In the evolving landscape of real estate investment trusts (REITs), W.P. Carey and Getty Realty recently demonstrated their astute management by executing equity offerings. These actions, perceived by some as potential dilutions, instead represent calculated strategies to fuel expansion and enhance shareholder value over the long term. The ensuing temporary market dips in their stock prices created an attractive entry point for discerning investors.

These companies, known for their disciplined approach, only proceed with such issuances when convinced of their accretive nature. This commitment to value creation, combined with a clear understanding of capital costs and acquisition cap rates, underscores their robust financial health and strategic foresight. For investors, these events highlight the importance of looking beyond immediate market reactions to grasp the underlying fundamental strength and growth potential.

Strategic Capital Raising and Value Creation

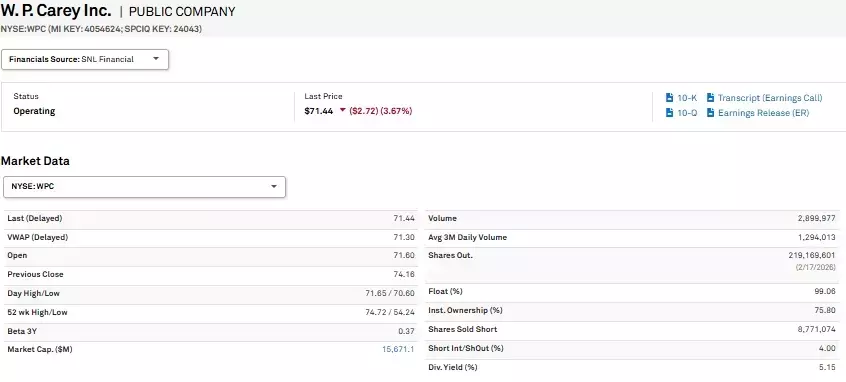

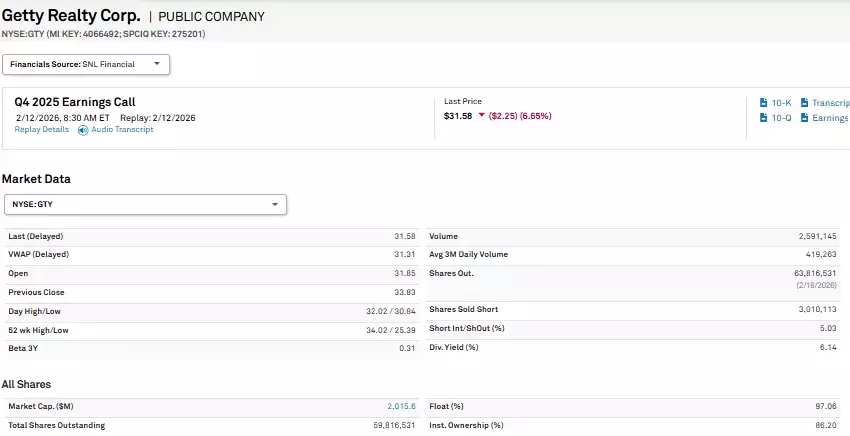

In 2026, as the REIT market regained its momentum, both W.P. Carey (WPC) and Getty Realty (GTY) seized the opportunity to issue new shares. This move, although met with initial stock price declines of approximately 4% for WPC and 7% for GTY on February 18, 2026, was not indicative of fundamental weakness but rather a temporary market reaction to increased liquidity. These equity issuances were strategically planned to fund acquisitions that would be accretive to their respective Adjusted Funds From Operations (AFFO) per share, thereby enhancing long-term shareholder value. The disciplined approach of these REITs, issuing equity only when conditions are favorable and the capital can be deployed for highly beneficial projects, showcases a management philosophy focused on sustainable growth and returns. The temporary price dips following these announcements offered a unique chance for investors to acquire shares at a discount, capitalizing on the market's short-sightedness and the companies' intrinsic strengths.

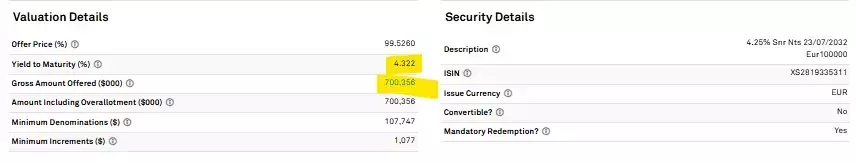

The decisions by W.P. Carey and Getty Realty to issue new equity were underpinned by meticulous financial analysis, ensuring that the cost of capital would be significantly lower than the returns from new property acquisitions. For WPC, the $432 million equity raise at $72 per share, combined with debt, facilitated approximately $864 million in acquisitions. With a blended capital cost of 5.75% and anticipated cap rates of about 7.25% on new investments, WPC projected a substantial accretive spread of 150 basis points. Similarly, GTY's $131 million equity raise at $32.75 per share, along with debt, allowed for investments at a 7.9% cash yield against a 6.71% blended capital cost, yielding an accretive spread of approximately 129 basis points. These figures underscore the value-adding nature of these transactions, as both companies effectively leverage their capital to expand their portfolios and drive earnings growth. The temporary market corrections provided an exceptional entry point for investors who recognized the underlying strategic value and the potential for rapid recovery in share price as the market absorbed the new information.

Accretive Growth and Management Discipline

The recent equity offerings by W.P. Carey and Getty Realty underscore a critical aspect of their operational strategy: a commitment to accretive growth. Unlike some companies that might issue equity out of necessity, these REITs chose to do so from a position of strength, leveraging a favorable market environment to fund expansions that are expected to directly contribute to increased AFFO per share. This proactive approach ensures that every dollar raised is deployed in a manner that enhances the company’s financial performance and shareholder returns. The temporary price fluctuations observed on the day of issuance, far from signaling distress, served as a clear indicator of market inefficiencies that astute investors could exploit. Both WPC and GTY demonstrated their capability to identify and execute investments that yield returns significantly above their cost of capital, reinforcing their status as well-managed entities in the competitive REIT sector.

The meticulous evaluation of the cost of capital against potential cap rates for new acquisitions is a hallmark of disciplined REIT management, exemplified by W.P. Carey and Getty Realty. These companies carefully assess market conditions, ensuring that equity is issued only when it can be utilized to generate superior returns. For instance, WPC's management targeted cap rates in the low to mid-7% range, creating a substantial positive spread over its blended cost of capital. GTY followed a similar strategy, achieving a notable accretive spread on its investments. This strategic financial engineering allows both REITs to grow their asset bases and income streams efficiently. The fact that these companies refrained from issuing equity when their stock prices were lower, waiting instead for valuations that supported accretive growth, speaks volumes about their long-term vision and dedication to shareholder value. This foresight and discipline are precisely what makes temporary dips in their stock prices, following such strategic moves, attractive buying opportunities for informed investors.