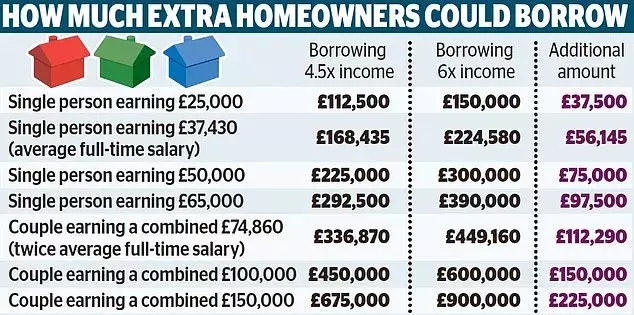

A recent policy adjustment by the Chancellor is set to reshape the landscape of homeownership, enabling individuals to secure mortgages at a higher income multiple. This strategic shift, intended to facilitate property acquisition for new buyers and those seeking larger homes, permits borrowing up to six times an applicant's income, a notable increase from the prior ceiling of four and a half times. Consequently, a couple earning average salaries could potentially access an additional £112,290, significantly boosting their purchasing power. This change is complemented by other measures, such as the increased availability of mortgages requiring only a 5% deposit and relaxed stress test criteria by lenders, making home financing more accessible.

However, this liberalisation of lending standards has ignited considerable debate among financial analysts and housing market observers. Critics caution that while the policy may appear beneficial on the surface, it carries substantial risks. A key concern is the potential for an artificial inflation of house prices, making homeownership even less attainable in the long run. Moreover, extending larger loans to households could exacerbate financial vulnerabilities, particularly given the current economic climate marked by high interest rates and rising living costs. There is a palpable fear that this could lead to an increase in mortgage arrears and property repossessions, mirroring the conditions that precipitated past financial downturns. Industry professionals point out that the lending restrictions now being eased were originally implemented to safeguard homeowners after the 2008 financial crisis, and their removal could reintroduce instability into the market.

Ultimately, the effectiveness and prudence of this new mortgage policy remain subjects of intense scrutiny. While the government's aim to assist more people onto the property ladder is commendable, the potential for unintended consequences, such as an overheated housing market and increased financial instability for borrowers, cannot be overlooked. The long-term impact on personal finances and the overall economic stability of the housing sector will largely depend on how these new measures interact with broader market forces and individual borrower resilience. It is a delicate balance between fostering accessibility and preventing undue risk, a challenge that will require careful monitoring and adaptive strategies to navigate successfully.

This evolving scenario underscores the vital importance of prudent financial planning and responsible borrowing. For aspiring homeowners, it highlights the need to thoroughly assess personal affordability beyond just initial loan approvals. For policymakers, it serves as a reminder that economic interventions, while well-intentioned, must be continuously evaluated for their systemic effects. By promoting financial literacy and encouraging sustainable lending practices, society can work towards a housing market that is both accessible and stable, safeguarding the well-being of its citizens and the broader economy.