Navigating the Volatile Markets: Insights on Oil Prices and Nike's Earnings

The markets are facing a tumultuous start to the day, with stock futures struggling to maintain their footing amidst a range of geopolitical and economic factors. Tensions in the Middle East, coupled with the release of key earnings reports, are shaping the narrative on Wall Street. As investors brace for potential fallout from the latest developments, the focus remains on how these events will impact the broader market landscape.Weathering the Storm: Navigating Volatility in Uncertain Times

Geopolitical Tensions Weigh on Investor Sentiment

The ongoing tensions in the Middle East have cast a shadow over the markets, with investors closely monitoring the situation for any potential escalation. The recent missile attack by Iran on Israel has heightened concerns, as the world waits to see how Israel will respond. This delicate geopolitical landscape is adding to the uncertainty that has gripped the markets, as investors grapple with the potential implications for global trade and energy supplies.In the face of these challenges, market participants are exercising caution, with many holding their breath to see how the situation unfolds. The potential for further conflict in the region has the potential to disrupt global supply chains and impact the flow of crucial commodities, such as oil, which could have far-reaching consequences for the broader economy.Analyzing the Impact of Economic Data

Amidst the geopolitical tensions, the markets are also closely watching the latest economic data releases. The recent report from ADP showing stronger-than-expected job growth in the private sector has provided a glimmer of optimism, with 143,000 new jobs created in September, surpassing the upwardly revised figure of 103,000 in August.This positive economic data suggests that the labor market remains resilient, even as concerns about a potential recession linger. Investors will be closely monitoring the upcoming employment report from the government, as well as other key economic indicators, to gauge the overall health of the economy and its potential impact on the markets.Navigating the Earnings Landscape

