In a stunning turn of events, the 2024 U.S. presidential election has shaken the political landscape, with former President Donald Trump emerging victorious over Vice President Kamala Harris. The outcome has sent shockwaves through the financial markets, as investors grapple with the implications of this unexpected result.

A Resurgence of Confidence in the American Economy

Dow Futures Soar, Signaling Investor Optimism

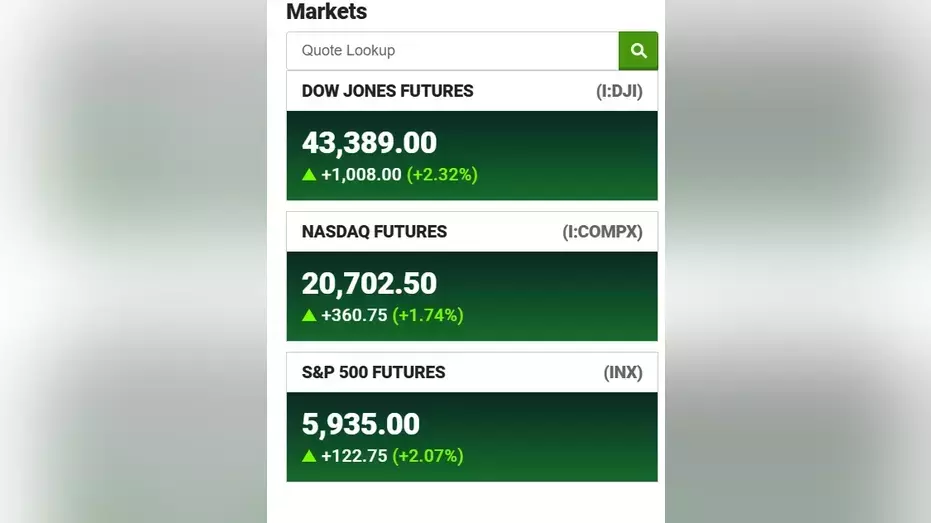

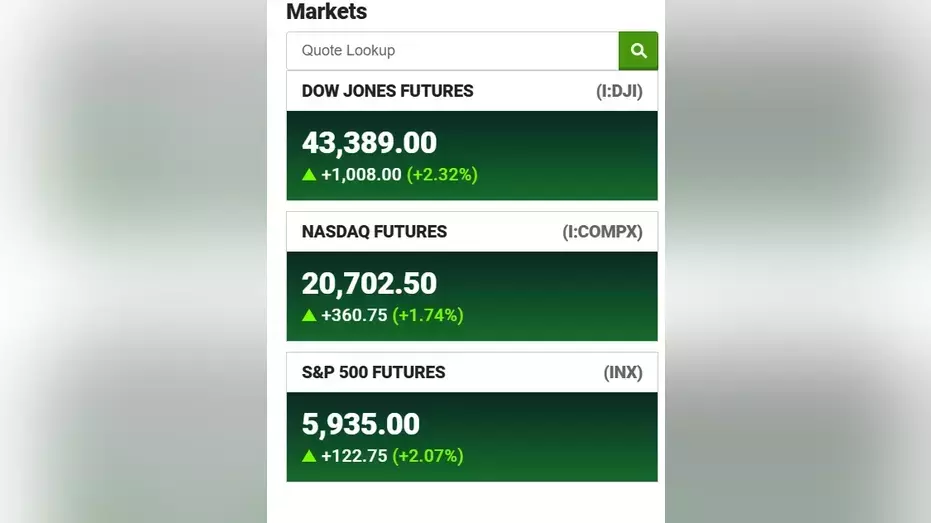

As the election results unfolded, U.S. stock futures experienced a dramatic surge, with the Dow Jones Industrial Average futures spiking over 1,000 points in the early morning hours. This remarkable rally underscores the market's confidence in Trump's ability to steer the economy back on track. Investors appear to be betting on the former president's pro-business policies and his track record of fostering economic growth during his previous term.A Bullish Outlook for the S&P 500 and Nasdaq

The optimism extended beyond the Dow, as the S&P 500 and Nasdaq futures also jumped by over 1% in the pre-market trading session. This broad-based rally suggests that investors are anticipating a resurgence of economic activity and a renewed sense of stability under Trump's leadership. The markets are signaling their belief that the former president's policies will reignite the engines of American prosperity.Elon Musk and Dana White Throw Their Weight Behind Trump

Adding to the excitement, Trump praised two high-profile supporters, Tesla CEO Elon Musk and UFC President Dana White, during his victory speech. Musk, the world's richest man, has been a vocal advocate for Trump's policies, particularly in the realm of technology and innovation. White, a longtime Trump ally, has also lent his support to the former president, further bolstering the perception of a pro-business administration.Cryptocurrencies Ride the Wave of Optimism

The market's enthusiasm extended to the cryptocurrency sector, with Bitcoin touching a new all-time high above the $73,000 level. Investors appear to be betting that a Trump presidency will be more favorable to the crypto industry, potentially paving the way for increased adoption and regulatory clarity.Overcoming the Challenges of Inflation

Despite the prevailing optimism, the American electorate has been grappling with the persistent challenge of high inflation. While prices have come down from their peak of 9%, the cost of everyday items, such as food, remains elevated. Trump's ability to address this economic hurdle will be closely watched by both investors and consumers alike.Restoring Certainty in Uncertain Times

As Ken Fisher, the chairman and founder of Fisher Investments, aptly observed, the outcome of the election has the potential to provide a "certain amount of falling uncertainty" in the markets. Investors are hopeful that Trump's return to the White House will usher in a new era of stability and predictability, allowing businesses and consumers to plan with greater confidence.In the end, the 2024 U.S. presidential election has proven to be a pivotal moment for the nation, with the markets responding with a resounding vote of confidence in Donald Trump's ability to revive the American economy and restore a sense of optimism in the face of adversity.You May Like