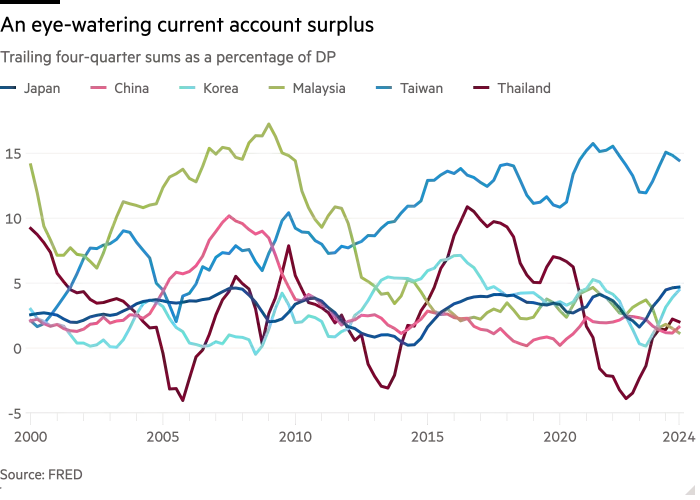

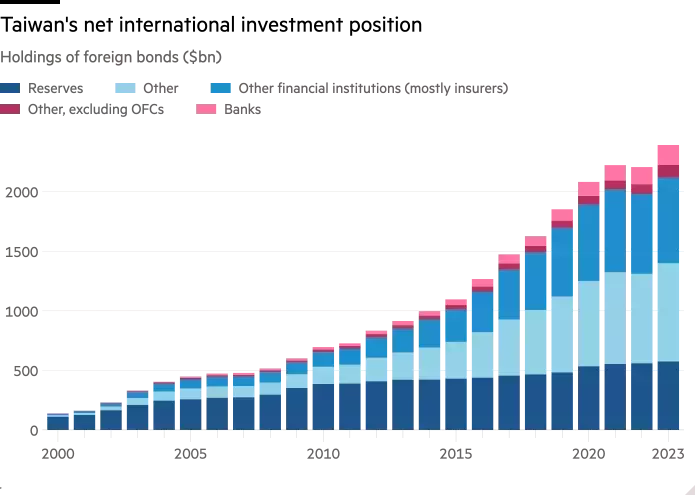

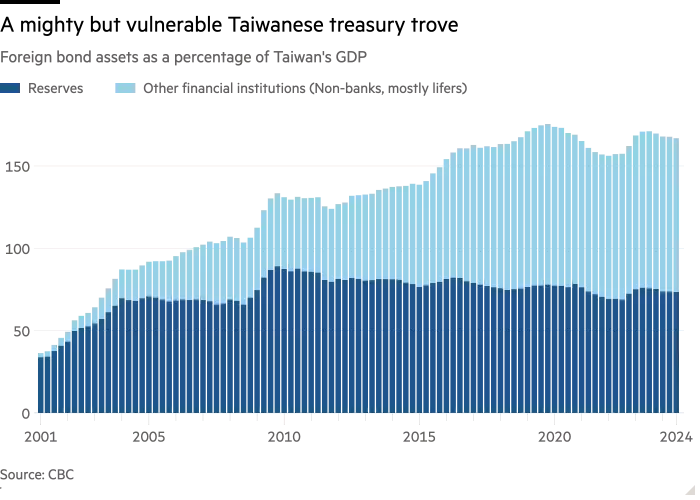

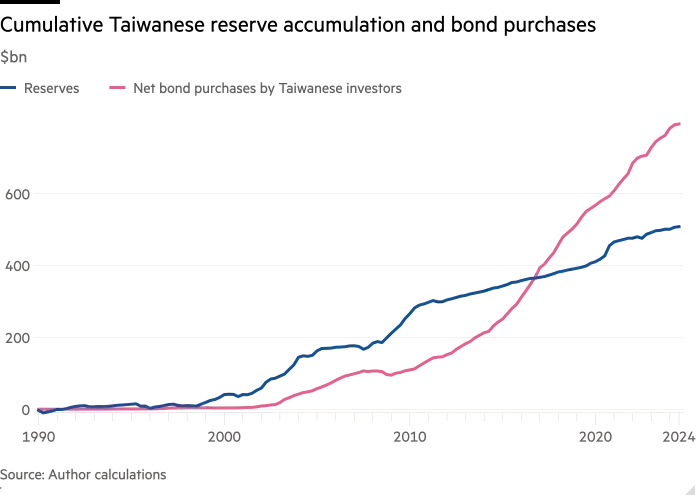

Over the past two decades, Taiwan has emerged as a significant player in the global fixed income market. The country has amassed an impressive $1.7 trillion in foreign assets, primarily in US bonds. This accumulation has been driven by Taiwan's persistent current account surpluses and strategic policy decisions. However, this financial prowess comes with considerable risks that could have far-reaching consequences for both Taiwan and the global economy.

