The Ultra 10-Year U.S. Treasury Note futures contract has rapidly established itself as a cornerstone in the interest rate market over the past decade. Launched in 2016 by CME Group, this innovative financial instrument was introduced at a pivotal time when the market was adapting to the Federal Reserve's first rate hike post-2008 financial crisis. Despite initial market volatility driven by global economic concerns, the Ultra10 quickly gained traction, offering unparalleled precision in hedging the crucial 10-year point of the Treasury curve. This contract's success highlights its effectiveness in providing robust risk management solutions for a diverse range of market participants, cementing its status as a primary benchmark.

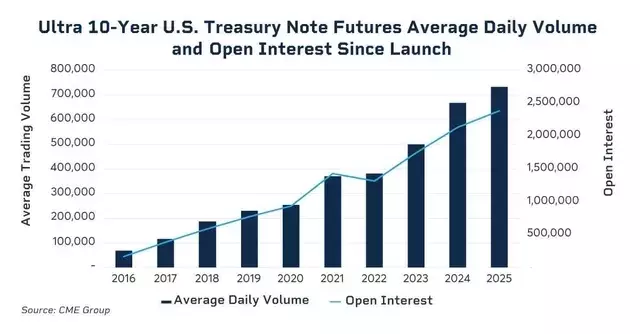

Its immediate and sustained growth underscores its critical importance to the financial system. The Ultra10's strict delivery rules ensure a close correlation with actual 10-year Treasury yields, which appealed greatly to mortgage and corporate bond desks seeking accurate hedging tools. Furthermore, it fostered new trading strategies, such as relative value trades against the classic 10-Year future, enhancing overall market liquidity. With daily volumes frequently exceeding 700,000 contracts and a growing options market, the Ultra10 is poised for continued expansion, driven by increasing Treasury issuance and the ongoing need for sophisticated risk management in an evolving rate landscape.

The Ascent of Ultra10 Futures: Revolutionizing Interest Rate Hedging

The Ultra 10-Year U.S. Treasury Note futures contract, since its inception, has profoundly transformed the landscape of interest rate hedging. Launched by CME Group in 2016, this instrument emerged during a period of significant market adjustment, as the financial world grappled with the Federal Reserve's inaugural interest rate increase following the 2008 financial crisis. Amidst this backdrop of economic uncertainty, marked by global slowdown fears and fluctuating oil prices, the Ultra10 provided a crucial mechanism for mitigating market risk, particularly at the 10-year point of the interest rate curve. This specific maturity, often considered the 'center of gravity' for global fixed-income markets, is indispensable for pricing and hedging the massive U.S. mortgage and corporate bond markets. The immediate embrace and subsequent exponential growth of the Ultra10 contract underscore its vital role in offering precise and effective risk management solutions, establishing it as a preeminent benchmark in the rates complex.

A decade ago, the market relied on the broader 'classic' 10-Year future, which allowed for a wide range of Treasury notes with remaining maturities between 6.5 and 10 years. The Ultra10 introduced tighter delivery specifications, requiring original-issue 10-year notes with at least nine years and five months remaining maturity. This change enabled hedgers to achieve a much more accurate correlation with the true 10-year yield, a critical advantage for managing risk in related markets. The market's response was remarkable, with the contract achieving significant liquidity and open interest within days of its launch, a feat rarely seen in new futures products. This rapid adoption was fueled by mortgage and corporate bond traders seeking precise hedging instruments, as well as Treasury basis traders who benefited from the contract's tight alignment with 'on-the-run' cash 10-year notes, facilitating more accurate arbitrage strategies. Far from cannibalizing the classic 10-Year, the Ultra10 spurred new relative value trading opportunities between the two contracts, boosting liquidity across both, and highlighting its role in fostering a more efficient and interconnected interest rate derivatives market.

Sustained Growth and Future Prospects for Ultra10 and its Options Market

Following its groundbreaking launch, the Ultra 10-Year futures contract quickly solidified its position as a highly liquid benchmark. By the close of 2016, it boasted a deep order book and sustained high trading volumes, cementing its role as a key component of the U.S. Treasury curve. This robust liquidity allows major asset managers to execute substantial block trades without significant price impact, demonstrating the contract's capacity to handle large-scale market activity. The continuous growth of Ultra10 volumes, routinely exceeding 700,000 contracts daily, highlights its enduring relevance and widespread acceptance among market participants. Its ability to enable precise hedging and facilitate intricate relative value trades has not only benefited its direct users but has also enhanced the overall efficiency and depth of the interest rate derivatives market, making it an indispensable tool for managing financial risk in a complex global economy.

As the Ultra 10-Year celebrates its tenth anniversary, the future looks exceptionally promising, with numerous growth opportunities on the horizon. The ongoing increase in Treasury issuance continues to generate demand for hedging tools and create new avenues for relative value trading, further entrenching the 10-year point as a foundational element of the U.S. financial system. Concurrently, the Ultra 10-Year options market is experiencing strong growth, leveraging the deep liquidity of the underlying futures contract. This expansion signifies a growing market appetite for more sophisticated and flexible risk management solutions. In an environment characterized by dynamic interest rate fluctuations, the development of Ultra 10-Year options provides market participants with enhanced tools to navigate volatility and manage exposures more effectively. The continued evolution of both the futures and options markets suggests that the Ultra10's journey of innovation and market impact is far from over, with substantial room for further development and increased integration into global financial strategies.