In a remarkable display of financial resilience, Ukraine's Ministry of Finance successfully raised a staggering UAH 23.16 billion (equivalent) through the sale of domestic government bonds at a recent auction. This achievement underscores the country's unwavering commitment to bolstering its economic foundations, even in the face of ongoing challenges.

Fortifying Ukraine's Financial Future: A Triumph of Determination

Tapping into Domestic Demand

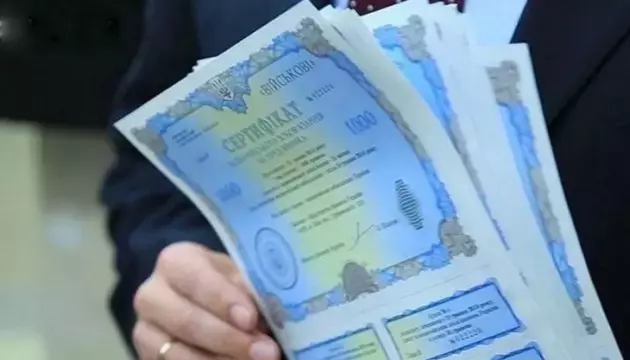

The auction saw a diverse range of investors, both domestic and international, eagerly participating in the placement of hryvnia-denominated government bonds. The ministry offered a variety of maturities, catering to the diverse investment preferences of its clientele. This strategic move not only generated substantial funds for the state budget but also demonstrated the growing confidence in Ukraine's financial markets.Notably, the ministry successfully placed UAH 5.055 billion in bonds with a 1-year maturity at a yield of 14.65%, UAH 5.322 billion with a 1.6-year maturity at 15.25%, and UAH 5.355 billion with a 2.6-year maturity at 16.25%. Additionally, the ministry secured UAH 602 million in bonds with a 3.4-year maturity at a yield of 16.8%. These figures underscore the strong appetite for Ukrainian debt, a testament to the country's unwavering resilience.Diversifying the Debt Portfolio

Alongside the hryvnia-denominated bonds, the ministry also offered dollar-denominated government bonds, further diversifying its debt portfolio. The auction saw the placement of $165 million in bonds with a 1-year maturity at a yield of 4.6%. This move not only strengthens Ukraine's access to international capital markets but also provides a hedge against currency fluctuations, enhancing the overall stability of the country's financial landscape.Expanding the Benchmark Bond List

The successful auction coincides with a significant development in Ukraine's financial ecosystem. The National Bank of Ukraine (NBU) has recently expanded the list of benchmark domestic government bonds that banks are permitted to use to partially meet their reserve requirements. This strategic move is expected to further bolster the liquidity and attractiveness of Ukrainian debt instruments, solidifying the country's position as a reliable investment destination.Navigating Challenges with Resilience

Ukraine's ability to raise such a substantial amount of funds through the domestic bond market is particularly noteworthy given the ongoing challenges the country faces. The nation's resilience in the face of adversity is a testament to the unwavering determination of its people and the steadfast commitment of its government to strengthen the country's financial foundations.As Ukraine continues to navigate the complexities of its economic landscape, the success of this bond auction serves as a beacon of hope, showcasing the country's ability to adapt, innovate, and thrive in the face of adversity. This achievement not only bolsters Ukraine's fiscal position but also reinforces its standing as a reliable and attractive investment destination, paving the way for a more prosperous future.You May Like