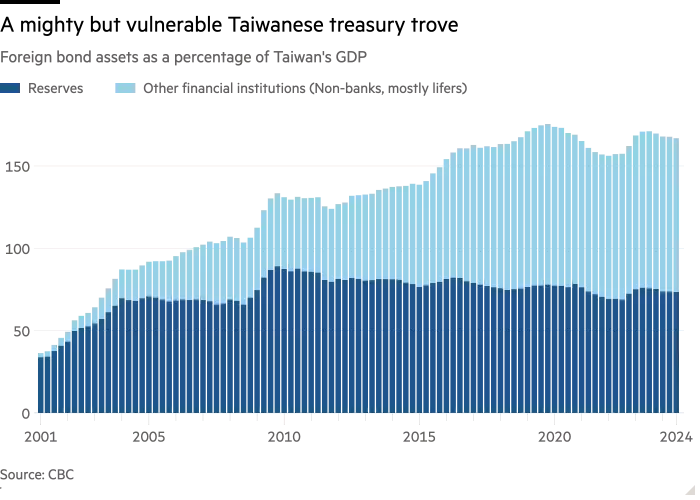

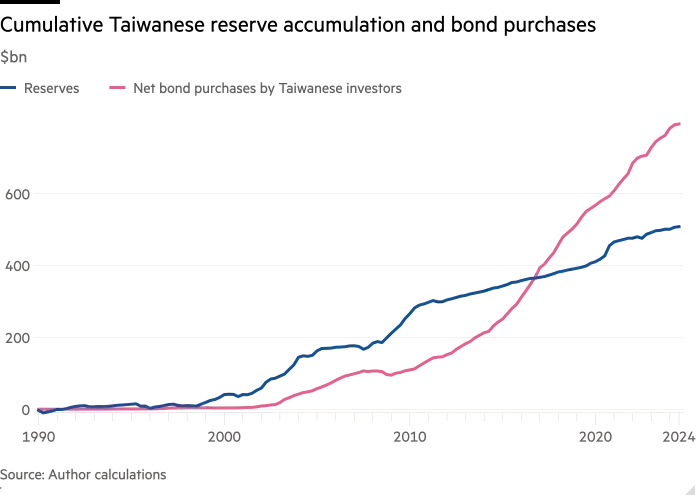

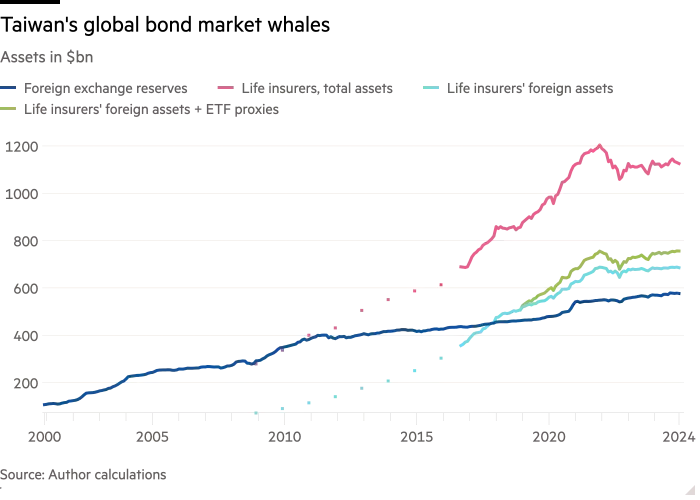

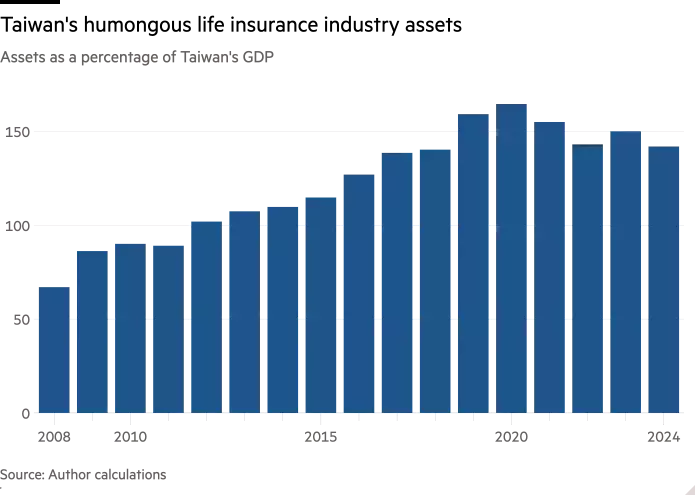

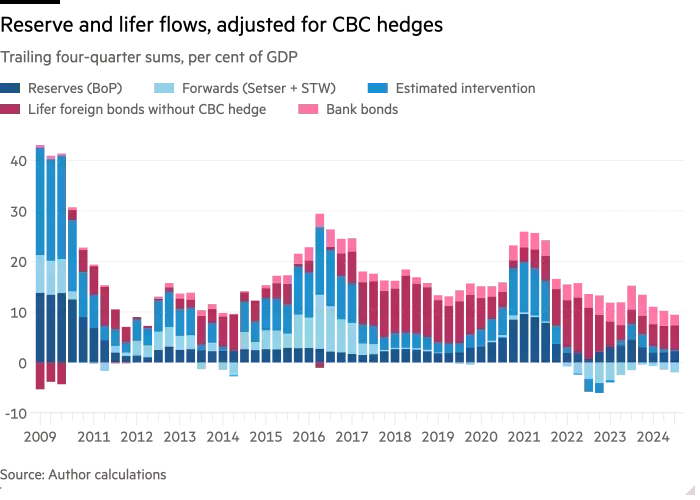

The heart of Taiwan's investment strategy lies in its central bank and life insurance industry. Initially, most of the surplus dollars accumulated at the central bank as foreign exchange reserves. However, as these reserves grew too large, they posed challenges for monetary management and attracted scrutiny from international observers. To address this, the Taiwanese government facilitated a shift towards private sector investments, particularly through life insurance companies. These insurers began issuing local currency policies and investing the proceeds overseas, primarily in US dollar-denominated assets. This move allowed the central bank to report slower reserve growth while maintaining a stable exchange rate.

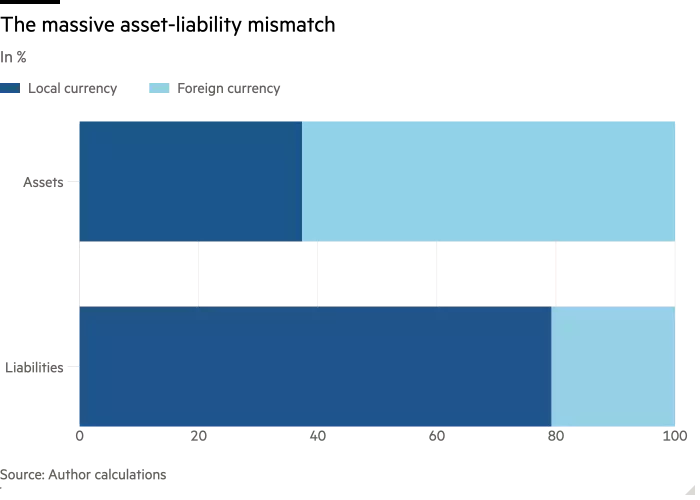

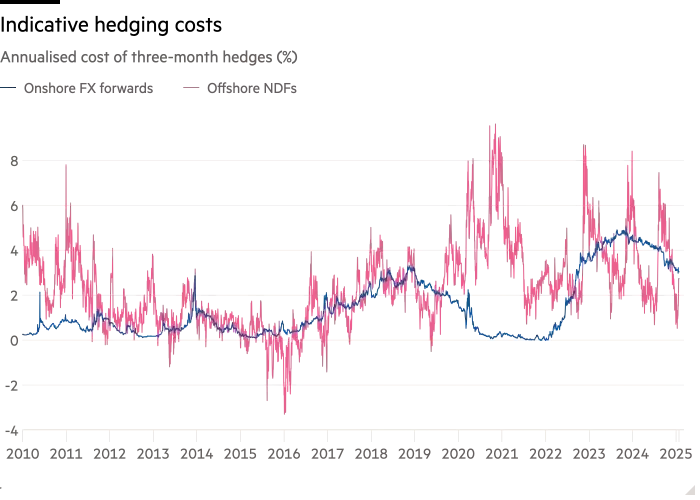

Despite the apparent success of this strategy, it has created significant vulnerabilities. A substantial portion of Taiwan's insurance industry assets are now denominated in US dollars, creating a massive currency mismatch. This exposure leaves the industry vulnerable to fluctuations in the USD/TWD exchange rate, rising interest rates, and the cost of hedging these risks. The potential losses from these exposures could be staggering, potentially exceeding the entire capital base of the insurance sector. Moreover, the interconnectedness of Taiwan's financial system means that any shock could ripple through the broader economy.

Looking ahead, Taiwan's financial stability hinges on several factors. The central bank's ability to manage the exchange rate and provide hedges is crucial, but it faces increasing challenges as global financial conditions evolve. Additionally, the ongoing trade surplus with the US and the structural weaknesses in the insurance industry pose long-term risks. While Taiwan's economic strength has been built on its prudent financial management, the hidden vulnerabilities in its bond investments highlight the need for more sustainable strategies. Ultimately, ensuring financial resilience will require addressing these imbalances before they lead to broader economic instability.