Achieving financial stability and accumulating wealth shouldn't be an arduous task requiring extensive calculations or significant lifestyle overhauls. The most effective savings applications are engineered to manage your finances discreetly, allocating small sums of money regularly, rounding up your daily expenditures, or streamlining tedious processes to ensure consistent adherence to your savings plan. Research consistently indicates that automation significantly enhances commitment and follow-through. When the act of saving money is integrated into the background of your daily activities, it negates the reliance on sheer willpower, leading to greater savings with minimal effort. This approach not only makes the process more manageable but also more successful.

This article explores leading applications that facilitate financial growth across various scenarios, catering to those who prefer a hands-off approach, precise goal tracking, automated round-ups, or a pre-payday financial cushion. These innovative tools offer diverse functionalities, from providing insightful spending analytics and setting up automatic transfers to offering high-yield savings accounts and even short-term cash advances. By leveraging the power of technology, these applications transform the daunting task of saving into an accessible and rewarding experience, empowering users to achieve their financial aspirations with ease and confidence.

The Power of Automated Savings: Effortless Wealth Building

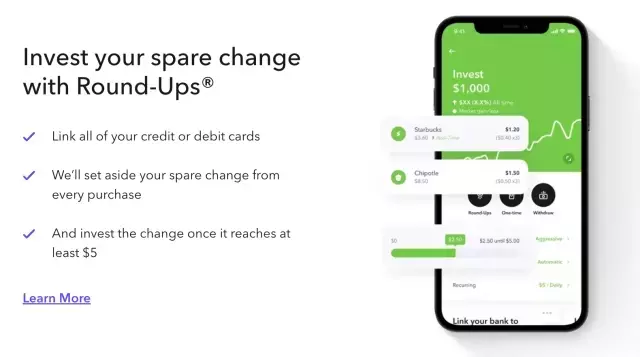

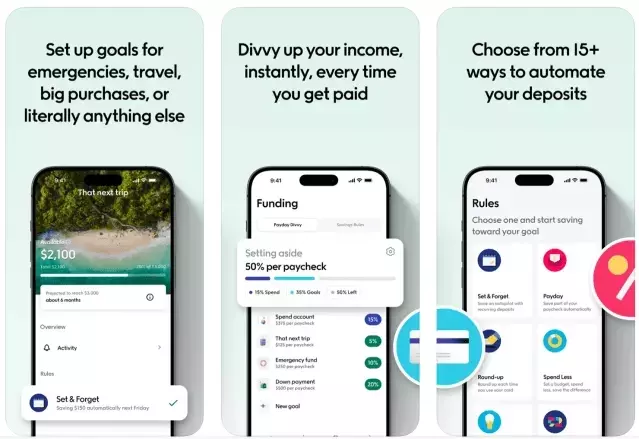

Harnessing automated tools is key to building a robust financial future without constantly monitoring every penny. The premier money-saving applications streamline the process, enabling users to effortlessly put aside funds. These platforms empower individuals to create and visualize specific financial objectives, whether for a down payment, a vacation, or an emergency fund. Through features like automated transfers, where small amounts are moved into a savings account on a set schedule, or round-ups, which automatically save the change from everyday purchases, these applications remove the psychological barrier to saving. They integrate seamlessly into daily life, making wealth accumulation an almost subconscious act, significantly increasing the likelihood of reaching financial milestones with less stress and more consistent progress.

