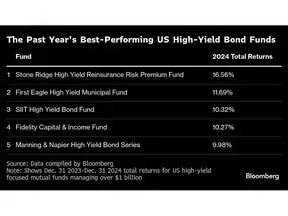

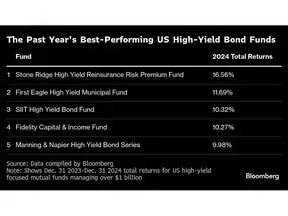

In the rapidly evolving financial landscape of 2024, top-performing US blue-chip bond funds have maintained their success by adopting a strategic approach. These funds are focusing on investments in debt from riskier but resilient companies, while steering clear of corporations vulnerable to interest-rate fluctuations. This strategy has proven effective, particularly as economic uncertainties persist. The emphasis on shorter-duration bonds has allowed these funds to outperform longer-duration counterparts, capitalizing on market conditions that favor immediate returns over long-term commitments.

Strategic Moves Yield Success for Leading Bond Fund Managers

During the autumn of 2024, leading asset management firms like Principal Asset Management and Pacific Investment Management Co. (PIMCO) achieved remarkable success by investing in higher-risk debt from well-rated companies. These firms identified lucrative opportunities in sectors poised to benefit from the burgeoning artificial intelligence (AI) industry. For instance, Principal Spectrum and Capital Securities Income Fund delivered an impressive total return of 9.81%, primarily through investments in US bank preferred stock, non-US banking additional tier 1 securities, and junior subordinated debt from insurance companies. Phil Jacoby, Chief Investment Officer at Spectrum Asset Management, emphasized the fund's continued focus on junior subordination in 2025 to leverage higher yields and income advantages.

PIMCO, on the other hand, found attractive prospects beyond traditional corporate bonds. Portfolio Manager Alfred Murata highlighted the widening spreads in higher-quality fixed-income assets like US government bonds and agency mortgage-backed securities. This shift has created favorable conditions for the PIMCO Low Duration Income Fund, which benefits from high-quality yet wider-spread investments. Murata and his team remain cautiously optimistic about sectors like healthcare and telecom, which are less sensitive to economic turbulence. They also anticipate positive impacts from AI-related industries, albeit with potential disruptions.

Other notable managers, such as Andrew Hofer from Brown Brothers Harriman and Marc Bushallow from Manning & Napier Advisors, shared similar strategies. Hofer’s quantitative valuation framework identified undervalued bonds with strong credit durability, while Bushallow focused on basic industries and healthcare, emphasizing disciplined investment practices. Mark Notkin of Fidelity Capital & Income Fund leveraged the flexibility to invest across the capital structure, including stocks, while Noah Funderburk from Pioneer Multi-Asset Ultrashort Income Fund prioritized short-duration bonds to mitigate risks associated with higher interest rates.

From a journalist's perspective, the success of these bond funds underscores the importance of adaptability and strategic foresight in volatile markets. By embracing riskier but resilient debt and focusing on shorter durations, these fund managers have not only navigated economic uncertainties but also capitalized on emerging trends like AI. Their disciplined approach serves as a valuable lesson for investors seeking stability and growth amidst shifting market dynamics. The key takeaway is that successful investing often requires a balance between taking calculated risks and maintaining a cautious, diversified portfolio.