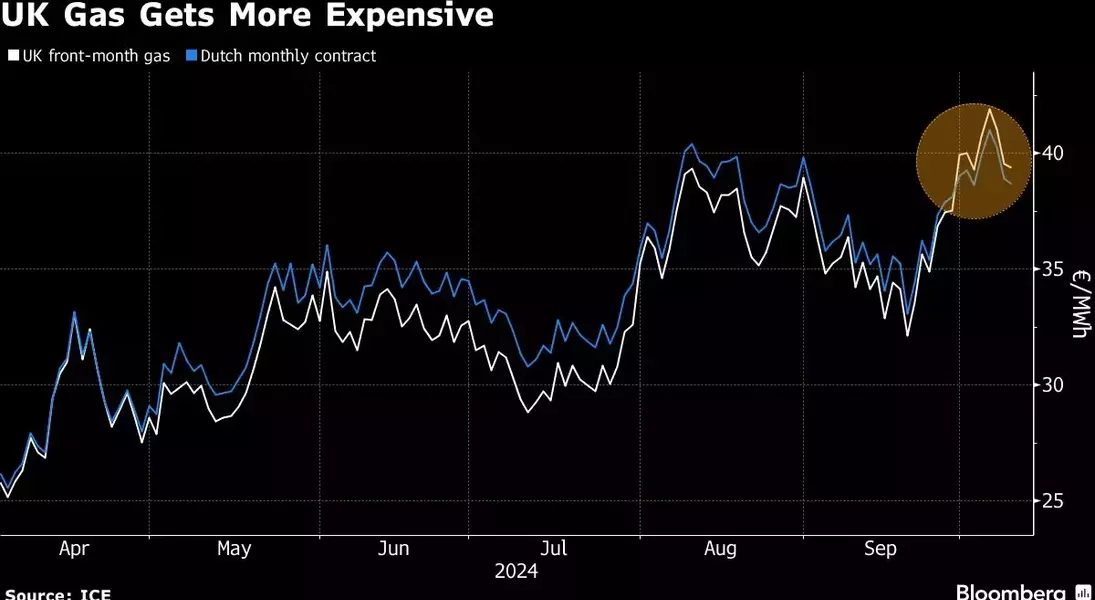

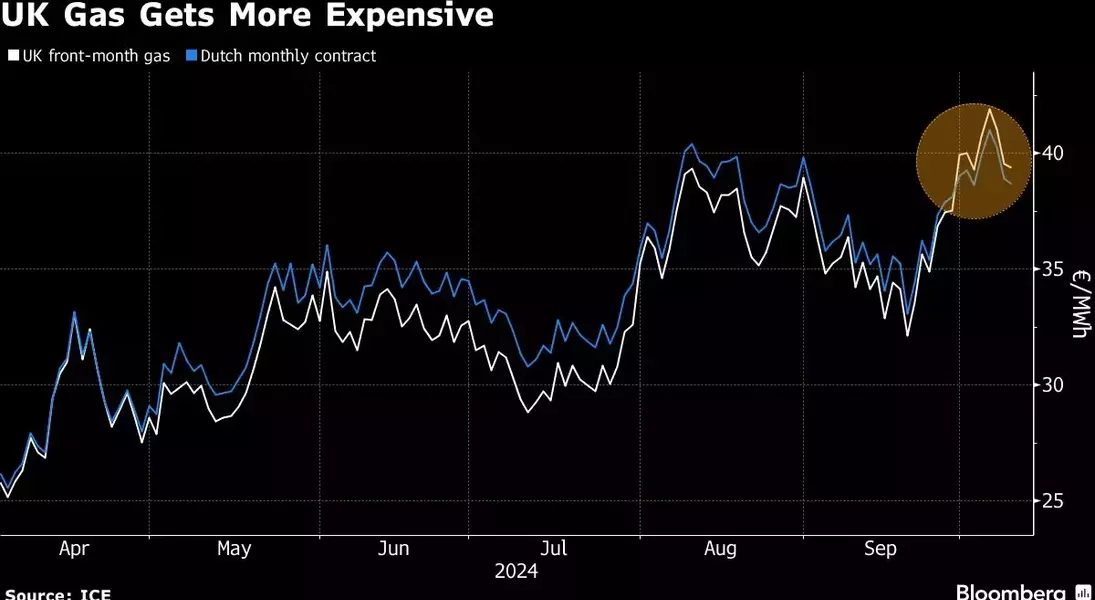

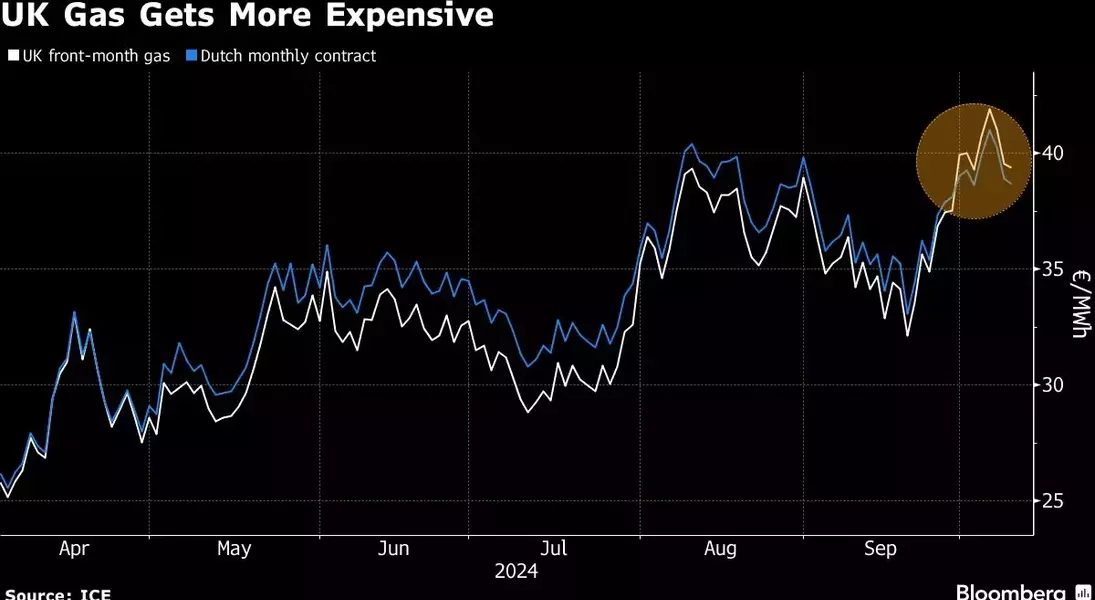

UK Gas Futures Surge Ahead of Continental Europe, Signaling Looming Demand Spike

The UK natural gas futures market has taken an unexpected turn, with prices surging ahead of their continental European counterparts. This shift signals that traders are bracing for a significant increase in demand, driven by a complex web of geopolitical tensions and supply chain concerns.Traders Brace for Potential Disruptions in Global Gas Supply

Escalating Tensions in the Middle East

The recent escalation of tensions in the Middle East has heightened concerns about the stability of liquefied natural gas (LNG) supplies from key exporter Qatar. Traders are closely monitoring the situation, as any disruptions to these critical supply lines could have far-reaching consequences for the European gas market. The UK, in particular, is vulnerable to such disruptions, as it lacks the robust winter storage capacities of its continental counterparts.Shifting LNG Trade Patterns

Another factor contributing to the UK's gas price premium is the changing dynamics of the global LNG trade. According to S&P Global's gas market analyst Elizabeth Kunle, LNG shipments to the UK have more than halved in the first nine months of 2023 compared to the previous year. This shift is driven by the European Union's increased capacity to import LNG, which has diverted some of the supply away from the UK and towards other terminals in northwest Europe and Italy.Domestic Supply Concerns

The UK's limited winter storage capacity, which can only hold enough gas to meet peak demand for less than 8 days, further exacerbates the country's vulnerability to supply disruptions. In contrast, Germany's storage facilities can meet up to 89 days of peak demand, providing a crucial buffer against potential shortages. This disparity has led the UK to rely more heavily on imports during the winter months, driving up the premium on its gas futures contracts.Preparing for a Potential Cold Snap

