In an era where fixed income markets have experienced unprecedented volatility, the decision of how to invest in bonds has never been more critical. As interest rates hover around historic levels, investors are faced with a pivotal choice: should they opt for individual bonds or bond funds? This article delves into the complexities and nuances of both options, providing a detailed analysis to help you make an informed decision.

The Time to Act: Secure Your Financial Future with Strategic Bond Investments

Navigating Fixed Income Challenges

The landscape of fixed income investing has undergone significant transformation over the past decade. Once characterized by historically low yields, the market has seen a dramatic shift with yields now approaching 5%. This shift is not just a statistical anomaly; it reflects broader economic trends such as rising inflation and fluctuating central bank policies.Investors who weathered the low-yield environment of the 2010s may find themselves eager to capitalize on the current favorable conditions. However, this enthusiasm must be tempered with a thorough understanding of the risks involved. The allure of higher yields can be enticing, but it is crucial to recognize that these returns come with their own set of challenges.Evaluating Individual Bonds Versus Bond Funds

One of the most contentious debates in investment circles revolves around the merits of holding individual bonds versus investing in bond funds. Both approaches offer distinct advantages and disadvantages, and the optimal choice depends on your specific financial objectives and risk tolerance.Individual bonds provide a sense of control and predictability. When held to maturity, they ensure the return of principal, which can be appealing in times of market uncertainty. However, this apparent safety comes at a cost. Investors must contend with the impact of inflation on the nominal value of their returns and the potential for lower-than-market yields during the holding period.Bond funds, on the other hand, offer diversification and liquidity. They allow investors to spread their risk across multiple securities, reducing exposure to any single issuer. Additionally, bond funds maintain a consistent maturity profile, which can be advantageous for those seeking stability in their investment portfolio.Understanding the Risks and Rewards

The decision between individual bonds and bond funds is not merely a matter of preference; it requires a careful assessment of the associated risks and rewards. While individual bonds may seem like a safer bet, they introduce different types of risk that are often overlooked.For instance, holding a bond until maturity guarantees the return of principal, but this nominal amount may lose purchasing power due to inflation. Moreover, the bondholder might miss out on higher yields available in the market. On the other hand, bond funds are subject to fluctuations in net asset value (NAV), reflecting changes in market interest rates. However, they also offer the opportunity to reinvest dividends and potentially benefit from capital appreciation.Tailoring Strategies to Your Financial Goals

Ultimately, the choice between individual bonds and bond funds should align with your financial goals and time horizon. If you have specific spending needs or liabilities that require precise timing, individual bonds can provide the necessary asset-liability matching. Building a bond ladder, which involves purchasing bonds with staggered maturities, can further mitigate interest rate risk and provide flexibility in managing cash flows.Conversely, if you prioritize liquidity and diversification, bond funds may be a more suitable option. These funds offer a static maturity profile, ensuring that your portfolio remains aligned with your target duration. Moreover, they provide access to a broader range of securities, enhancing overall portfolio resilience.Exploring Current Market Opportunities

