Nvidia has captured considerable attention as a leading innovator in artificial intelligence, primarily due to its groundbreaking graphics processing units. However, the foundational element enabling this technological progress often goes unrecognized: the critical manufacturing capabilities provided by Taiwan Semiconductor Manufacturing Company (TSMC). This analysis delves into TSMC's pivotal role as the world's foremost independent semiconductor foundry, highlighting its essential contribution to the production of advanced AI chips. We examine why, despite the focus on chip designers like Nvidia and AMD, TSMC's position as a neutral and indispensable partner in the AI ecosystem makes it a potentially more stable and growth-oriented investment for the long term, poised to benefit from the increasing global expenditure on AI infrastructure, regardless of specific design preferences.

While industry giants such as Nvidia and AMD lead in designing the chips that power artificial intelligence, their success is intrinsically linked to the sophisticated manufacturing processes executed by companies like TSMC. This relationship underscores TSMC's strategic importance in the rapidly expanding AI landscape. As demand for AI capabilities continues to surge, the need for cutting-edge semiconductor fabrication intensifies, placing TSMC at the heart of this technological revolution. The company's unique ability to produce diverse and highly complex integrated circuits positions it as an essential enabler for the entire AI industry, suggesting a robust future independent of the fortunes of any single chip design firm.

TSMC's Indispensable Role in Global Semiconductor Manufacturing

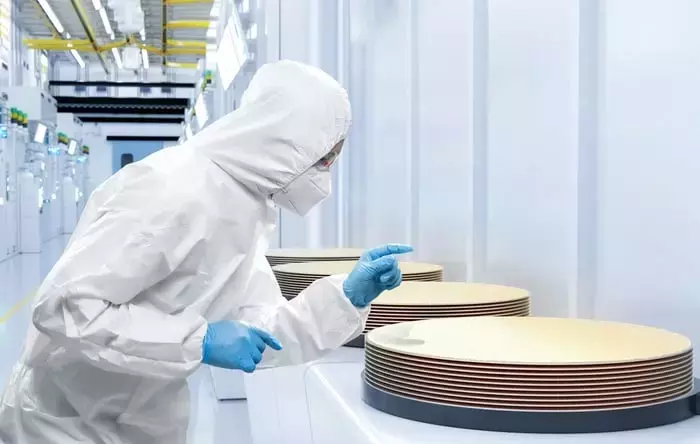

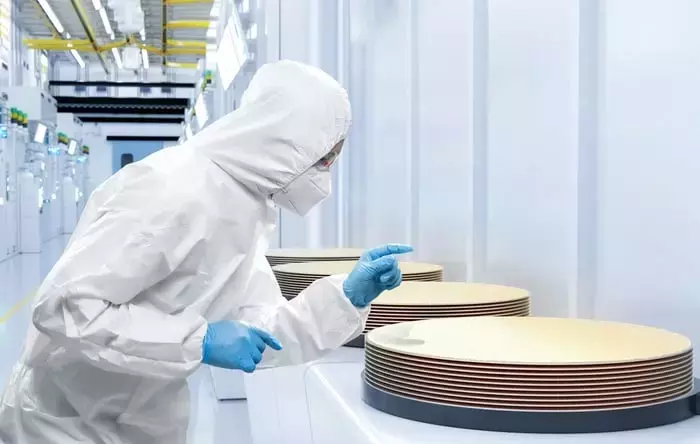

Taiwan Semiconductor Manufacturing Company (TSMC) is a cornerstone of the global semiconductor sector, functioning as the vital foundry that translates intricate chip designs into tangible processors. Its operational supremacy makes it indispensable, particularly for powering the advanced artificial intelligence applications currently driving technological innovation. TSMC's manufacturing prowess extends to producing the GPUs for Nvidia, CPUs for Advanced Micro Devices, and an expanding array of specialized silicon that major cloud providers utilize to enhance AI workload efficiency. With an approximate 68% share of the global foundry market revenue, TSMC significantly outpaces its competitors, including Samsung Electronics, which holds a mere 8%.

The company's profound influence stems from its role in manufacturing the sophisticated chips that underpin the entire digital economy, from consumer electronics to complex AI systems. TSMC's advanced fabrication technologies are crucial for creating the high-performance components needed for modern computing. This capability allows it to serve a broad spectrum of clients, ensuring that advanced designs from companies like Nvidia and AMD can be brought to fruition. Its dominant market share reflects its technological leadership and reliability, making it a critical partner for nearly every major player in the semiconductor industry. As AI continues to evolve, the demand for TSMC's specialized foundry services is set to grow exponentially, reinforcing its status as a foundational pillar of the tech world.

Why TSMC May Outperform Other AI Chipmakers

A key argument against the sustained high growth of companies like Nvidia and AMD is the increasing trend of hyperscale cloud providers developing their own application-specific integrated circuits (ASICs). These large-scale operators are motivated to design their custom silicon to optimize the performance of AI models and reduce their dependence on external suppliers. This shift, exemplified by Google's Tensor Processing Units (TPUs), Amazon's Trainium and Inferentia chips, and Microsoft's proprietary AI accelerators, could divert significant investment away from standard GPUs, potentially slowing growth for traditional chip designers.

However, this trend presents a unique advantage for TSMC. Even custom ASICs require specialized manufacturing, and TSMC's unparalleled expertise in advanced fabrication services positions it as the preferred partner. Unlike chip designers who are vulnerable to shifts in market preference or the emergence of in-house solutions by their clients, TSMC remains a neutral beneficiary. The company profits irrespective of which specific chip design gains prominence, as all advanced silicon ultimately relies on its manufacturing capabilities. This agnostic position allows TSMC to ride the broad, secular tailwinds of massive investments in AI infrastructure, making its stock a compelling long-term prospect that may offer more stable and consistent growth compared to companies solely focused on chip design.