Navigating the Evolving Landscape of Residential Property Values

Understanding the Current Upward Trend in Property Valuations

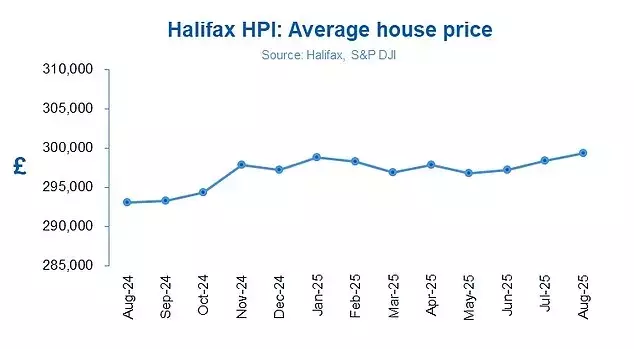

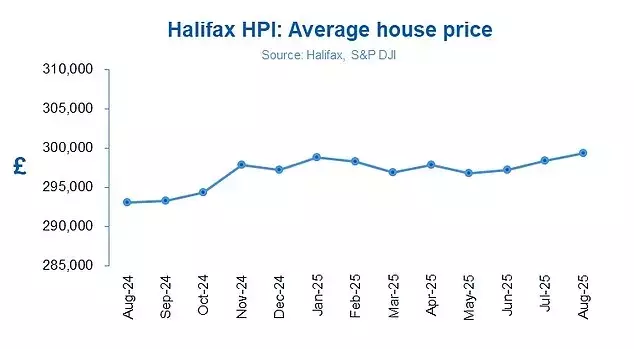

Residential property values have climbed to unprecedented levels, marking a significant milestone in the housing market. Data from a leading mortgage provider reveals a consistent ascent over the past three months, pushing the average home price to nearly £300,000. This ongoing rise contrasts sharply with prevailing pessimistic sentiments that have focused on declining prices in more affluent urban centers.

Analyzing Regional Disparities in Real Estate Growth

A clear divergence in property market performance is observable across various regions. While areas in northern England, including the North East, North West, and Yorkshire and the Humber, have seen robust growth exceeding 4% annually, some southern regions have experienced a deceleration. London, despite its status as the most expensive market, shows only marginal year-on-year appreciation. Northern Ireland and Scotland, however, stand out with notable annual price increases, indicating a vibrant market in those areas.

Mortgage Rates and Buyer Affordability: A Shifting Dynamic

The current landscape of mortgage lending reflects improved conditions for prospective homeowners. A key factor contributing to market stability is the gradual reduction in borrowing costs over the past two years, making financing more accessible. Furthermore, strong wage increases have outpaced property value inflation, enhancing purchasing power for many. For first-time buyers, the cost of homeownership remains more economical than renting, despite a slight decrease in their typical purchase price in recent months, influenced by changes in transaction taxes.

Expert Outlook: Future Trajectories and Potential Market Influences

Industry specialists project a continued, albeit measured, upward movement in residential property values throughout the remainder of the year. This optimistic forecast is underpinned by improving affordability metrics and consistent demand. Nevertheless, an undercurrent of uncertainty persists, largely due to ongoing speculation about forthcoming fiscal policies, particularly those related to property taxation. These potential changes are prompting some buyers to adopt a cautious stance, influencing transaction volumes and price negotiations in certain market segments.

The Impact of Policy and Tax Speculation on Market Behavior

Rumors concerning significant adjustments to property transaction duties and capital gains taxes are creating a speculative environment within the housing sector. This uncertainty is notably affecting discretionary purchases and leading to an increase in transaction cancellations, especially in higher-value brackets. While some buyers might expedite their plans to preempt tax revisions, others are waiting for clearer policy directions. Experts suggest that the market's immediate future will be characterized by a delicate balance between demand and supply, with prices highly sensitive to perceived risks and opportunities.