U.S. stocks were on the verge of a brief pause on Thursday following a string of recent peaks. Federal Reserve Chair Jerome Powell's remarks played a significant role, as he downplayed the likelihood of an immediate rate-cutting cycle. This had an immediate effect on the stock markets. Meanwhile, Bitcoin achieved a remarkable milestone by surging above $100,000 for the first time ever.

Unraveling the Dynamics of Stocks and Bitcoin Amid Fed's Actions

Stock Market Trends After Recent Highs

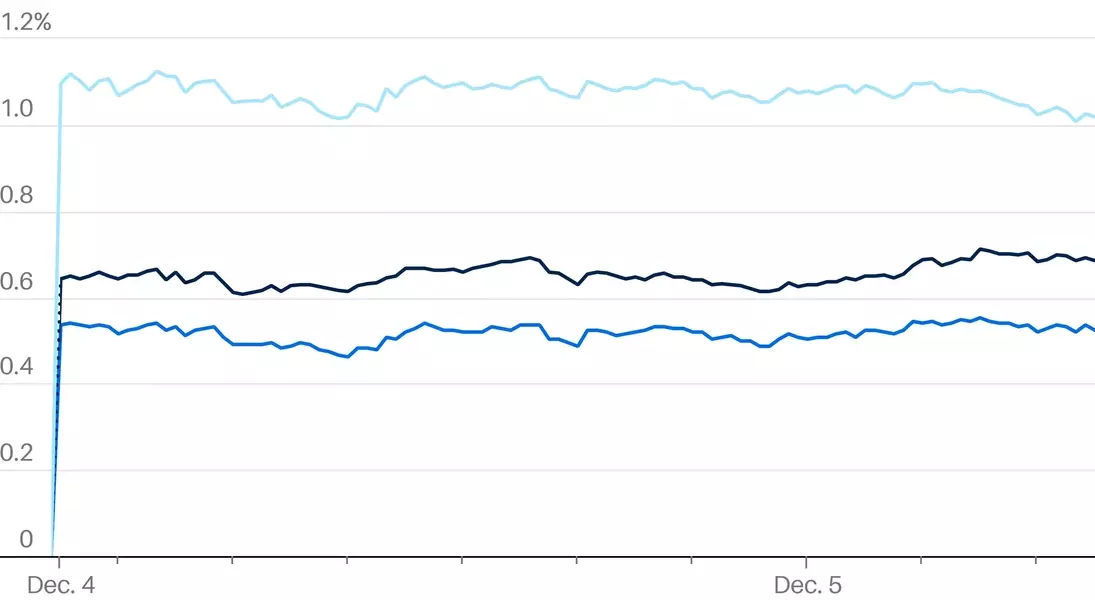

The Dow Jones Industrial Average futures remained relatively stable. After reaching a new record high by closing above 45,000 in the previous trading session, it now shows a lack of significant upward momentum. S&P 500 futures dipped by 0.1%, indicating a cautious sentiment in the broader market. Nasdaq 100 futures also experienced a minor decline of 0.2%, suggesting that the tech-heavy sector might be taking a breather. This shows that despite the recent highs, the markets are not immune to changes in economic and monetary policies.The Fed's stance on interest rates has a profound impact on stock market movements. When Powell emphasized that there is no immediate need to cut rates quickly due to uncertainties in the inflation outlook and a solid economic backdrop, it sent a signal to the market. Investors are now waiting to see how these factors will play out in the coming months.The Significance of Bitcoin's Breakthrough

Bitcoin's ascent to $100,000 is a major event in the cryptocurrency world. It not only represents a significant milestone for Bitcoin but also attracts the attention of investors and the general public. The突破 (breakthrough) of this psychological barrier indicates the growing acceptance and popularity of cryptocurrencies. However, it also raises questions about the sustainability of this upward trend and the potential risks associated with the highly volatile cryptocurrency market.Many experts believe that Bitcoin's rise is driven by a combination of factors such as increased institutional interest, growing mainstream awareness, and the potential for Bitcoin to serve as a hedge against inflation. But at the same time, they also caution that the cryptocurrency market is highly unpredictable and subject to various regulatory and market uncertainties.The Fed's Role in Shaping the Financial Landscape

Jerome Powell's statements at the New York Times DealBook Summit highlighted the Fed's cautious approach to interest rate decisions. The Fed's focus on maintaining stability in the economy and managing inflation risks is crucial in determining the direction of financial markets. By pushing back against the hopes of a swift rate-cutting cycle, the Fed is signaling that it will take a measured approach to monetary policy.This approach has implications not only for stock markets but also for other asset classes. It affects borrowing costs, investment decisions, and consumer spending. As the Fed continues to navigate through the uncertainties of the current economic environment, its actions will continue to shape the financial landscape and influence market trends.In conclusion, the recent developments in U.S. stocks and Bitcoin are closely tied to the Fed's stance on interest rates. The markets are waiting to see how these factors will unfold in the future and how they will impact investment decisions and economic growth. You May Like