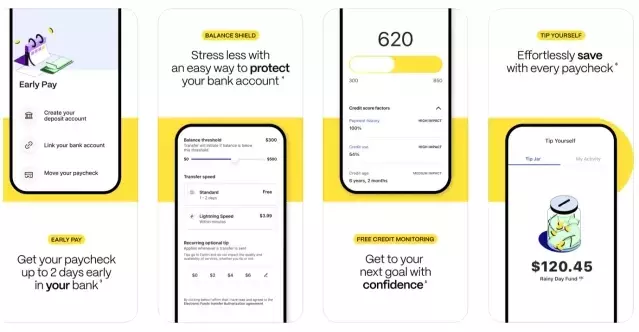

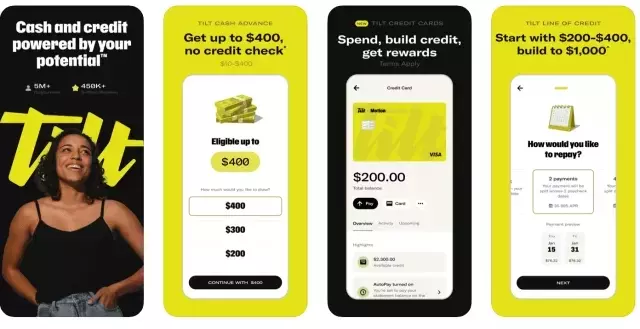

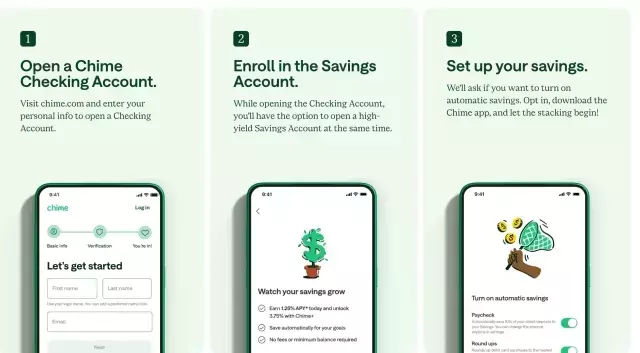

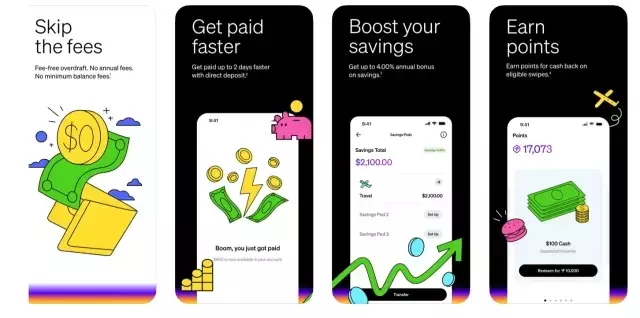

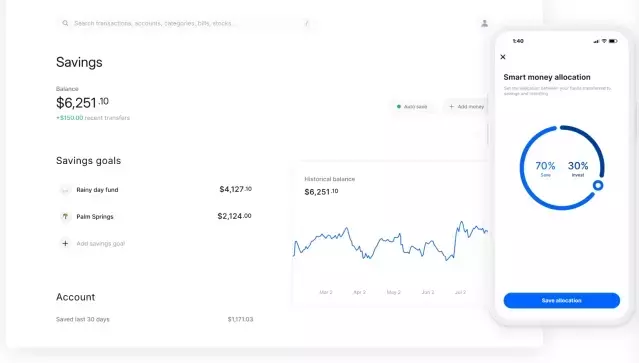

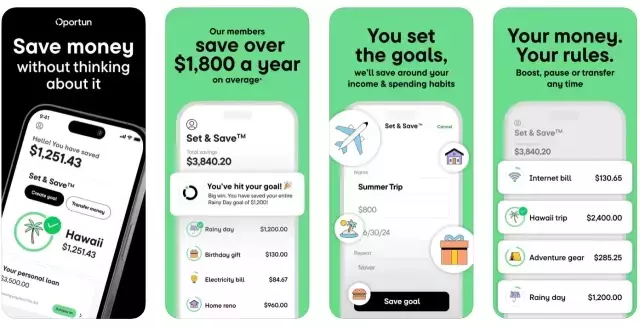

These applications revolutionize personal finance by automating the accumulation of funds through various intelligent mechanisms. They typically offer insights into spending patterns, provide timely alerts, and facilitate trend analysis to promote consistent saving habits. Key functionalities include scheduled transfers of small amounts on a daily, weekly, or payday basis; rounding up transactions to the nearest dollar and depositing the difference; and creating designated savings "buckets" for specific goals like emergency funds or travel, complete with progress tracking. Advanced rules allow for conditional savings, such as setting aside money when a paycheck arrives or after spending at a particular retailer. Furthermore, some apps provide high-yield savings options, allowing users to earn interest, while others offer cash buffer tools, like small, interest-free cash advances, to cover immediate needs before the next payday. This comprehensive suite of features transforms saving from a disciplined chore into an integrated, rewarding part of financial management.

Diverse Savings Strategies: Tailoring Apps to Your Financial Needs

The array of money-saving applications available today offers a tailored approach to financial growth, allowing users to select tools that best fit their individual needs and preferences. From apps designed for quick saving targets and AI-driven automation to those offering high-yield accounts and integrated investment opportunities, the market provides diverse solutions. For instance, some apps excel in helping users visualize and achieve short-term goals through manual or automated transfers into designated "jars" without incurring fees or requiring minimum balances. Others leverage artificial intelligence to analyze income and expenses, dynamically adjusting savings contributions to prevent overdrafts while maximizing accumulation. This adaptability ensures that everyone, regardless of their financial literacy or current circumstances, can find a suitable platform to enhance their saving efficiency.

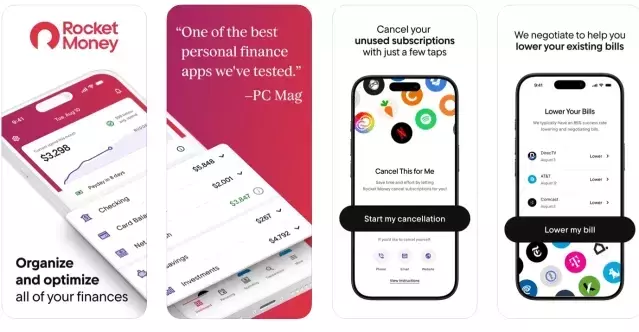

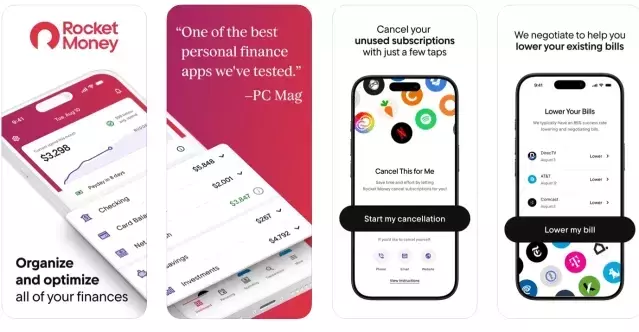

Beyond basic automation, many applications provide sophisticated features that cater to more complex financial behaviors and aspirations. Platforms like Dave and Chime combine automated savings with competitive interest rates and supplementary earning opportunities, such as side hustle boards. Current introduces "flexible savings pods" for managing multiple, distinct financial goals with personalized interest boosts. Albert acts as a comprehensive financial hub, offering smart money features that analyze and save based on spending, alongside budgeting, investing, and identity protection services. Acorns distinguishes itself by turning spare change into investments through round-ups, promoting long-term wealth building with expertly managed portfolios. Qapital encourages unique saving habits with over 15 customizable rules, linking savings to everyday activities or specific triggers. Lastly, Rocket Money not only automates savings but also actively manages and cancels unwanted subscriptions, providing a holistic approach to financial optimization. This wide spectrum of functionalities ensures that individuals can choose an app that aligns perfectly with their financial journey, fostering consistent saving and smart money management.