Navigating the Equity Index Futures Expiration: A Comprehensive Guide

As the September contract for emini US equity futures on the CME approaches expiration, it's crucial for traders to stay informed and prepared. This comprehensive guide will delve into the intricacies of the equity index futures market, providing valuable insights and practical advice to help you navigate the upcoming expiration seamlessly.Unlock the Power of Equity Index Futures Trading

Understanding the Equity Index Futures Landscape

The equity index futures market offers a dynamic and versatile trading environment, allowing market participants to gain exposure to the broader equity market. These futures contracts provide a convenient way to hedge against market fluctuations or speculate on the direction of major stock indices, such as the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average.One of the key features of equity index futures is the ability to roll over positions from one contract month to the next. This process, known as the "equity index roll," enables traders to maintain their market exposure while transitioning to the contract with the highest trading volume. By understanding the mechanics of this roll process, traders can optimize their trading strategies and capitalize on the opportunities presented by the changing contract landscape.Navigating the Equity Index Roll Dates

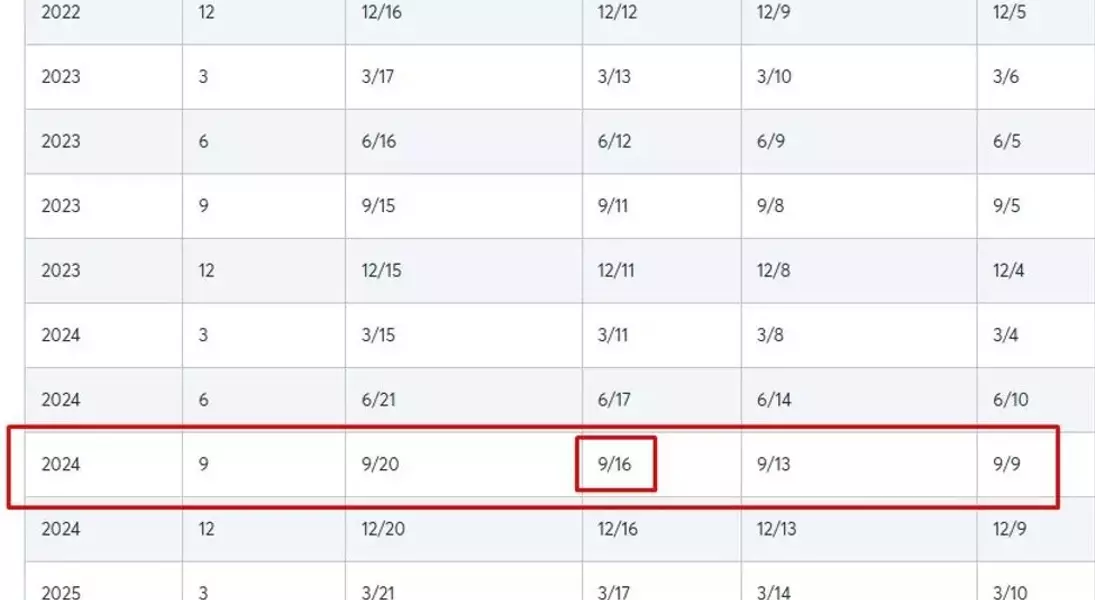

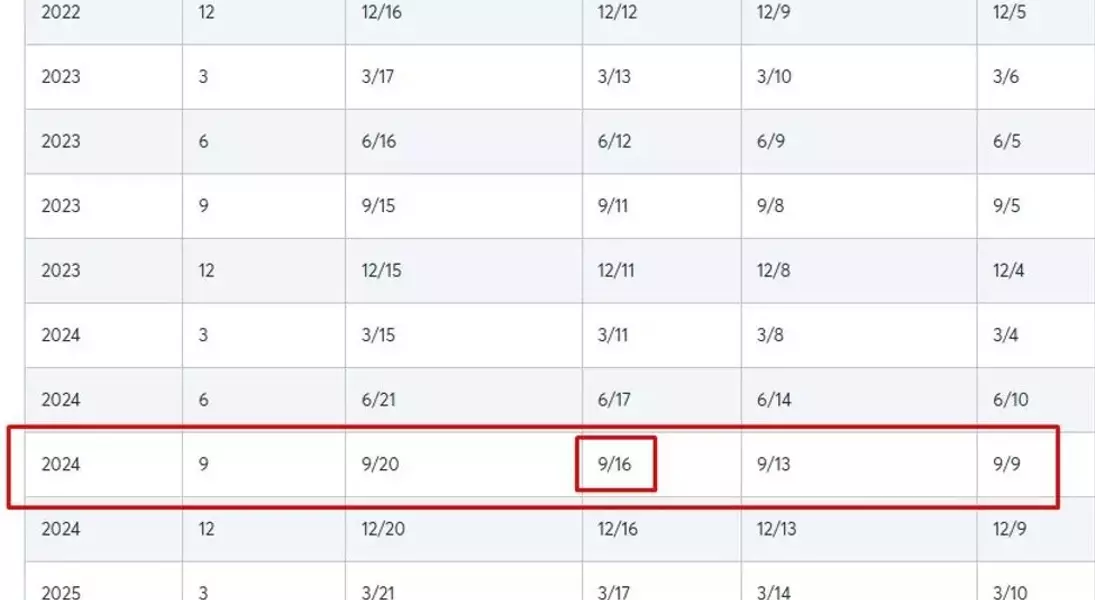

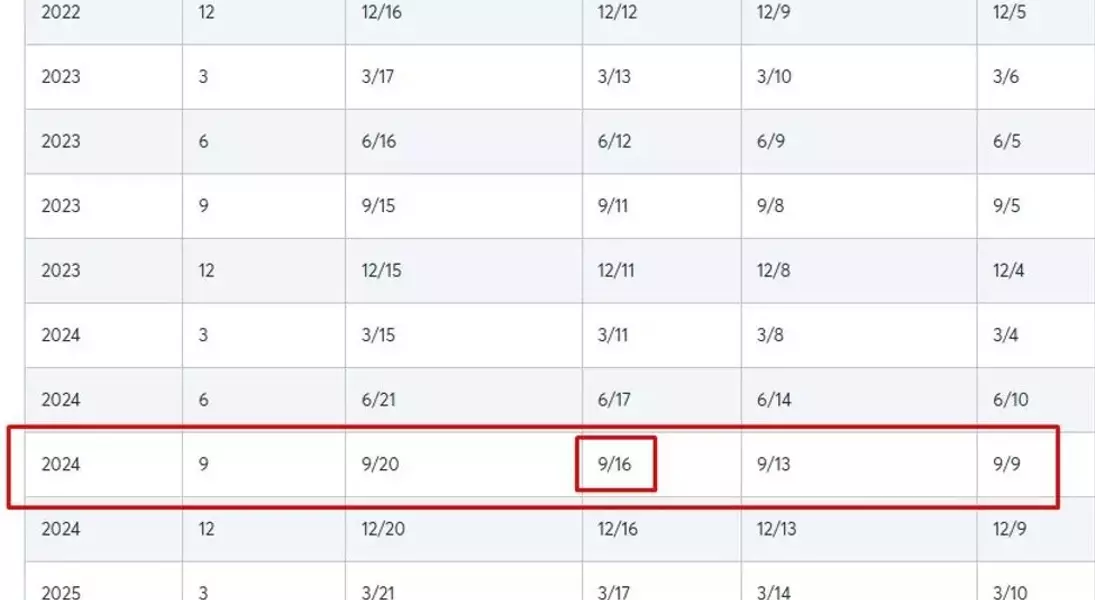

The equity index roll typically occurs on the Monday prior to the third Friday of the expiration month. This standardized schedule allows traders to plan and execute their roll strategies with precision. As the September contract approaches expiration, it's crucial for traders to be aware of the upcoming roll date and prepare accordingly.During the roll period, traders can choose to roll their positions to the next available contract month, ensuring their market exposure is maintained. This flexibility allows traders to adapt their strategies to changing market conditions and take advantage of the liquidity and volume shifts in the new contract.Strategies for a Successful Equity Index Roll

Executing a successful equity index roll requires a well-thought-out approach. Traders should consider factors such as market volatility, trading volume, and the relative strength of the current and upcoming contracts. By carefully analyzing these variables, traders can make informed decisions on the optimal timing and execution of their roll.One effective strategy is to monitor the trading volume and open interest in the current and upcoming contracts. As the new contract gains traction and becomes the primary focus of market participants, traders can time their roll to coincide with the shift in liquidity. This can help minimize the impact of the roll on their trading positions and potentially capture any favorable pricing differences between the contracts.Additionally, traders may explore advanced techniques like spread trading or calendar spreads to manage the roll process. These strategies can help mitigate risk and potentially generate additional trading opportunities during the transition between contract months.Staying Informed and Prepared

Navigating the equity index futures market, especially during the expiration and roll periods, requires a proactive and informed approach. Traders should stay up-to-date with the latest market news, regulatory changes, and industry developments that may impact their trading strategies.Leveraging educational resources, such as webinars, trading platforms, and industry publications, can provide valuable insights and help traders develop a deeper understanding of the equity index futures market. By continuously expanding their knowledge and adapting their strategies, traders can position themselves for success in the ever-evolving equity index futures landscape.You May Like