Stocks Rebound as Tech Regains Footing and Oil Prices Retreat

US stocks rebounded on Tuesday, with the tech-heavy Nasdaq Composite leading the charge as investors welcomed a resurgence in tech stocks and a pullback in surging oil prices. The focus shifted back to interest rates and the state of the US economy, as the market grappled with the implications of the Federal Reserve's policy decisions.Navigating the Shifting Tides of the Market

Tech Stocks Recoup Losses, Lifting the Nasdaq

The Nasdaq Composite (^IXIC) rose around 1.2% as tech megacaps, including Amazon (AMZN), Apple (AAPL), and Alphabet (GOOG, GOOGL), recouped some of the previous session's losses. The rebound in tech stocks was a welcome sight for investors, who had been closely monitoring the sector's performance amid the broader market volatility.Nvidia (NVDA), the chip heavyweight, was a standout performer, building on a closing gain and rising another 4% on Tuesday. The company's partner, Hon Hai, pointed to "crazy" AI demand, further fueling investor optimism in the semiconductor space.Oil Prices Retreat, Easing Pressure on the Market

Oil prices, which had been a source of concern for investors, also came under pressure on Tuesday. West Texas Intermediate (CL=F) tanked more than 4.5%, while Brent (BZ=F), the international benchmark price, also slipped more than 4.5%.The reversal in oil prices came after the recent rally, which had been driven by speculation that a retaliatory move from Israel against Iran in the ongoing Middle East conflict could involve targeting Iran's oil infrastructure. However, the delayed response from Israel and the lack of further escalation in the region led to a corrective phase in the oil market.Additionally, the disappointment from China's economic planner, who failed to announce any large or new stimulus measures, also contributed to the decline in oil prices. The world's largest oil importer, China, had been a key driver of the recent oil price surge, and the lack of additional stimulus measures weighed on investor sentiment.Shifting Focus to Fed Policy and Economic Data

Investors also turned their attention to the Federal Reserve's policy decisions, as markets continued to grapple with the implications of the central bank's interest rate hikes. New York Fed president John Williams told the Financial Times that the Fed's policy is "well positioned" to achieve a "soft landing" for the economy, while Fed governor Adriana Kugler emphasized that data will continue to drive rate decisions.The upcoming CPI inflation report, scheduled for release on Thursday, has become a focal point for investors, as it will provide further clues on the path forward for interest rates. The report's findings will be closely scrutinized, as they could have a significant impact on the Fed's future policy actions and the overall direction of the market.Earnings Season Kicks Off with Mixed Results

The third-quarter earnings reporting period has begun, with PepsiCo (PEP) being one of the first major companies to report. The snack and drinks giant posted a surprise drop in quarterly revenue and lowered its forecast for 2024 sales growth, sending a cautionary signal to investors.Wall Street analysts have projected earnings to grow 4.7% for the quarter, marking the fifth straight quarter of growth since the same period a year prior. However, this would also be the slowest year-over-year growth since the fourth quarter of 2023.Deutsche Bank's chief equity strategist, Binky Chadha, warned that the strong rally and above-average positioning in the market going into the earnings season could lead to a "muted market reaction" compared to the typical 2% rise in the S&P 500 (^GSPC) during the first four weeks of earnings reports.China's Stimulus Hopes Fade, Impacting Global Markets

