Navigating the Shifting Tides: Decoding the Fed's Surprise Rate Cut and Its Market Implications

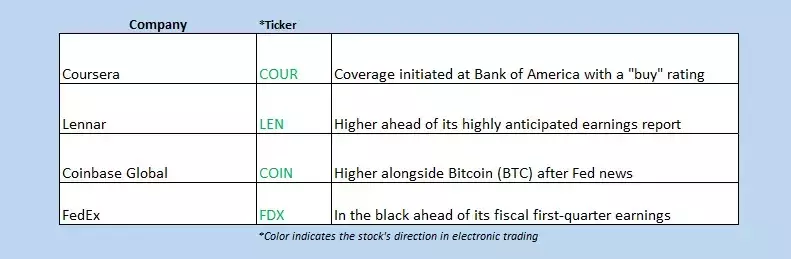

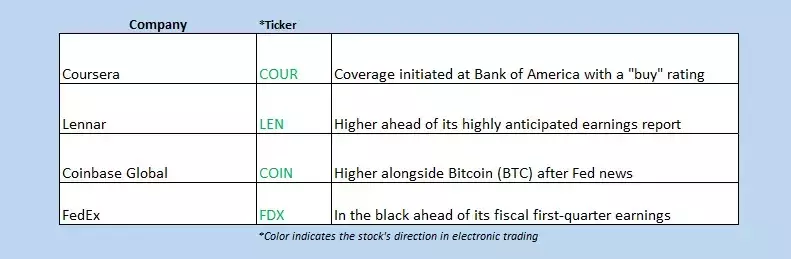

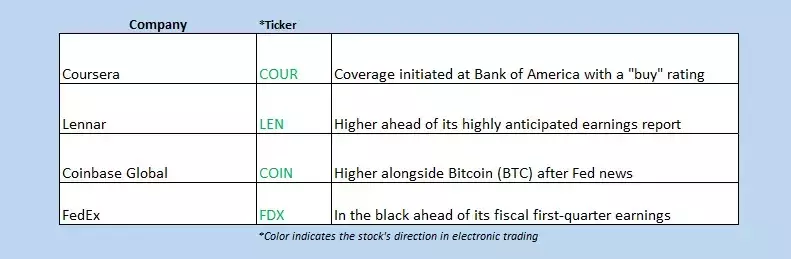

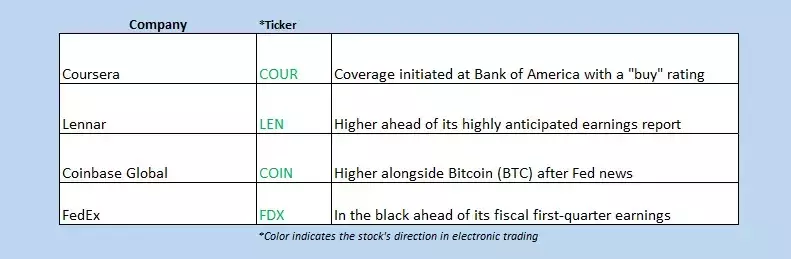

The U.S. Federal Reserve's unexpected 50 basis point interest rate cut has sent shockwaves through the financial markets, sparking a surge in stock futures and a renewed sense of optimism for a potential "soft landing" for the economy. As investors and analysts dissect the implications of this bold move, the markets are poised to react with a mix of enthusiasm and cautious optimism.Unlocking the Potential of a Resurgent Market

Dow Futures Soar, Nasdaq Rallies as Tech Stocks Lead the Charge

The markets are set to open with a bang, as Dow Jones Industrial Average (DJI) futures are indicating a staggering 400-point surge, while Nasdaq futures are more than 2% higher. This surge is largely driven by a rally in tech stocks, which have been buoyed by the Fed's decision to cut rates. Investors are eagerly anticipating the potential for a sustained market rally, as the central bank's move aims to stimulate economic growth and provide a much-needed boost to consumer confidence.Jobless Claims Plummet, Fueling Hopes for a Soft Economic Landing

Adding fuel to the market's optimism is the unexpected drop in weekly jobless claims, which have fallen far below analyst estimates. This data point suggests that the labor market remains resilient, even in the face of broader economic challenges. The Philadelphia Fed's manufacturing gauge also moved back into growth territory, further reinforcing the notion that the economy may be able to navigate the current headwinds without a hard landing.Overseas Inflation Data Sparks Global Market Reactions

The ripple effects of the Fed's decision are being felt across the globe, as inflation data from Asia and Europe also take center stage. The Hong Kong Monetary Authority has followed suit, slashing rates by 50 basis points, while the Bank of Japan is set to conclude its two-day policy meeting tomorrow. Retail stocks in Europe are also rallying, contributing to the positive sentiment in major indexes like the FTSE 100, CAC 40, and DAX.Analyzing the Implications: Navigating the Shifting Landscape

The Fed's surprise move has undoubtedly shaken up the market landscape, and investors are now tasked with deciphering the long-term implications. While the initial market reaction has been overwhelmingly positive, it remains to be seen whether this momentum can be sustained in the face of ongoing economic challenges. Analysts will be closely monitoring the impact on consumer spending, business investment, and the overall trajectory of the economy as the central bank's decision ripples through the financial system.Adapting to the New Normal: Strategies for Navigating the Evolving Market

As the markets grapple with the aftermath of the Fed's surprise move, investors and traders will need to adapt their strategies to the shifting landscape. This may involve reevaluating portfolio allocations, closely monitoring economic indicators, and staying nimble in the face of potential volatility. The ability to identify and capitalize on emerging trends will be crucial in navigating the evolving market conditions and positioning oneself for potential opportunities.You May Like