Bridging the Fiscal Divide: Innovating Social Security's Future

Unlocking New Revenue Streams for Social Security

A recent study indicates that classifying employer-sponsored health coverage as taxable income could augment annual payroll tax contributions by approximately $400 per employee. This strategic adjustment has the potential to narrow Social Security's extended funding gap by roughly a quarter over the next 75 years, according to findings from the Center for Retirement Research at Boston College.

Navigating the Equity Landscape of Proposed Reforms

The aforementioned report, released on Tuesday, highlights a key characteristic of this proposed tax adjustment: its regressive nature. Since the measure would not impose additional taxes on high-income individuals earning above the existing wage ceiling, its primary financial impact would fall on lower-income workers. Despite this, the report suggests that integrating this approach could still play a constructive role within a broader framework of Social Security reform initiatives.

The Growing Imbalance: Social Security's Fiscal Strain

The concept emerges as Social Security grapples with an expanding budgetary shortfall. Since 2021, the program's expenditures have outpaced its revenues. Projections indicate a 2.7% increase in the cost-of-living adjustment for 2026, further exacerbating the deficit.

Understanding the Deficit: A Closer Look at Social Security's Finances

In 2023, Social Security generated $1.351 trillion in revenue but distributed $1.392 trillion in benefits, resulting in a $41 billion deficit. The program's trust fund has, to date, absorbed this financial gap; however, current forecasts predict its depletion by 2035. Should this occur, Social Security would only be able to fulfill 83% of its promised benefits, a figure anticipated to decline to 73% by 2098.

The Evolving Taxable Wage Base: A Historical Perspective

For 2025, payroll taxes are capped at wages and salaries up to $176,100, with this threshold adjusting annually. Nevertheless, the earnings of high-income individuals are escalating at a faster pace, leading to a reduction in the proportion of taxable income, from 89% in 1985 to 83% in 2023.

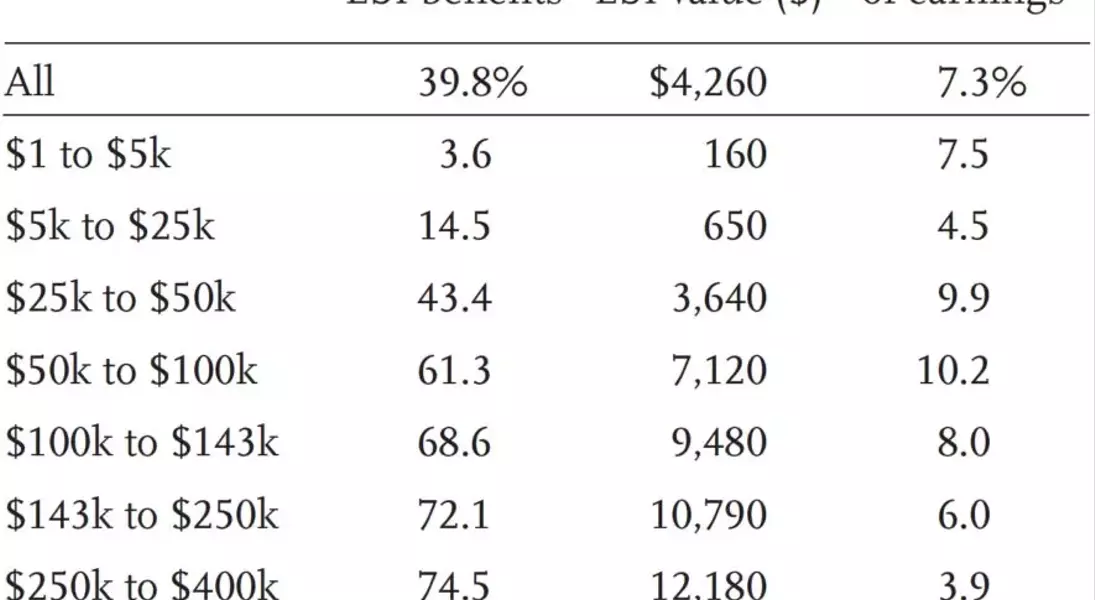

Quantifying the Impact of Including Employer Benefits

Typically, employer contributions towards benefits like health insurance, retirement savings plans, and disability coverage are excluded from federal income and payroll tax calculations. In 2021, approximately 40% of the workforce received employer-sponsored health insurance, with average annual contributions amounting to $10,710, representing 11.8% of total wages.

Assessing the Financial Uplift: Revenue Projections

Incorporating employer-sponsored health insurance into the payroll tax base would have elevated the average yearly Social Security contribution from $5,920 to $6,340 in 2021, generating an additional $70 billion in revenue for that year. The estimated impact would be more pronounced if focusing solely on individuals receiving employer-sponsored health benefits.

Comparative Analysis: Alternative Funding Strategies

Despite its potential, this measure is projected to yield less revenue compared to other proposed solutions. For instance, eliminating the existing wage cap entirely could boost the average annual contribution by $1,330. Combining the elimination of the cap with the inclusion of employer-sponsored health insurance could further increase contributions by $1,869.

The Disparate Effects of Policy Adjustments

"It is evident that these policy adjustments would disproportionately affect individuals across different income brackets," states the report. "While raising the taxable maximum would impose a slight increase in taxes for high-income earners, integrating employer-sponsored health benefits into the payroll tax base would require greater contributions from lower-income earners, without generating any additional revenue from the highest earners."