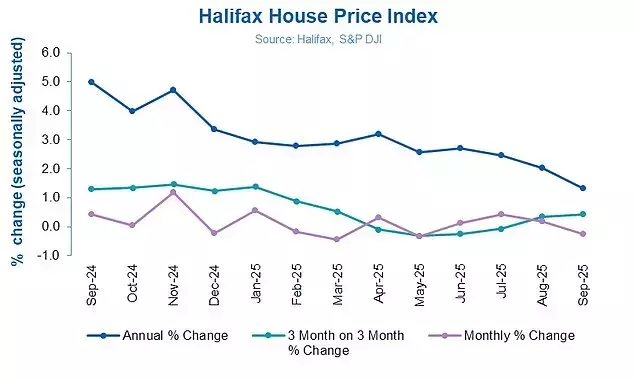

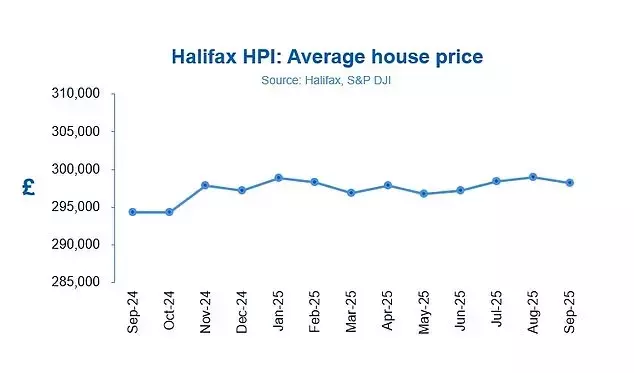

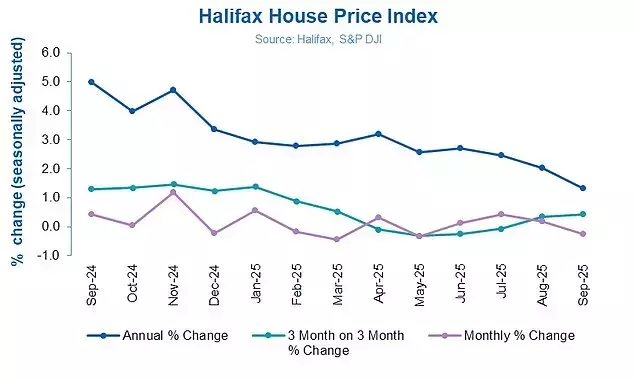

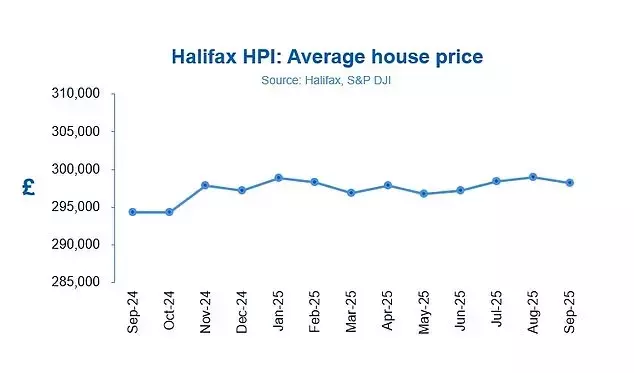

The British housing market witnessed a notable downturn in September, with property values experiencing a 0.3% reduction. This contraction is largely attributed to widespread uncertainty among both prospective buyers and sellers, who are bracing for potential changes to property taxation expected to be unveiled in the November Budget. The average cost of a home now stands at approximately £298,184, a slight decrease from the previous month's figure of £298,978, which had shown a modest 0.2% increase. This recent dip means that since the beginning of 2025, property values have only risen by a mere 0.3%, and are just 1.3% higher compared to September of the previous year.

However, this national trend masks considerable regional variations. Areas like Northern Ireland and Scotland have demonstrated robust growth, with home values increasing by 6.5% and 4.5% respectively over the past year. The North East of England also saw a significant rise of 4.8%, closely followed by the North West at 3.9%. In stark contrast, the Southern regions of England, including the South West, London, and the South East, recorded either marginal growth or outright declines. The South West, for instance, experienced a 0.2% decrease in home values, with the average property now priced at £303,067. London, while remaining the most expensive market with an average property value of £543,497, only saw a modest 0.6% increase, and the South East registered a mere 0.2% rise.

Property market analysts, such as Tom Bill, Head of UK Residential Research at Knight Frank, point directly to the impending Budget and associated tax reform rumors as the primary cause for the market's slowdown. Speculation surrounds several proposals, including the potential transformation of stamp duty from a one-time charge into an annual tax, and the introduction of capital gains tax on residential properties valued above £1.5 million. These proposed changes are casting a shadow of caution over the market, prompting many to adopt a wait-and-see approach. Bill suggests that prices are likely to continue their gentle descent until there is a clear understanding of the government's future fiscal policies.

Jonathan Hopper, CEO of Garrington Property Finders, echoes this sentiment, observing a split in market behavior. While higher-end properties are particularly affected by the tax hike fears, leading many owners to delay transactions, the entry-level market shows a different dynamic. First-time buyers are being encouraged by stable, or even slightly falling, prices and more favorable mortgage interest rates, prompting them to enter the market. This divergence highlights the varied impacts of economic uncertainty and policy rumors across different segments of the property ladder.

The overall market sentiment is one of apprehension, with both buyers and sellers pausing their activities. This stagnation is particularly pronounced in the higher price brackets, where the potential tax implications are more significant. The wait for the November Budget's announcements is essentially holding a substantial portion of the property market in limbo, impacting sales volumes and price movements, especially in the usually vibrant Southern regions. Until the Chancellor, Rachel Reeves, clarifies the government's stance on property taxation, experts anticipate a continued period of subdued activity and modest price adjustments.