Tech markets have been experiencing a bit of a breather today, with futures on the Dow Jones Industrial Average and S&P 500 Index struggling for direction. The Nasdaq-100 Index futures are pointed lower, as the tech sector takes a break from its recent upward surge. Later in the day, traders will be closely watching the release of wholesale inventories data for October. Additionally, chip giant Nvidia is now under Chinese investigation.

Unraveling the Tech Market's Pause with Nvidia's Influence

Tech Sector's Breathing Room

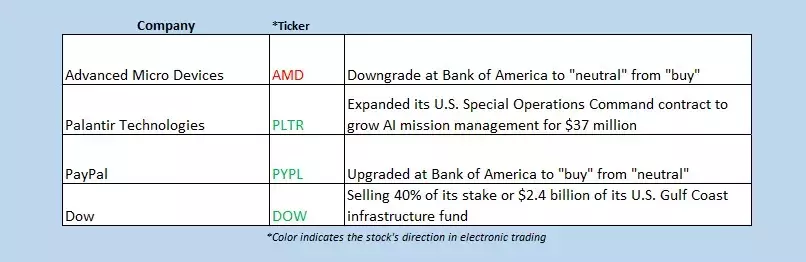

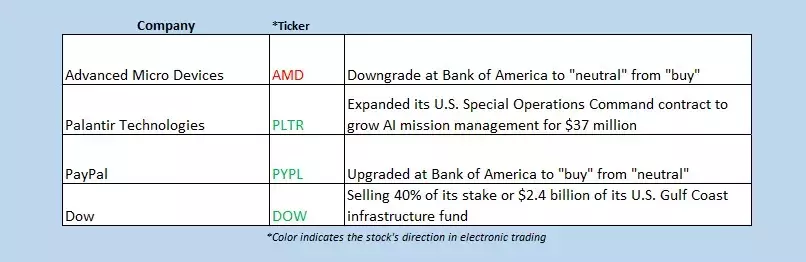

Futures on the Dow Jones Industrial Average and S&P 500 Index are currently in a state of indecision. The Nasdaq-100 Index futures have taken a downward turn, indicating a temporary slowdown in the tech sector. This comes after last week's record highs. Traders are eagerly awaiting the release of wholesale inventories data for October, which could provide some clarity on the market's direction.The chip industry, led by Nvidia, is also facing challenges. Nvidia's stock is down 2.3% before the bell due to a possible antimonopoly law violation investigation in China. Despite this setback, Nvidia still maintains a significant year-over-year lead of 205.7%.Stock Movements and Analyst Upgrades

The Cboe Options Exchange saw a significant increase in call and put contracts last Friday. The single-session equity put/call ratio rose to 0.54, while the 21-day moving average remained at 0.62. Morgan Stanley upgraded Reddit Inc stock to "overweight" from "equal weight" this morning and raised its price target to $200 from $70. The analyst noted the social network's strong ad revenue growth. As a result, RDDT is 4.5% higher in premarket trading and has added over 146% in 2024.Macy's Inc stock is also showing signs of movement. It is up 3.1% ahead of the open following requests from Barington Capital. The activist investor group has asked the retailer to create a real estate unit, modify its capital allocation plan, and reassess options for its Bloomingdale's and Bluemercury operations. However, M is still down 18.3% this year.Asian and European Market Trends

Asian markets finished mixed yesterday. In Hong Kong, the Hang Seng managed to surge in the last hour of trading after China committed to a more proactive monetary policy in 2025. The index jumped 2.8% in response to this news. However, consumer price index data in China showed a 0.2% year-over-year increase, which was lower than the expected 0.5%.In South Korea, President Yoon Suk Yeol avoided impeachment after his controversial implementation of martial law. For the session, China's Shanghai Composite slid 0.05%, South Korea's Kospi fell 2.8%, and Japan's Nikkei inched 0.2% higher.European markets are also showing mixed trends due to geopolitical tensions. At last check, London's FTSE 100 and France's CAC 40 are up 0.5%, while Germany's DAX slides 0.1%.You May Like