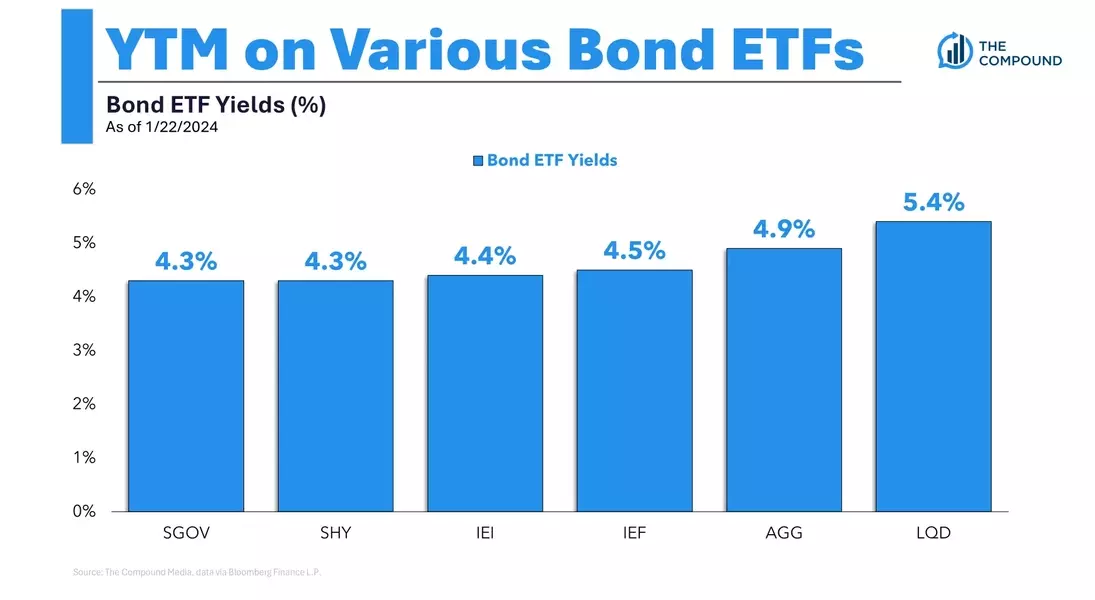

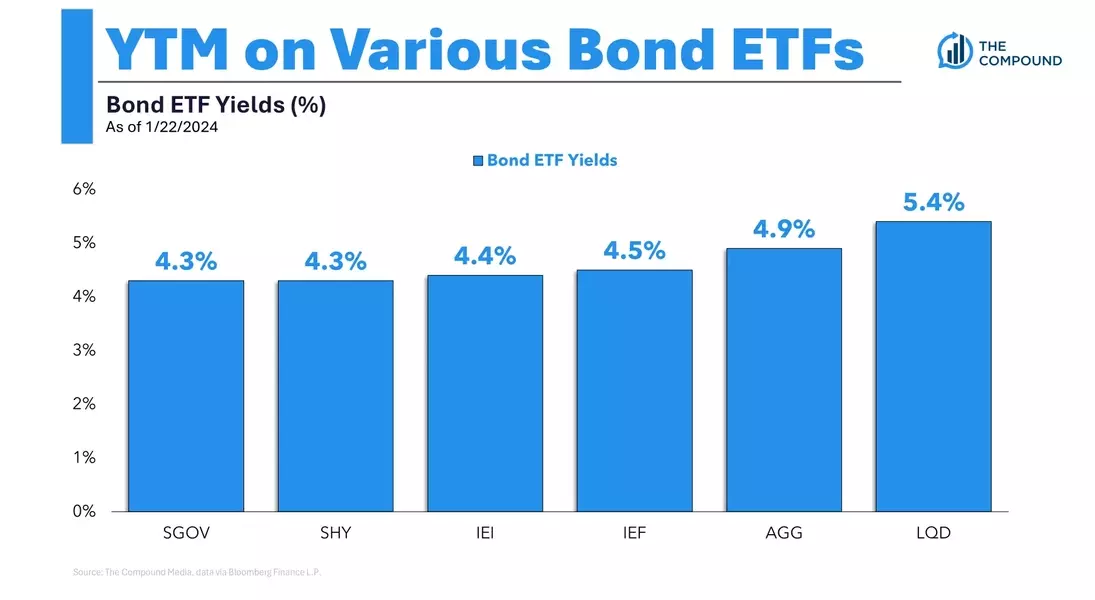

In today's market, yields on various types of bonds and bond funds present compelling opportunities. For instance, total bond market index funds like AGG offer yields around 5%, while corporate bond funds can provide even higher returns. Treasury yields remain competitive, and although cash yields are declining, they still offer a safe haven for conservative investors.While no one can predict the future direction of interest rates, it is clear that locking in current yields could prove beneficial in the long run. Whether through individual bonds or bond funds, the key is to develop a strategy that aligns with your financial aspirations and risk tolerance.