Navigating Volatility: A Billionaire Investor's Measured Approach to Market Dynamics

Unveiling Market Insights: The Significance of Quarterly Filings for Investors

Quarterly filings, such as Form 13Fs, offer a transparent window into the investment decisions of prominent fund managers. These documents, submitted to regulatory bodies, disclose the buying and selling activities of major investment firms, providing valuable intelligence for individual investors seeking to understand the movements of institutional capital. By tracking these disclosures, market participants can gain a clearer perspective on the strategic positioning of influential players in the financial arena.

The Prudent Actions of a Leading Investor: Terry Smith's Cautious Market Signal

Terry Smith, often referred to as "Britain's Warren Buffett," has been a decisive net seller of equities. His recent actions, as documented in Fundsmith's filings, indicate a clear message to the broader financial community. Over the past year, his firm has divested from a greater number of existing holdings and significantly reduced positions in key assets like Meta Platforms and Microsoft, despite adding a few new stocks and increasing some existing stakes. This strategic shift underscores a cautious approach amidst what he perceives as elevated market valuations.

Historical Context: Understanding Market Cycles and Valuation Trends

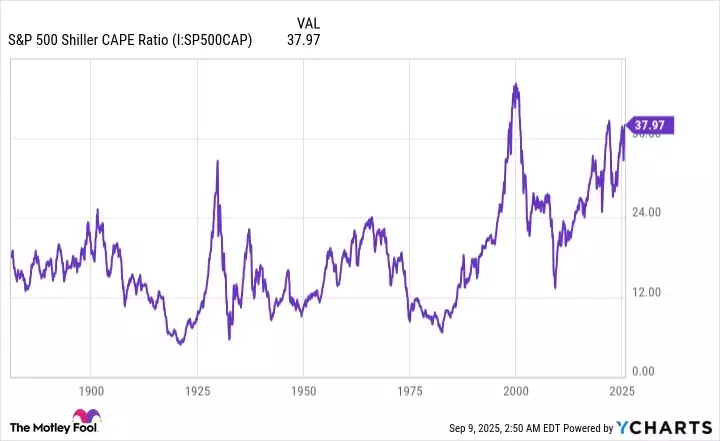

The current market environment, characterized by high valuations, prompts a historical examination of asset pricing. The S&P 500's Shiller price-to-earnings (P/E) Ratio, a cyclically adjusted valuation metric, has reached levels seen only a few times in over a century. Historically, when this ratio surpasses certain thresholds, it has often preceded significant market corrections. This data suggests that while innovations like artificial intelligence may drive near-term growth, the market's current premium might not be sustainable in the long run, echoing past bubble-bursting events. Such periods often lead to substantial downturns, as history has repeatedly demonstrated.

The Resilient Nature of Equity Markets: A Long-Term Perspective

Despite the prevailing concerns regarding market overvaluation, there remains a compelling long-term optimistic view on equity investments. Historically, periods of market decline are significantly shorter than periods of growth. Data analyzing S&P 500 bull and bear markets since the Great Depression reveals that bull markets, on average, last considerably longer than bear markets. This inherent upward bias in the stock market reinforces the wisdom of a buy-and-hold strategy for quality assets, a principle both Terry Smith and Warren Buffett staunchly advocate. While short-term volatility is inevitable, the foundational strength and wealth-creation potential of the stock market endure over extended periods.