Navigating the Volatile Market: Insights and Strategies for Investors

The stock market rally experienced a setback on Tuesday, with the major indexes retreating from record highs. The Dow Jones Industrial Average, S&P 500 index, and Nasdaq composite all saw losses, driven by negative earnings guidance from industry giants like UnitedHealth and ASML. However, the market's resilience was evident, as small caps and several sectors managed to show strength or resilience amidst the broader decline.Unlocking the Potential in a Shifting Landscape

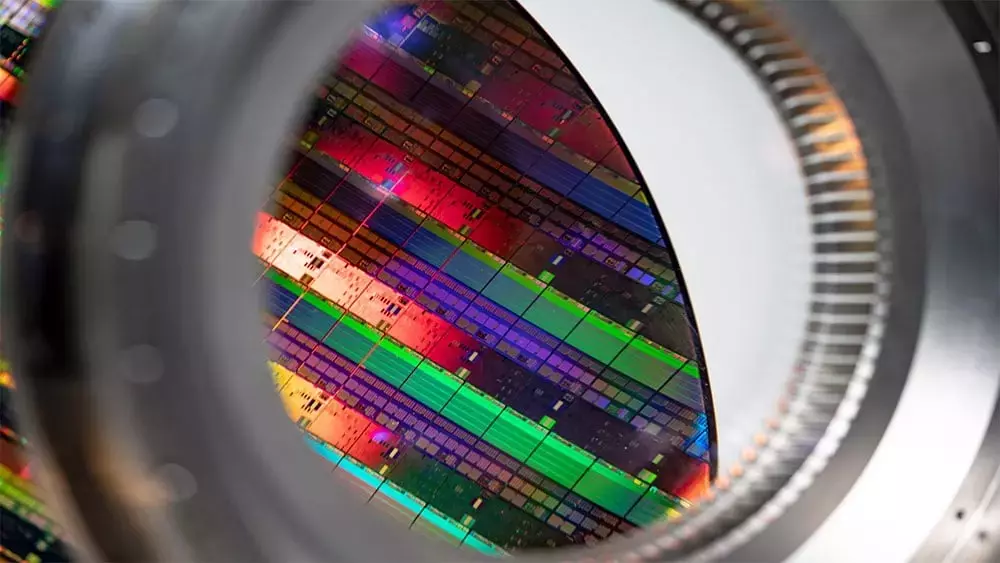

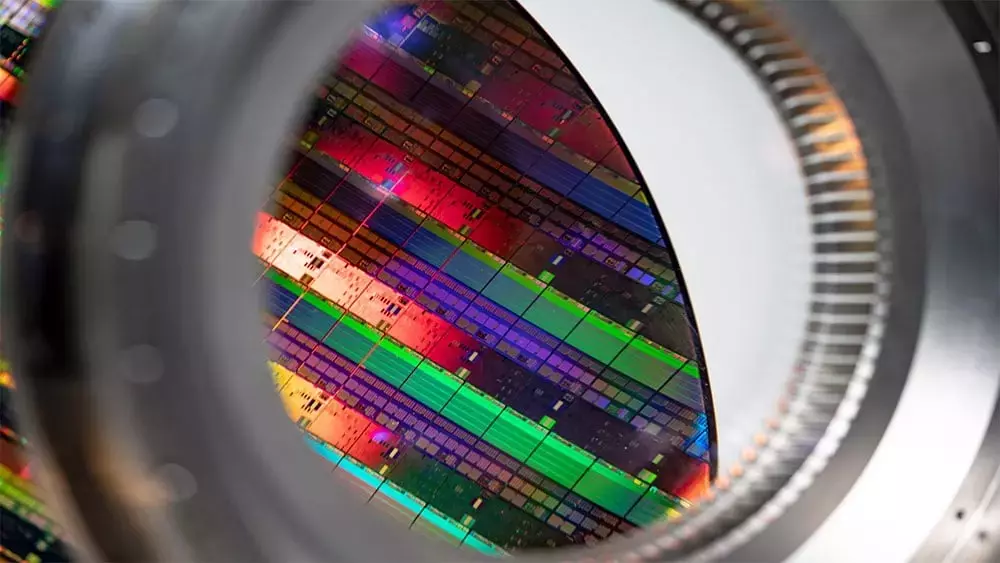

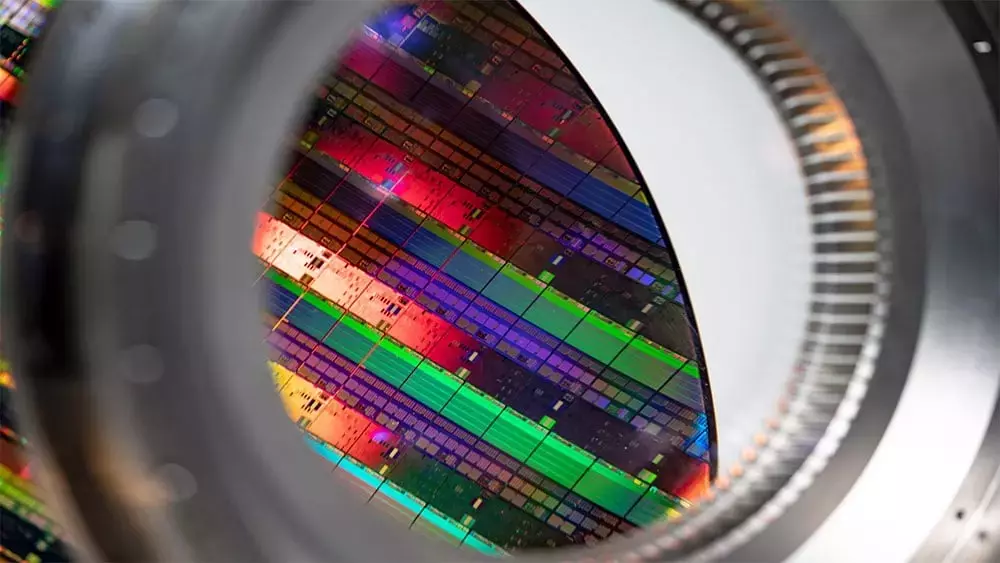

Chip Stocks Take a Hit, but Opportunities Remain

The news of ASML's weak guidance sent shockwaves through the chip industry, with Nvidia, Broadcom, and Taiwan Semiconductor all experiencing significant declines. However, a closer look reveals that some of these AI-focused stocks, including Nvidia, managed to hold above key support levels, suggesting potential opportunities for savvy investors. As the market navigates the implications of ASML's warning and potential changes in AI chip export restrictions, it will be crucial for investors to closely monitor the performance and positioning of these industry leaders.Resilience in Unexpected Sectors

While the chip and energy sectors faced headwinds, other areas of the market demonstrated remarkable resilience. Homebuilders, financials, retailers, hospitals, travel, and long-term care stocks all advanced or held up well, with many flashing buy signals. This diversity of leadership highlights the importance of maintaining a well-diversified portfolio and being attuned to emerging trends across various industries.Navigating the Volatility: Strategies for Investors

The market's mixed performance on Tuesday presented a complex landscape for investors. Some may have opted to trim or exit positions in recent tech buys or heavily invested in AI names, while others, holding solid gains amid the market rally, may have chosen to maintain their positions. The key, as always, is to follow a disciplined investment strategy that aligns with your risk tolerance and long-term goals.Utilizing weekly charts can help position traders put bad days in perspective and maintain a broader view of the market's trajectory. Staying engaged with the market, reviewing watchlists, and monitoring your portfolio are crucial steps in navigating the volatility. Investors should also closely follow market trends and leading sectors to identify potential opportunities and mitigate risks.The Importance of Diversification and Adaptability

Tuesday's market action underscored the importance of diversification and adaptability in investment strategies. While certain sectors and industries faced challenges, others demonstrated resilience, highlighting the need for investors to maintain a well-rounded portfolio that can withstand the ebbs and flows of the market.By staying attuned to emerging trends, monitoring key indicators, and being willing to adjust their approach as market conditions evolve, investors can position themselves to capitalize on opportunities and weather the storms that inevitably arise in the financial markets. Embracing a flexible and proactive mindset can be the key to navigating the volatile landscape and achieving long-term investment success.