Navigating the Evolving Terrain of UK Housing Accessibility

A Look Back: How Affordability Has Shifted

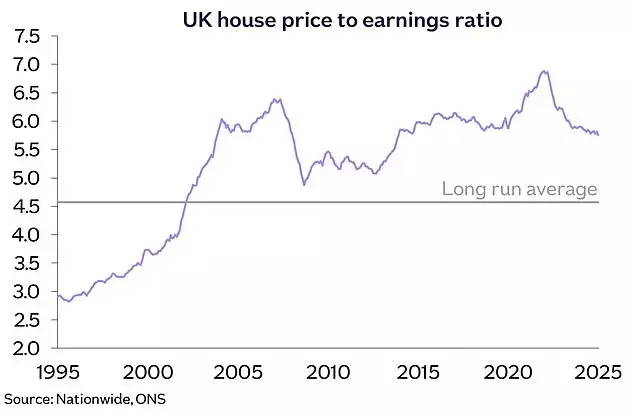

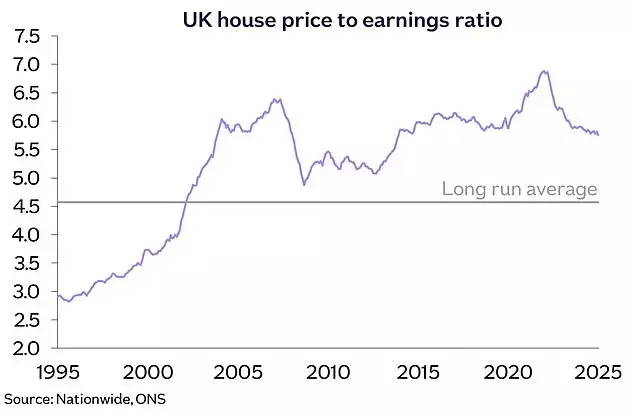

New data from Nationwide Building Society reveals an interesting trend: despite a general perception of rising property costs, the average UK home is marginally more attainable today than it was twenty years prior. This assessment is based on the critical ratio of average property prices to average annual full-time salaries. In the period from April to June this year, the average house price stood at 5.8 times the typical income, a slight decrease from 5.9 times recorded during the same quarter in 2005. This shift reflects a period where earnings have outpaced property value appreciation, with salaries increasing by 76 percent against a 73 percent rise in house prices over the two-decade span. Nevertheless, the current ratio remains above the long-term average of 4.8, indicating that housing still poses a significant financial hurdle for many.

Regional Disparities: A Tale of Two Britains

While the national statistics offer a glimmer of improved affordability, a closer examination reveals stark regional differences. London, for instance, has seen a marked decline in housing accessibility, with its house price-to-earnings ratio escalating from 7.1 to 9.2 over the last 20 years. Surrounding metropolitan areas have experienced a similar, albeit less dramatic, increase. Conversely, the North of England has witnessed the most notable improvement in affordability, with its ratio falling from 5.4 in 2005 to 4 in 2025. This regional divergence underscores the uneven impact of market forces and income growth across the UK, making the dream of homeownership more distant for those in high-cost areas.

The Impact of Interest Rates on Homeownership

Beyond the house price-to-earnings ratio, interest rates play a pivotal role in determining the true cost of homeownership, particularly for first-time buyers. Compared to 2005, initial mortgage payments, as a percentage of take-home pay for a first-time buyer with a 20 percent deposit, have slightly reduced from 38 percent to 34 percent. However, this overall improvement masks the significant deterioration in affordability seen over the past five years due to sharp increases in interest rates during 2022 and 2023. For example, a £200,000 mortgage in 2020 at 1.7 percent interest would have cost approximately £818 per month, whereas today, at rates around 4.15 percent, the monthly payment for the same amount could exceed £1,072. Nationwide anticipates a gradual easing of these financial pressures, driven by a combination of potential rate reductions and continued wage growth outpacing property price increases.

The Deposit Dilemma: Rising Rents and Saving Challenges

Despite some statistical improvements in the house price-to-earnings ratio, the practical hurdles to homeownership remain substantial, particularly the challenge of accumulating a sufficient deposit. Industry experts, such as Jeremy Leaf, a North London estate agent, point out that the house price-to-earnings ratio doesn't fully account for the dramatic rise in rental costs, especially in major cities like London. This surge in rent makes it increasingly difficult for aspiring buyers to save the necessary funds for a down payment, often leading to delayed property purchases. The sensitivity of the market to financial incentives, as evidenced by the impact of past stamp duty holidays, further highlights the importance of addressing initial costs for first-time buyers. Moving forward, government initiatives aimed at supporting deposit accumulation, such as improvements to schemes like 'Freedom to Buy,' could be crucial in revitalizing the housing market.