Unraveling the Impact of Inflation on Stock Futures

Record Highs and Jobs Report

Last Friday, both the S&P 500 and Nasdaq Composite achieved record highs. This came after the jobs report surprised with better-than-expected figures. However, the market was cautious as the data wasn't overly hot to shift rate-cut expectations. It's a delicate balance that investors are trying to understand and capitalize on.

The jobs report's influence on the market is significant. It provides insights into the health of the economy and can have a ripple effect on stock prices. Investors are closely monitoring these indicators to make informed decisions.

Dow's Consecutive Drop

The Dow faced a setback as it fell for the second consecutive day. UnitedHealth shares played a role in dragging it down following the fatal shooting of executive Brian Thompson. This incident highlights the vulnerability of individual stocks and how they can impact broader market indices.

Market volatility is not new, but events like this can add an extra layer of uncertainty. Investors are now looking for signs of stability and recovery in the Dow.

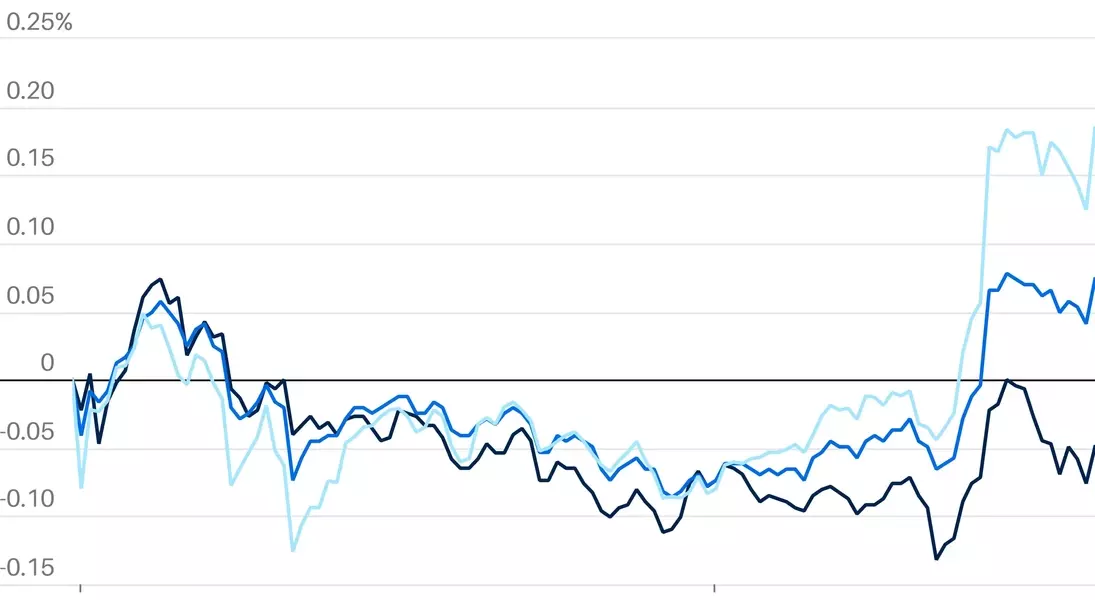

Looking Ahead to Inflation Data

The upcoming key inflation data is the focus of attention. It will provide crucial information about the direction of interest rates and the overall health of the economy. Investors are bracing themselves for this data release, as it could potentially trigger significant market movements.

Understanding inflation trends is essential for investors. It helps them assess the value of their investments and make adjustments accordingly. The upcoming data will be a litmus test for the market's sentiment.