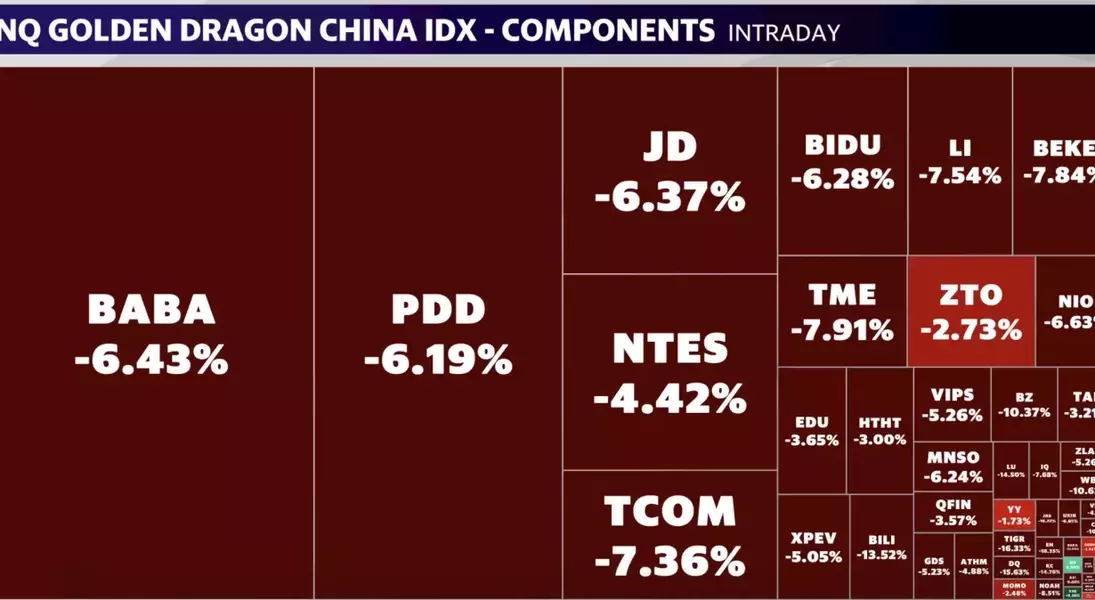

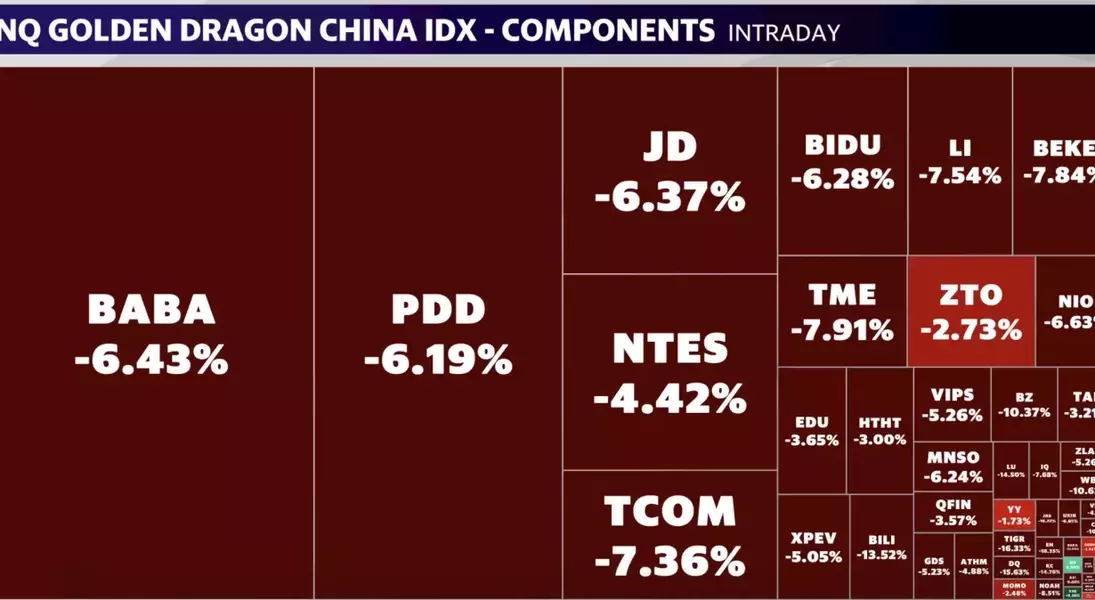

The recent surge in Chinese stocks hit a pause on Tuesday, as Beijing failed to roll out another large stimulus package, disappointing investors who had been hoping for more fuel to the unprecedented rally.Hong Kong's benchmark Hang Seng Index (^HSI), which is heavily weighted with large Chinese stocks, dropped around 9% on Tuesday, its worst day since October 2008. China's benchmark CSI 300 (000300.SS) also experienced a volatile day, initially climbing 10% after markets reopened from the country's weeklong holiday, but later giving up those gains to finish the day up a more modest 6%.The lack of a significant stimulus announcement from China's top economic planner, the National Development and Reform Commission (NDRC), was a surprise to investors who had been betting on Beijing's efforts to course-correct its struggling economy. The NDRC only stated that it's committed to enacting further support to reach its economic goals, which include an annual growth target of "around 5%."The disappointment in China's stimulus measures had a ripple effect on global markets, as investors had been closely watching the country's economic recovery and its potential impact on the broader global economy.