The technology landscape is witnessing an intense competition among industry titans as they strive to achieve the monumental $5 trillion market capitalization. While Apple historically led the charge to earlier trillion-dollar milestones, it appears that the current race is being dominated by Nvidia, Microsoft, and surprisingly, Alphabet. This shift is attributed to Nvidia's rapid growth in the AI computing sector and Microsoft's strong performance in cloud services, both heavily benefiting from the artificial intelligence boom. Meanwhile, Apple's recent growth deceleration and perceived lack of generative AI innovation have opened a window for Alphabet, which is demonstrating robust revenue and profit expansion, to potentially overtake its long-standing rival in this high-stakes valuation pursuit.

Historically, Apple has been the frontrunner in reaching significant market capitalization thresholds, being the first to hit $1 trillion, $2 trillion, and even $3 trillion. However, the landscape has changed with Nvidia recently claiming the $4 trillion mark, closely followed by Microsoft. This indicates a potential shift in momentum, with new contenders emerging to redefine market leadership. The current valuations show Nvidia at approximately $4.4 trillion, Microsoft at $3.8 trillion, and Apple at $3.7 trillion. The author posits that Apple may not be among the first three companies to reach $5 trillion, suggesting that Alphabet, despite being a 'dark horse' candidate, possesses a strong chance to achieve this feat.

The projected path for Nvidia and Microsoft to reach the $5 trillion valuation appears relatively straightforward. Nvidia, already at $4.4 trillion, requires only a 14% increase in its market cap to cross the $5 trillion threshold. This target is considered highly achievable, especially given the company's strong performance in the artificial intelligence computing sector. The demand for Nvidia's graphics processing units (GPUs) is experiencing significant momentum, driven by the expanding AI industry. A strong earnings report from Nvidia in the coming months could easily propel it past this milestone.

Microsoft's journey to $5 trillion is also bolstered by the AI megatrend, primarily through its Azure cloud computing division. Azure has emerged as a critical platform for building AI models, making it a substantial growth engine for Microsoft. In the fourth quarter of fiscal year 2025, Azure reported a remarkable 39% year-over-year growth, contributing significantly to the intelligent cloud division's $29.9 billion revenue. This robust growth trajectory is expected to continue throughout 2026, pushing Microsoft closer to the $5 trillion valuation.

