Navigating Uncertainty: Economic Data and Geopolitics Shape Market Trends

Pre-Market Trends: Early Indications for Major Stock Indexes

Before the market opened on Friday, key stock index futures showed a marginal downward movement. This slight decrease was observed across the Dow Jones Industrial Average, S&P 500, and Nasdaq 100, signaling investor anticipation ahead of significant economic announcements.

Geopolitical Impact: Rising Oil Prices and Market Sensitivity

Market sentiment was notably affected by geopolitical developments, specifically the heightened tensions between the United States and Iran. This situation contributed to a significant increase in oil prices, reaching a six-month high, which in turn influenced stock market performance.

Inflationary Pressures: Personal Consumption Expenditures Index Rises

The Personal Consumption Expenditures (PCE) price index, a crucial measure for the Federal Reserve's inflation assessment, indicated a year-over-year increase of 2.9% in December. This figure exceeded economists' forecasts, highlighting persistent inflationary pressures. Core inflation, excluding volatile components like food and energy, aligned with expectations at 3%, up from the previous month.

Economic Growth: GDP Data Reveals Slower Expansion

New data on Gross Domestic Product (GDP) showed that the U.S. economy expanded at an annualized rate of 1.4%, a figure considerably lower than anticipated and a sharp decline from the previous quarter's robust growth. This slower pace of economic expansion adds another layer of complexity for policymakers.

Diverse Economic Indicators: Manufacturing, Housing, and Consumer Sentiment

Beyond inflation and GDP, Friday's economic calendar included reports on manufacturing and services sector activity, new home sales figures, and consumer sentiment. These varied indicators collectively provide a comprehensive, albeit mixed, picture of the economy's current health.

Bond Market Reaction: Treasury Yields Respond to Reports

The yield on the 10-year Treasury note, a benchmark influencing various consumer loan interest rates, experienced a modest uptick following the release of the inflation and GDP reports. Despite this increase, overall yields have seen a slight reduction since the beginning of the year.

Company-Specific Movements: Notable Stock Performance

Individual company stocks also saw significant shifts. Applovin shares gained momentum following news of its venture into social media. Conversely, Grail's stock plummeted after unfavorable clinical trial outcomes for a cancer treatment. Akamai Technologies also faced a downturn, with its first-quarter financial outlook falling short of projections.

Commodity Markets: Fluctuations in Oil, Gold, and Silver

In the commodity markets, West Texas Intermediate crude oil futures experienced a minor decline. Gold prices appreciated by approximately 1%, while silver saw a more substantial gain of 4%. These movements reflect broader investor reactions to economic and geopolitical shifts.

