Unraveling the Market's Potential at Year's Close

Central Bank Actions and Their Impact on Stocks

The Federal Reserve's decision to cut interest rates by another quarter point is a crucial event that could have far-reaching consequences for the stock market. Lower interest rates generally make borrowing cheaper, which can stimulate economic growth and lead to increased corporate profits. This, in turn, may boost stock prices as investors become more optimistic about the future. The Bank of Japan and the Bank of England's policy announcements will also be closely watched as they can influence global financial markets. These central banks play a vital role in maintaining economic stability and managing inflation, and their actions can have a ripple effect on various asset classes.

For example, a cut in interest rates by the Federal Reserve could lead to increased liquidity in the market, making it easier for companies to raise capital through debt issuance. This can support stock prices as companies have more funds available for expansion and investment. On the other hand, if the central banks' actions are not in line with market expectations, it could lead to volatility and uncertainty. Investors will be closely monitoring the details of these policy decisions and how they are likely to affect different sectors of the economy.

Futures and Stock Market Indicators

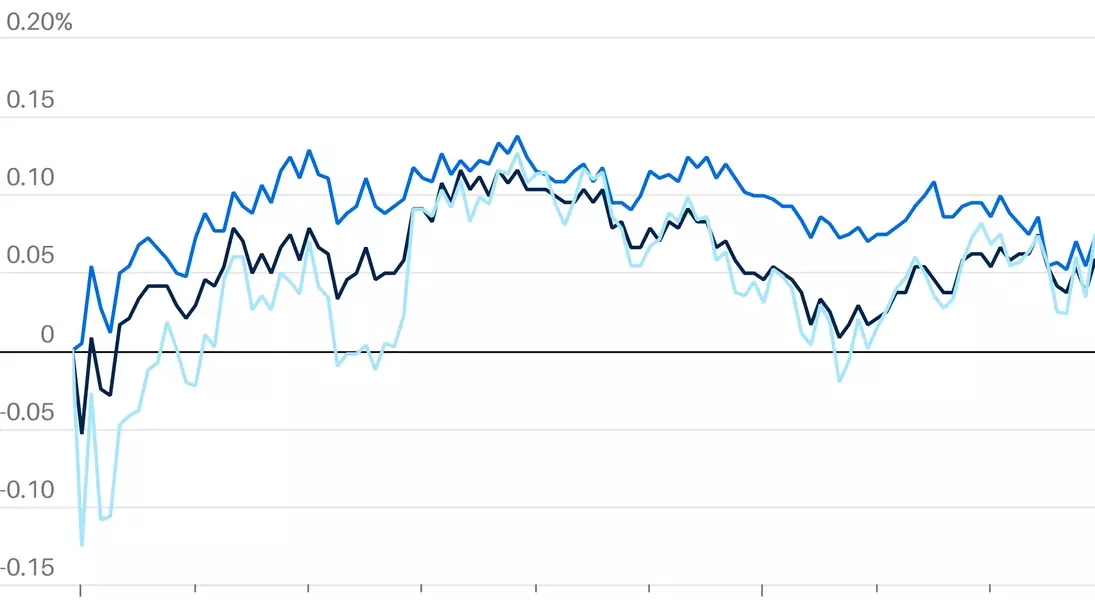

The rise in futures tracking the Dow Jones Industrial Average and the S&P 500 and Nasdaq 100 contracts indicates a potential shift in market sentiment. These indicators provide valuable insights into the direction that the stock market may take in the short term. A rising futures market often suggests that investors are optimistic about the future performance of stocks and are willing to take on more risk. However, it is important to note that futures are not always a reliable predictor of actual market movements, and other factors such as economic data and geopolitical events can also influence stock prices.

For instance, if there are positive economic indicators released during the trading week, such as strong employment data or improved consumer sentiment, it could further fuel the rally in stocks. On the other hand, if there are any geopolitical tensions or negative news events, it could dampen investor confidence and lead to a sell-off in the market. Therefore, it is essential to consider a wide range of factors when analyzing the stock market and making investment decisions.

The Significance of the Final Trading Week

The final full trading week of the year holds particular significance for investors and market participants. It is a time when many investors review their portfolios and make decisions about their year-end positions. The performance of stocks during this week can have a lasting impact on their overall returns for the year. Additionally, it is a period when market participants often look ahead to the next year and assess the potential opportunities and risks.

For example, if stocks manage to end the year on a positive note, it can provide a boost to investor confidence and set the stage for a strong start to the new year. On the other hand, if there is a significant decline in stock prices during this week, it could lead to a more cautious approach by investors in the coming months. Therefore, the final trading week often sees increased trading activity as investors try to position themselves for the end of the year and beyond.