's performance and are positioning themselves to capitalize on its growth potential. Manappuram Finance's diversified lending portfolio, which includes gold loans, microfinance, and other consumer finance products, has enabled it to navigate the evolving financial landscape. The surge in open interest could signal that investors are anticipating the company's continued expansion, driven by factors such as increasing market share, product diversification, or technological advancements.Tata Steel: A Shift in Investor Sentiment

Tata Steel, a prominent player in the steel industry, has also experienced a notable increase in its futures open interest, rising by 9.51% to 44,23,400 contracts. This surge reflects a shift in investor sentiment towards the company, potentially driven by factors such as the global steel market's recovery, Tata Steel's strategic initiatives, or its ability to navigate the challenges posed by the COVID-19 pandemic. The increase in open interest could indicate that investors are positioning themselves to benefit from the company's potential growth opportunities, which may include capacity expansions, product diversification, or international expansion.The surge in futures open interest across these four stocks highlights the evolving dynamics within the Indian equity markets. As investors closely monitor the performance and potential of these companies, the increase in open interest suggests a growing appetite for exposure to these stocks through the futures market. This trend underscores the importance of closely tracking and analyzing open interest data to gain insights into market sentiment and potential investment opportunities.