Stock futures are struggling for direction after more record highs for the major indexes on Monday. Futures on the Dow Jones Industrial Average (DJIA) are modestly higher this morning, while futures on the Nasdaq-100 Index (NDX) and S&P 500 Index (SPX) sit flat. Remarks from several Federal Reserve officials are due out today, alongside the National Federation of Independent Business' (NFIB) optimism index. Meanwhile, Treasury yields are inching higher ahead of this week's inflation data.

Unlocking the Secrets of the Market's Meteoric Rise

Navigating the Peaks and Valleys of the Stock Market

The stock market has been on a remarkable run, with the major indexes reaching new all-time highs. Investors are closely watching the movements of the Dow Jones Industrial Average (DJIA), Nasdaq-100 Index (NDX), and S&P 500 Index (SPX) as they continue to push higher. This surge in stock prices has been fueled by a combination of factors, including the ongoing economic recovery, strong corporate earnings, and the continued support of the Federal Reserve.However, the path to these record-breaking levels has not been without its challenges. Volatility has been a constant companion, with the market experiencing periodic dips and corrections. Investors must navigate these ups and downs with a keen eye, staying vigilant for potential risks and opportunities.The Influence of Federal Reserve Remarks and Economic Data

Investors are eagerly awaiting the remarks from several Federal Reserve officials scheduled for today. These comments will provide valuable insights into the central bank's monetary policy and its potential impact on the markets. Additionally, the release of the National Federation of Independent Business' (NFIB) optimism index will offer a glimpse into the sentiment of small businesses, a crucial component of the broader economic landscape.Alongside these events, the markets are also bracing for the release of key inflation data later this week. Inflation has been a significant concern for investors, as rising prices can erode consumer purchasing power and put pressure on corporate profits. The upcoming inflation figures will be closely scrutinized, as they could influence the Federal Reserve's future policy decisions and the overall direction of the stock market.Analyzing the Performance of Specific Sectors and Stocks

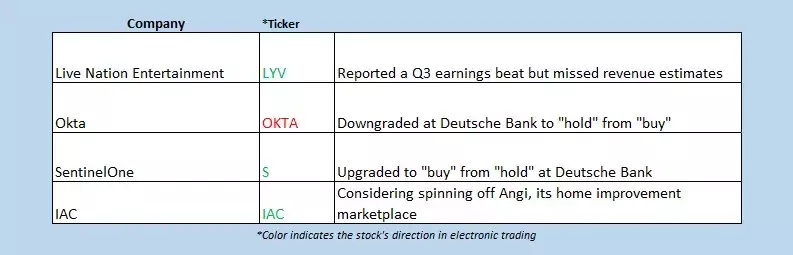

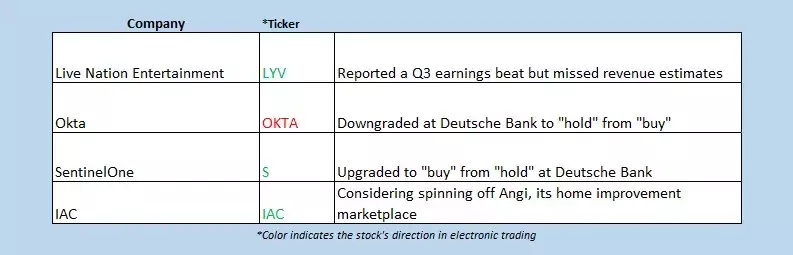

While the major indexes have been reaching new highs, the performance of individual sectors and stocks has been varied. Certain industries, such as technology and e-commerce, have continued to thrive, with companies like Shopify Inc. (NYSE:SHOP) and Twilio Inc. (NYSE:TWLO) reporting strong quarterly results and experiencing significant stock price appreciation.On the other hand, sectors like housing have faced challenges, with Home Depot Inc. (NYSE:HD) reporting better-than-expected earnings but also acknowledging the impact of rising interest rates on the housing market. Investors must carefully analyze the performance of individual companies and sectors to identify potential opportunities and risks within the broader market landscape.The Importance of Monitoring Options Activity and Investor Sentiment

The options market can provide valuable insights into investor sentiment and market dynamics. The Cboe Options Exchange (CBOE) saw over 2.5 million call contracts and more than 1.2 million put contracts exchanged on Monday, indicating a bullish sentiment among options traders. The single-session equity put/call ratio fell to 0.48, while the 21-day moving average remained at 0.62, suggesting that investors are more inclined to take on bullish positions.These options market metrics, combined with the overall performance of the stock market, can help investors better understand the prevailing sentiment and potential future market movements. By closely monitoring these indicators, investors can make more informed decisions and position themselves to capitalize on the ongoing market trends.You May Like