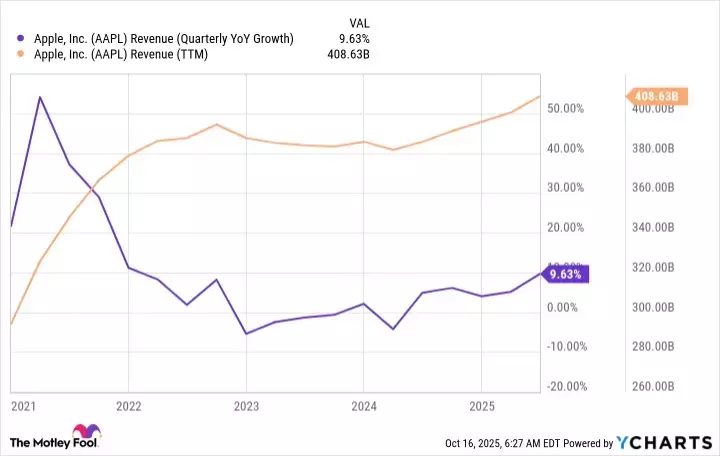

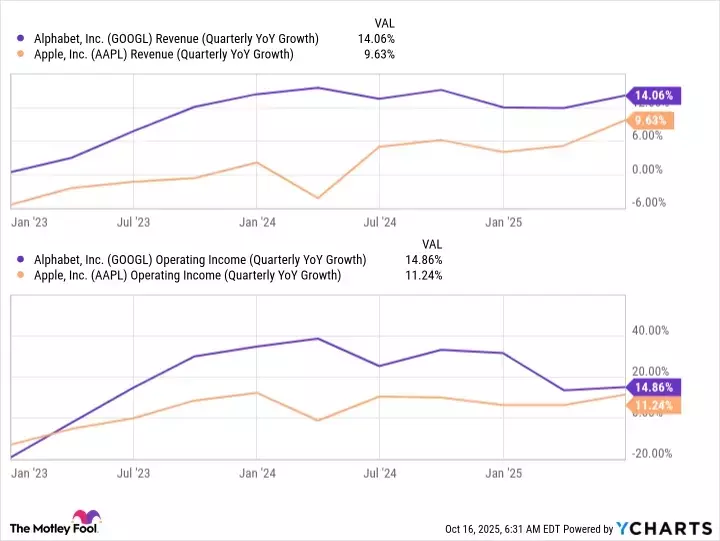

Conversely, Apple's recent performance raises questions about its ability to maintain its historical market leadership. Since 2022, Apple's revenue growth has been sluggish, with several quarters even showing negative growth. While Apple's strong brand loyalty has historically shielded its stock from significant downturns despite these challenges, its perceived lack of breakthroughs in generative AI could become a critical impediment. This absence of innovation in a rapidly evolving tech sector might deter investors and open opportunities for rivals.

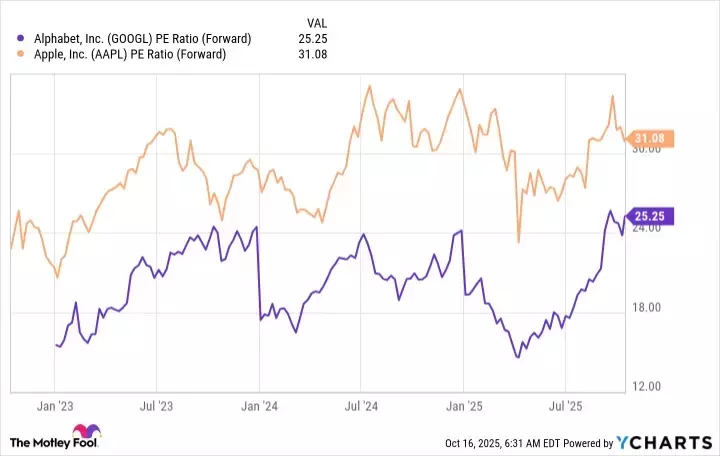

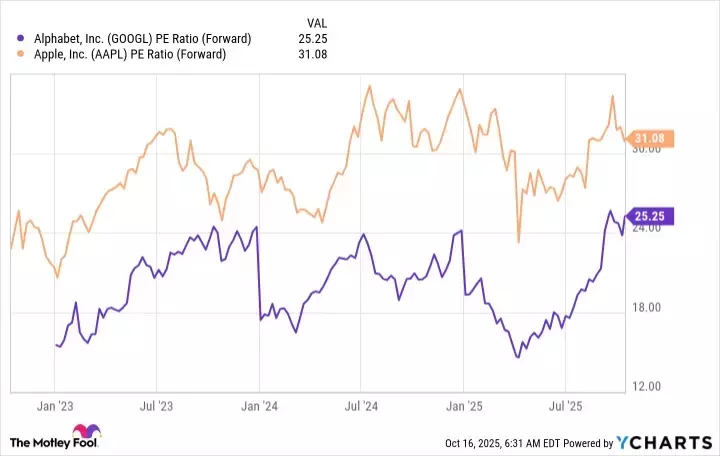

In this evolving scenario, Alphabet presents a compelling alternative. As a leader in the AI space with a robust cloud computing business, Alphabet is well-positioned to capitalize on current market trends. Its core advertising business, powered by Google Search, has regained its footing and is delivering solid results, further contributing to its strong growth. Despite these advantages, Alphabet currently trades at a discount compared to Apple, even with superior growth rates. This undervaluation, combined with its strong AI and cloud capabilities, suggests that Alphabet could not only close the market cap gap but also surpass Apple to become the third company to reach a $5 trillion valuation, making it an attractive long-term investment.

The race for a $5 trillion market valuation highlights the dynamic nature of the technology sector, with artificial intelligence and cloud computing acting as primary catalysts for growth. While Apple's brand power has been a formidable asset, its recent growth challenges and limited visible advancements in generative AI have created an opening. Nvidia and Microsoft are well on their way, driven by their respective leadership in AI hardware and cloud infrastructure. Alphabet, with its strong AI initiatives, revitalized advertising business, and favorable valuation, is poised to emerge as a significant contender, potentially reshaping the hierarchy of the world's most valuable companies.