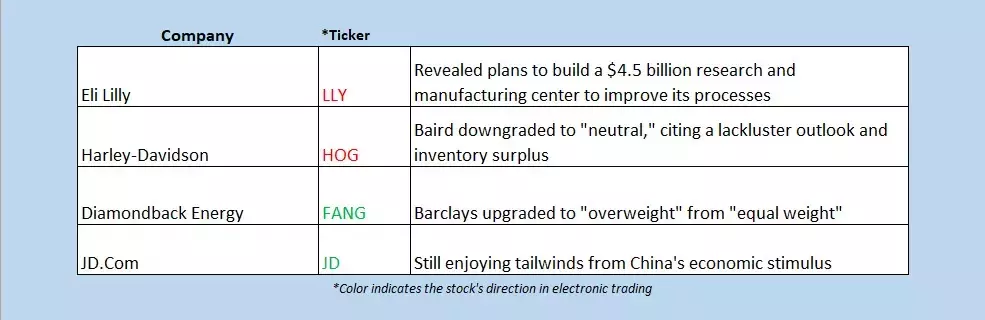

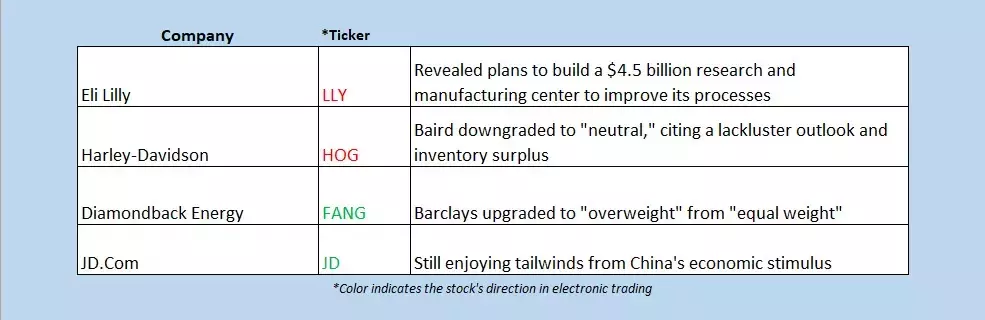

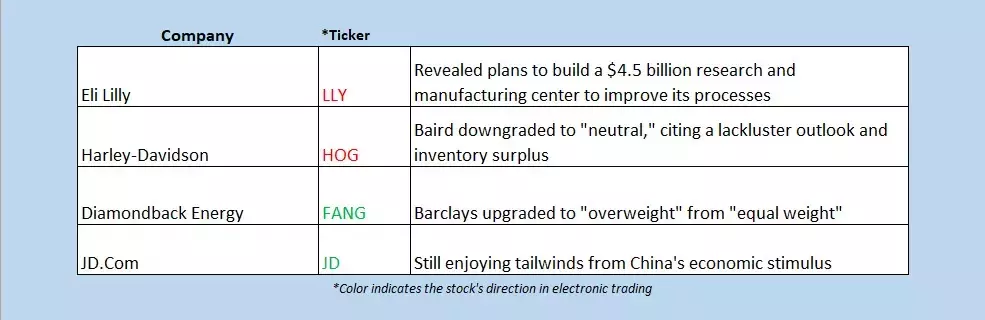

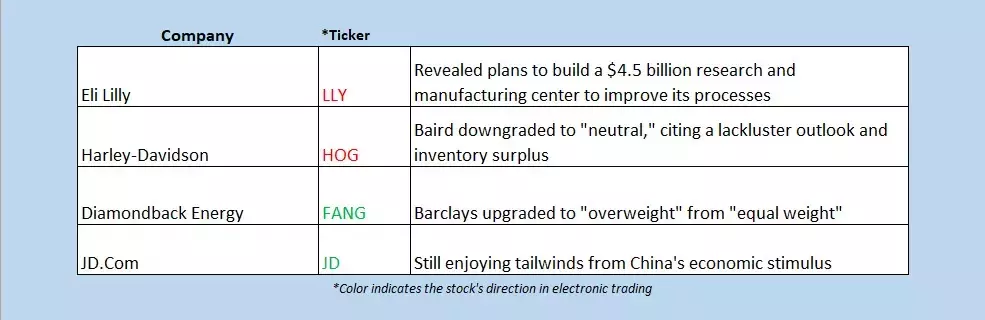

In addition to the geopolitical and economic factors, the markets are also grappling with the release of key earnings reports, including the highly anticipated results from Nike Inc. (NYSE: NKE). The sportswear giant's fiscal first-quarter financial report topped estimates, with revenue meeting expectations. However, the company's North American sales fell 11%, driven by a 14% drop in footwear sales.The mixed performance from Nike has prompted several analysts to trim their price targets, reflecting the challenges the company is facing in its core market. The company's decision to withdraw its fiscal 2025 guidance and delay its first investor day in seven years has further added to the uncertainty, as investors await the new CEO's evaluation of the firm's strategies.The performance of Nike's stock, which is down 17.9% year-to-date, serves as a reminder of the volatility and unpredictability that can characterize the earnings season. As investors navigate this landscape, they must carefully assess the implications of these reports and their potential impact on the broader market.Navigating the Energy Sector Amidst Geopolitical Tensions

Amid the broader market turmoil, the energy sector is garnering significant attention, with oil stocks rising across the board. Investors are closely monitoring the impact of the Middle East tensions on crude prices, as the potential for supply disruptions or geopolitical instability could have far-reaching consequences for the energy industry.One notable performer in the energy sector is Marathon Oil Corp (NYSE: MRO), which is up 1.9% in premarket trading and looking to build on its 14.4% year-to-date lead. The company's stock is benefiting from the broader rally in the energy sector, as investors seek exposure to the potential upside in oil prices.As the energy landscape continues to evolve, investors must carefully assess the risks and opportunities presented by the various players in the sector. The ability to navigate the complexities of the energy market, while also considering the broader geopolitical factors, will be crucial in determining investment strategies and portfolio performance.