The financial markets are currently experiencing significant volatility, particularly in futures trading. This article explores the nuances of daily price movements in various futures contracts and provides strategic trading ideas for Nvidia (NVDA) and the Invesco QQQ Trust (QQQ). Understanding these dynamics is crucial for traders to align their strategies with market conditions and risk tolerance. Additionally, we delve into earnings season forecasts and recent yield trends, offering insights that can inform investment decisions.

Navigating Futures Markets: Risk Management and Contract Selection

Futures markets offer leveraged exposure to various indices, but they also come with inherent risks due to amplified price movements. Traders must carefully consider their account size and risk tolerance when selecting contracts. Micro contracts provide a viable alternative for those seeking lower capital exposure while tracking the same underlying markets. For instance, micro contracts like /MNQ move at one-tenth the magnitude of their larger counterparts, making them more suitable for smaller accounts.

To effectively manage risk, it's essential to understand the median daily price movements across different futures products. For example, NASDAQ futures (/NQ) exhibit median daily moves of $3,948, which can be substantial. Similarly, S&P 500 futures (/ES) and Russell 2000 futures (/RTY) have corresponding micro contracts (/MES and /M2K) that scale down these movements by a factor of ten. By comprehending these patterns, traders can choose products that best fit their trading style and capital constraints.

Trading Strategies for Nvidia and QQQ: Capitalizing on Market Trends

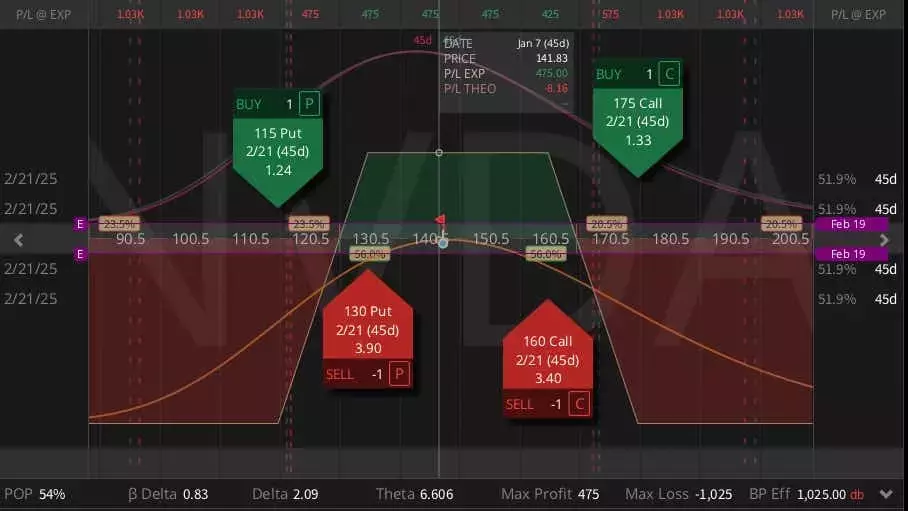

As earnings season approaches, traders are looking for strategic ways to capitalize on market movements. Two notable stocks under scrutiny are Nvidia (NVDA) and the Invesco QQQ Trust (QQQ). NVDA has been oscillating within a range since October 2024, presenting opportunities for options strategies. An iron condor setup in February could be beneficial, especially given the recent "buy the rumor, sell the news" reaction to CEO Jensen Huang's CES keynote. This strategy involves shorting put and call spreads to capture premium while limiting downside risk.

For QQQ, a CRAB trade offers a unique approach to benefiting from an upside grind. This complex strategy combines elements of a butterfly and ratio spread, with the ATM option further out in time to add positive gamma. By going long the 525 call in March and establishing a 2x/1x 550/575 call spread, traders can achieve defined risk, long delta, positive gamma, and slightly long theta. This setup is particularly advantageous during dips, as it allows traders to ride upward momentum while managing short-term theta decay.