This report delves into the intricate dynamics of President Trump's trade negotiations with China, particularly focusing on their impact on the global technology sector. It examines the recent postponement of trade talks and, more critically, a controversial agreement involving Nvidia and the sale of advanced semiconductors to Chinese entities. The narrative explores the potential ramifications of this deal, including concerns over state-sponsored capitalism and the evolving relationship between U.S. corporations and the government. It also highlights the ongoing debate among policymakers and security experts regarding the strategic implications for artificial intelligence technology and the broader principles of American economic policy.

The Shifting Sands of U.S.-China Trade Relations and High-Tech Diplomacy

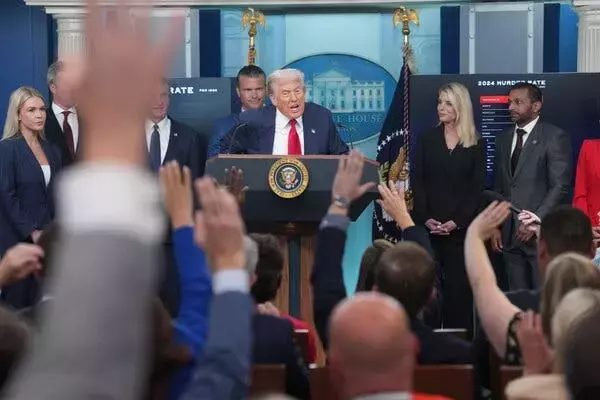

In a significant development that momentarily alleviated global economic anxieties, President Trump, on a recent Monday at the White House, announced a 90-day extension to the ongoing trade discussions with China. This decision effectively defers a contentious trade confrontation that has cast a long shadow over international markets. Despite this temporary reprieve, new concerns have emerged regarding the nature of concessions being made in these intricate negotiations.

A focal point of this renewed debate is a recently brokered agreement that permits major American semiconductor manufacturers, specifically Nvidia and Advanced Micro Devices (AMD), to resume the sale of certain powerful semiconductors to Chinese companies. This pivotal arrangement stipulates that the United States government will receive a 15% share of the revenue generated from these sales. President Trump defended this deal by characterizing the Nvidia H20 processors involved as 'obsolete.' Nevertheless, he hinted at the future possibility of a modified, less potent version of Nvidia's cutting-edge Blackwell chips also becoming available for sale to China.

This particular agreement has ignited considerable apprehension among U.S. lawmakers and national security strategists. Their primary concern revolves around the potential for Beijing to gain enhanced access to advanced artificial intelligence processing technology, which could have far-reaching geopolitical implications. The arrangement has also sparked a broader discourse on the fundamental principles of American capitalism and whether such deals could blur the lines between private enterprise and governmental influence, potentially transforming leading U.S. tech firms into de facto extensions of the state.

A Crossroads for Global Commerce and Technological Sovereignty

The latest developments in U.S.-China trade relations present a fascinating and complex picture, forcing us to ponder the very essence of economic strategy in an interconnected world. From a journalistic perspective, these events highlight a critical juncture where national security, economic policy, and technological advancement intersect. The decision to postpone tariffs, while providing short-term relief, seems to be a delicate dance, perpetually balancing immediate economic pressures with long-term strategic objectives.

The agreement allowing Nvidia and AMD to sell advanced chips to China, coupled with the U.S. government's revenue share, is particularly intriguing. It raises profound questions about the nature of state intervention in the free market. Is this a pragmatic compromise to maintain economic ties, or does it signal a dangerous precedent of blurring the lines between corporate independence and state control? If the U.S. government effectively takes a cut from the sales of private companies to foreign entities, does it inadvertently legitimize a form of state-sponsored capitalism? This could, in turn, redefine how global markets perceive American businesses, potentially undermining the very brand of free enterprise that the U.S. has championed for decades.

Moreover, the debate surrounding the 'obsolescence' of certain chips and the potential future sale of downgraded versions of cutting-edge technology to China underscores the constant tension between commercial interests and national security. It forces us to ask: at what point does technological exchange become a strategic vulnerability? As a reader, I'm left to ponder the long-term implications of these choices. Will this strategy genuinely mitigate tensions, or will it merely delay the inevitable, perhaps even empowering a strategic competitor in the long run? The intricate web of trade, technology, and geopolitics demands a nuanced understanding, and these events serve as a potent reminder of the high stakes involved in every decision made on the global economic stage.