The UK's gas futures premium is also a reflection of traders' concerns about the potential for a prolonged cold snap this winter. As Nick Campbell, a managing director at Inspired Plc, explains, "A prolonged cold snap could quickly drain UK storage facilities, hence the need to price at a premium to the continent." This premium serves as an incentive for suppliers to direct more gas towards the UK, ensuring that the country has sufficient supplies to meet the increased demand during periods of extreme weather.Domestic Gas Usage Decline

Interestingly, the UK's domestic gas usage by the power sector has also declined, further contributing to the country's reliance on imports. This trend, coupled with the EU's increased LNG import capacity, has led to a situation where the UK may even remain a net gas exporter in November, despite the current premium on its futures contracts.Potential for Short-lived Premium

However, according to S&P Global's Elizabeth Kunle, the current premium on UK gas futures may be short-lived, barring any significant changes in weather patterns or geopolitical developments. The UK's "quite robust" domestic supply could potentially offset the need for a sustained premium, potentially leading to a narrowing of the gap between UK and continental European gas prices.In conclusion, the surge in UK natural gas futures prices compared to their continental European counterparts reflects a complex interplay of geopolitical tensions, supply chain disruptions, and domestic market dynamics. As traders navigate these challenges, the UK's gas market remains a focal point for close observation, with the potential for further volatility and shifting trade patterns in the months ahead.