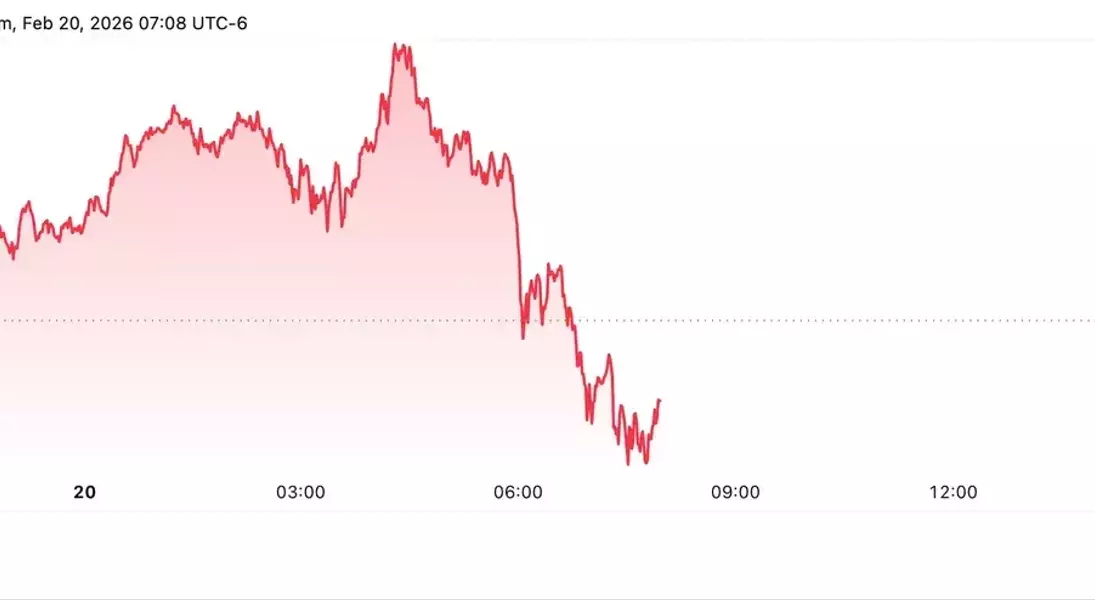

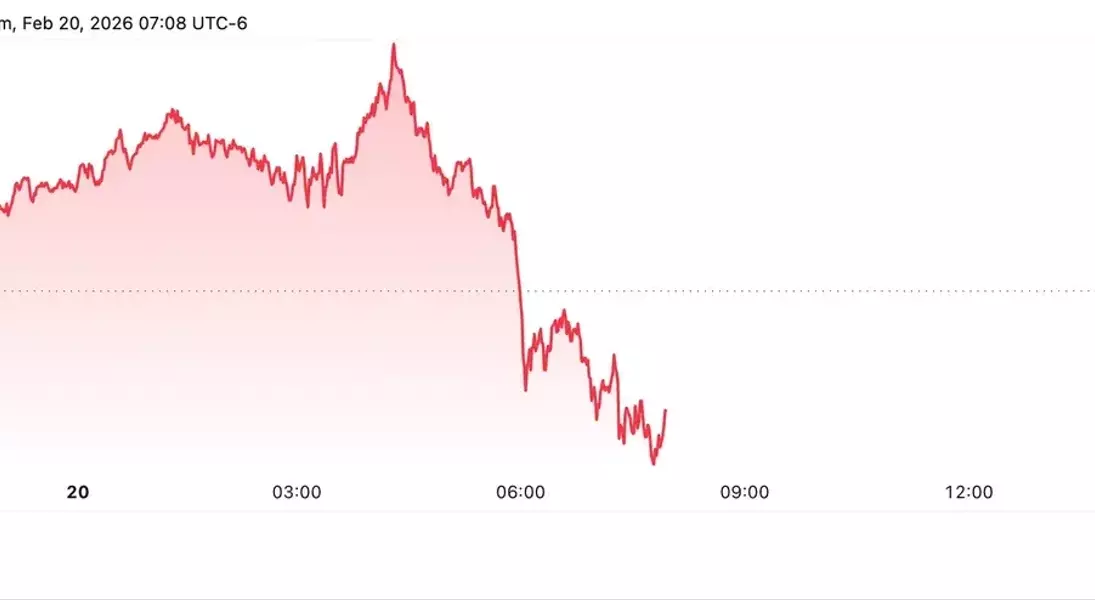

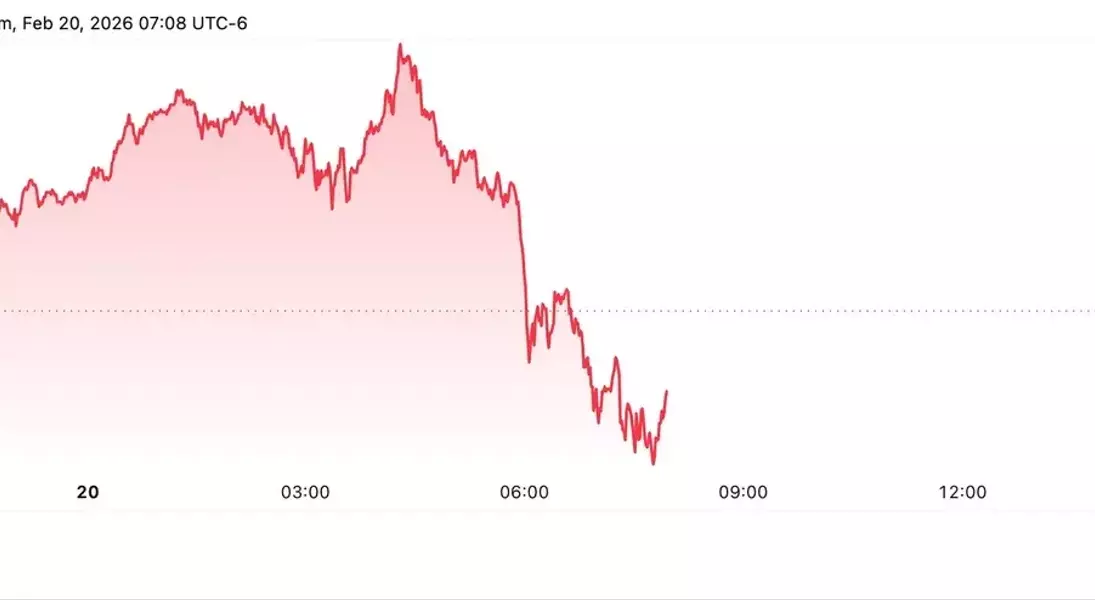

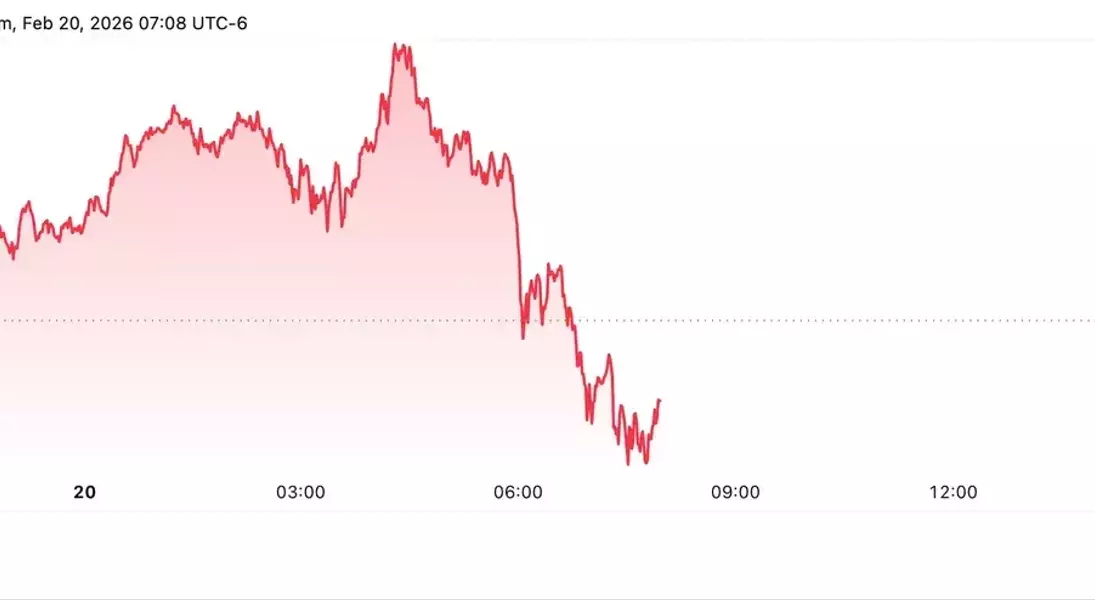

Cryptocurrency and Currency Markets: Bitcoin and the U.S. Dollar Index

Bitcoin's value slightly decreased, trading below the $67,000 mark after earlier highs. The U.S. dollar index, which tracks the dollar's strength against a basket of major currencies, registered a fractional dip, indicating minor fluctuations in global currency valuations.