The British property market displayed a complex picture in May, marked by an overall increase in average house prices alongside pronounced regional variations. Data from the Office for National Statistics indicates a 1.1 percent monthly rise, contributing to a 3.9 percent annual growth, pushing the average UK home value to £269,000—a substantial £10,000 increase from the previous year. This upswing, however, follows a 2.7 percent dip in April, signaling a volatile yet generally upward trend. Property experts note that the market is undergoing a re-calibration, urging sellers to adopt realistic pricing strategies in light of shifting buyer sentiment and broader economic influences.

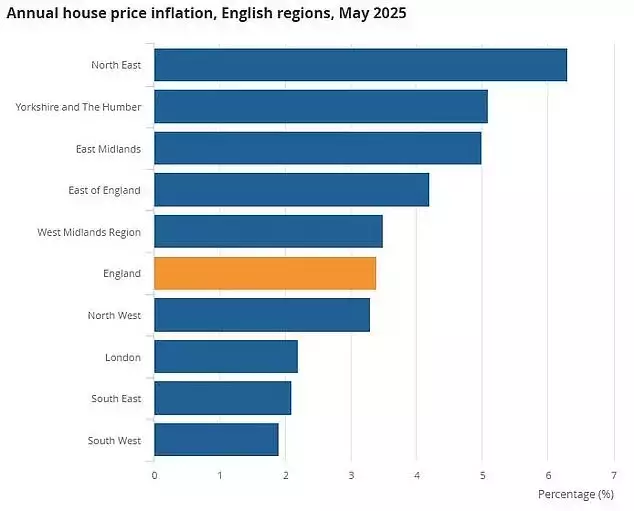

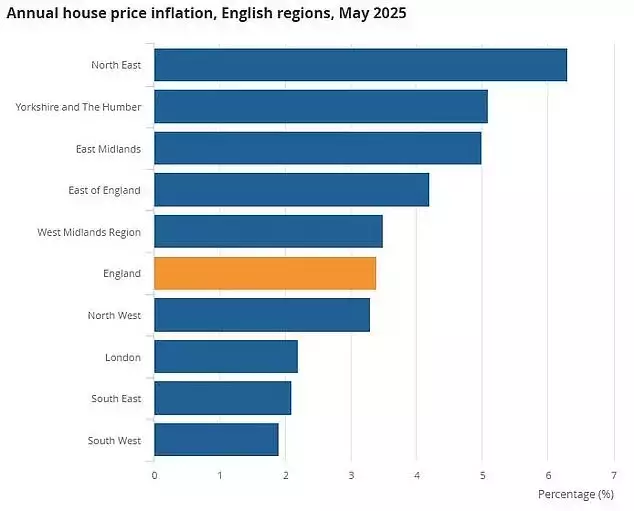

A notable trend is the stark geographical divide in housing performance. Northern areas, including Scotland and the North East of England, are experiencing strong momentum, with house prices surging by more than 6 percent year-on-year. For instance, the average property in the North East now commands approximately £159,142, reflecting robust demand outpacing supply in these perceived value-for-money regions. Conversely, the South West and South East of England recorded more modest annual gains of 1.9 and 2.1 percent respectively. London, in particular, presented a contrasting narrative, with May seeing a 1.4 percent decline in average prices, bringing its annual growth to just 2.2 percent. The capital's unique market, heavily influenced by international buyers, appears to be grappling with an exodus of affluent homeowners, contributing to a cooling effect, especially in prime inner-city areas where values remain below 2014 levels.

Beyond geographical distinctions, the type of property also plays a crucial role in price dynamics. Detached houses continue to be a strong performer, appreciating by 5.4 percent over the past year, reaching an average of £441,349. In stark contrast, flats and maisonettes saw a marginal 1.5 percent increase, averaging £198,262. New build properties are experiencing exceptionally rapid growth, with average prices soaring by an impressive 29.9 percent year-on-year to £419,862. This diverse performance across property types and regions underscores the nuanced nature of the current housing landscape, where localized factors and specific market segments dictate varying outcomes for homeowners and prospective buyers.

This evolving property market, characterized by localized booms and corrections, highlights the importance of adaptability and informed decision-making. For individuals and families, understanding these regional and property-specific trends is crucial for making sound financial choices. The resilience of certain areas and property types, even amidst broader economic shifts, serves as a testament to the enduring value of strategic investment and the continuous pursuit of opportunities within a dynamic environment. Embracing change and adjusting expectations in line with expert advice fosters a more stable and equitable real estate landscape, benefiting all participants.