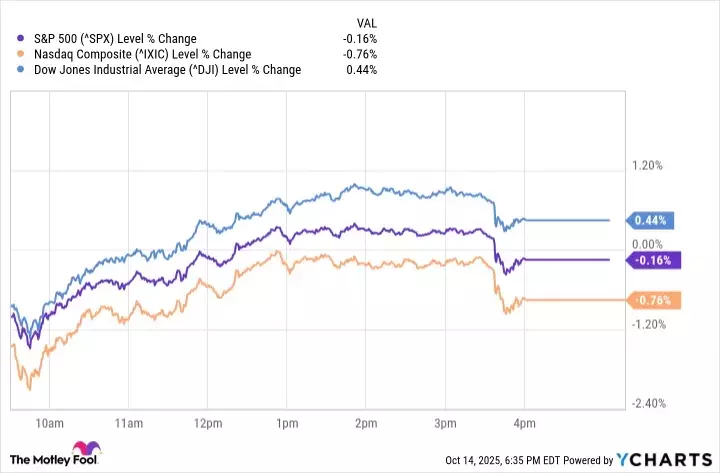

On Monday, U.S. equities faced a late-day slump, primarily influenced by growing trade disputes between America and China. The S&P 500 and Nasdaq Composite both concluded the trading session in negative territory. Although the Dow Jones Industrial Average managed a modest increase, bolstered by strong performances in banking and industrial sectors earlier in the day, the broader market sentiment shifted downwards as the trading day ended. Adding to investor concerns were comments from Federal Reserve Chair Jerome Powell, who reiterated the Fed's data-driven approach to future interest rate adjustments.

Market Snapshot: Trade Wars and Fed Watch

As Monday's trading drew to a close, a palpable shift in market sentiment occurred, largely due to renewed friction in U.S.-China trade relations. News emerged suggesting that Beijing had imposed restrictions on new collaborations with specific international manufacturers, fueling anxieties about a potential slowdown in global investment and disruptions across supply chains. This development cast a shadow over earlier market enthusiasm, particularly impacting technology and semiconductor firms.

The S&P 500 index concluded the day with a marginal decrease of 0.16%, settling at 6,644.31. Similarly, the Nasdaq Composite, heavily weighted with technology companies, saw a more pronounced drop of 0.76%, closing at 22,521.70. In contrast, the Dow Jones Industrial Average managed to eke out a 0.44% gain, reaching 46,270.46, thanks to the robust performance of its banking and industrial components earlier in the session.

Federal Reserve Chair Jerome Powell's recent statements also played a crucial role in shaping investor behavior. Powell underscored the Fed's commitment to a data-centric approach when considering future interest rate adjustments, implying a cautious outlook on potential rate cuts. This combination of trade uncertainty and a tempered monetary policy perspective led to notable declines in several prominent tech and semiconductor stocks. Companies such as Nvidia Corp. and Intel Corp. were among the day's biggest losers, reflecting investor apprehension about the industry's future performance in a challenging economic landscape.

Conversely, certain sectors demonstrated resilience. Financial heavyweights like Wells Fargo & Co. and Citigroup Inc., alongside industrial giant Caterpillar Inc., provided significant uplift to the Dow. Their strong earnings reports and inherent industrial stability helped buffer the index against the broader market's downturn, showcasing the diverse reactions of different market segments to prevailing economic currents.

Moving forward, market participants are keenly observing developments in the U.S.-China relationship. The ongoing trade negotiations and any shifts in policy are expected to heavily influence global economic stability and market direction. Additionally, upcoming inflation data will be critical in assessing the health of the economy and guiding investor decisions. These factors will be pivotal in determining whether global trade and economic growth can regain momentum in the coming period.

The recent market fluctuations underscore the profound impact of geopolitical tensions and central bank policies on investor confidence. The delicate balance between international trade relations and domestic economic strategies is a constant challenge for global markets. Investors must remain vigilant, adapting their strategies to navigate an increasingly interconnected and often unpredictable financial world. This period demands a thoughtful approach, focusing on diversified portfolios and a keen awareness of macroeconomic indicators to mitigate risks and identify opportunities.