As the world grapples with the ongoing pandemic and its far-reaching economic implications, the financial markets are poised to undergo a significant transformation in the coming week. From the highly anticipated U.S. presidential election to the Federal Reserve's monetary policy decisions, the focus of investors and analysts alike is set to shift decisively, presenting both challenges and opportunities for those navigating the complex landscape.

Charting the Course: A Comprehensive Outlook on the Upcoming Market Landscape

The Pulse of the Nation: Decoding the U.S. Presidential Election

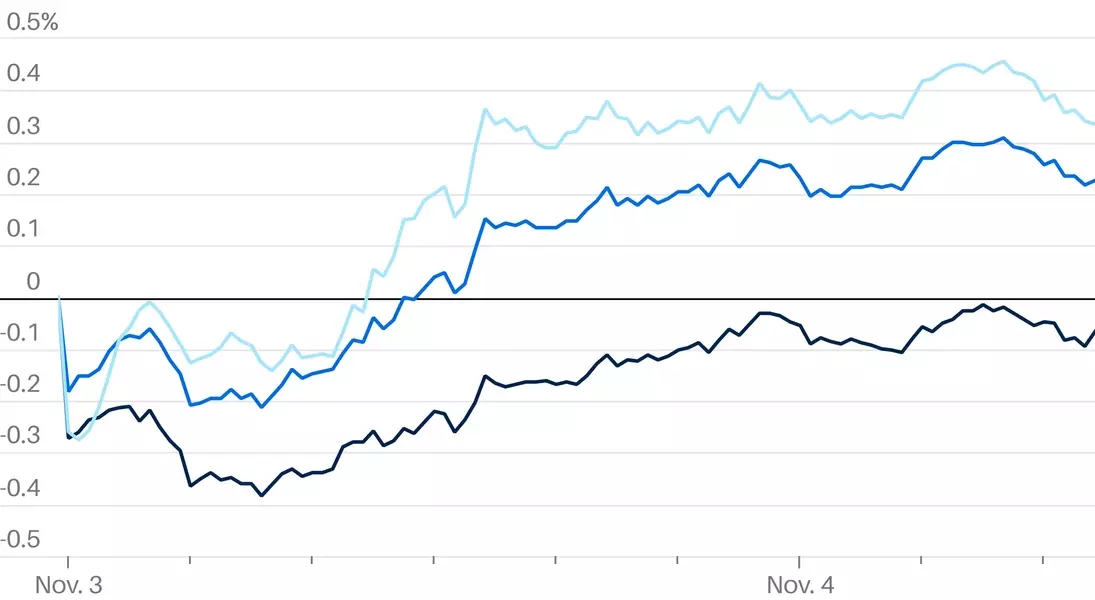

The upcoming U.S. presidential election has captured the attention of the global financial community, as the outcome could have far-reaching implications for the markets. Investors are closely monitoring the race between Democratic candidate Vice President Kamala Harris and Republican candidate former President Donald Trump, with the potential for a protracted vote-counting process adding to the uncertainty. Analysts suggest that the market's reaction will largely depend on the perceived policy platforms of the winning candidate, with potential shifts in taxation, regulation, and trade agreements being closely scrutinized.The Fed's Balancing Act: Navigating Monetary Policy Decisions

Alongside the election, the Federal Reserve's monetary policy meeting is set to take center stage, with investors eagerly awaiting the central bank's latest decisions. The Fed's actions, including potential adjustments to interest rates and asset purchase programs, could have a significant impact on the broader market sentiment. Economists will be closely analyzing the Fed's economic projections and any signals regarding the future trajectory of monetary policy, as they seek to gauge the central bank's response to the ongoing economic challenges.Earnings Season: Deciphering Corporate Performance

As the market's attention shifts, the ongoing earnings season will also play a crucial role in shaping investor sentiment. Companies across various sectors will be reporting their financial results, providing valuable insights into the state of the economy and the resilience of corporate America. Analysts will be closely examining these earnings reports, looking for clues about the pace of the economic recovery and the potential impact of the pandemic on different industries.Global Interconnectedness: Navigating International Dynamics

The interconnected nature of the global economy means that events and policies beyond the U.S. borders will also have a significant influence on the market's trajectory. Investors will be closely monitoring developments in other major economies, such as China and the European Union, as well as any shifts in international trade agreements and geopolitical tensions. The ability to navigate these complex global dynamics will be a key factor in determining the success of market participants in the coming weeks.Volatility and Opportunity: Adapting to a Shifting Landscape

As the market landscape undergoes these transformative shifts, investors and analysts will need to be nimble and adaptable. Periods of heightened volatility often present both challenges and opportunities, and the ability to identify and capitalize on emerging trends will be crucial. Diversification, risk management, and a deep understanding of the underlying drivers of market movements will be essential tools for navigating the uncertain terrain ahead.In conclusion, the coming week promises to be a pivotal moment for the financial markets, as the focus shifts from earnings to elections and economic policy decisions. By staying informed, analyzing the available data, and maintaining a strategic, adaptable approach, market participants can position themselves to navigate the shifting tides and potentially uncover new avenues for growth and success.You May Like