Navigating the Fed's Monetary Policy Shift: Deciphering the Implications

As the financial world eagerly awaits the Federal Reserve's latest policy decision, a sense of anticipation and uncertainty hangs in the air. Investors are widely anticipating the first rate cut in four years, but the extent of the move remains a subject of debate. Meanwhile, the latest economic data has provided some encouraging signs, with housing starts surging in August and mortgage rates cooling off. As the market braces for the Fed's announcement, the potential implications for stocks and the broader economy are the focus of intense scrutiny.Unlocking the Secrets of the Fed's Monetary Policy Shift

Decoding the Fed's Rate Cut Dilemma

The Federal Reserve's upcoming policy decision is poised to have a significant impact on the financial markets and the broader economy. Investors are closely watching whether the central bank will opt for a half-point or a quarter-point rate cut, as either move could have vastly different implications. A more aggressive half-point reduction could signal the Fed's heightened concerns about the economic outlook, potentially triggering a more pronounced market reaction. Conversely, a more modest quarter-point cut might be interpreted as a more cautious approach, potentially dampening the enthusiasm of some investors.The decision-making process at the Fed is a delicate balancing act, as policymakers must weigh a range of factors, including the strength of the labor market, the trajectory of inflation, and the potential risks posed by global trade tensions. The central bank's mandate to maintain price stability and promote maximum employment adds an additional layer of complexity to the equation. As the Fed navigates these challenges, its actions will be closely scrutinized for clues about the future direction of monetary policy and its potential impact on the economy.Unpacking the Housing Market's Resilience

Amidst the uncertainty surrounding the Fed's policy decision, the latest housing data has provided a glimmer of optimism. The sharp increase in housing starts in August, exceeding market expectations, suggests that the housing market may be regaining its footing. This positive development can be attributed, in part, to the cooling of mortgage rates, which have provided a boost to homebuyer demand.The resilience of the housing sector is a crucial indicator of the broader economic health, as it has a ripple effect on various industries, from construction to home furnishings. The surge in housing starts could signal that consumer confidence remains relatively strong, despite the lingering concerns about the economic outlook. As the Fed deliberates its next move, the housing market's performance will be closely watched for insights into the overall state of the economy and the potential impact of the central bank's actions.Navigating the Shifting Landscape of Global Markets

As the world's financial markets eagerly await the Fed's decision, the global economic landscape has also been undergoing significant shifts. The performance of major bourses in Asia, with the Nikkei and Shanghai Composite both posting modest gains, suggests a cautious optimism among investors. However, the closure of markets in South Korea and Hong Kong for holidays underscores the uneven nature of the global recovery.Across the Atlantic, European markets are exhibiting a more subdued tone, with the FTSE 100, CAC 40, and DAX all trading lower. Investors are closely monitoring the inflation data from the United Kingdom, which came in at an unchanged 2.2% for August, as they await the Bank of England's upcoming policy decision. The divergent trends in global markets highlight the complex interplay of regional economic factors and the potential for spillover effects from the Fed's actions.As the world's financial centers navigate these shifting tides, the need for a nuanced understanding of the global economic landscape has never been more crucial. Investors and policymakers alike must remain vigilant, ready to adapt to the evolving market dynamics and the potential ripple effects of the Fed's monetary policy decisions.Deciphering the Implications for Stocks and Options Trading

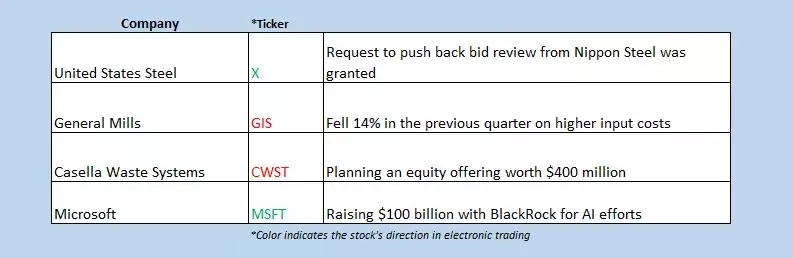

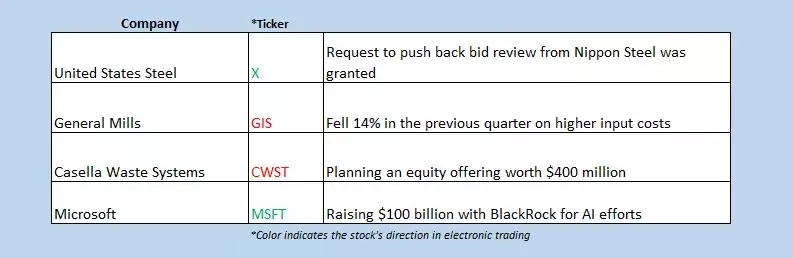

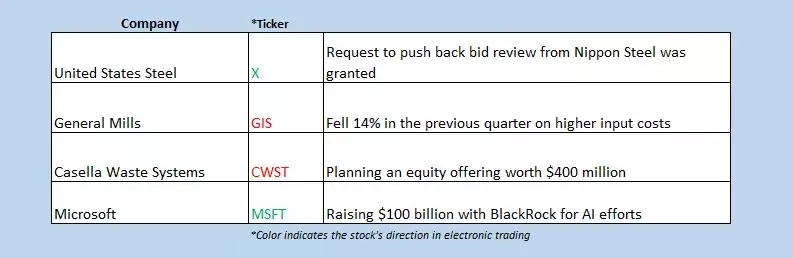

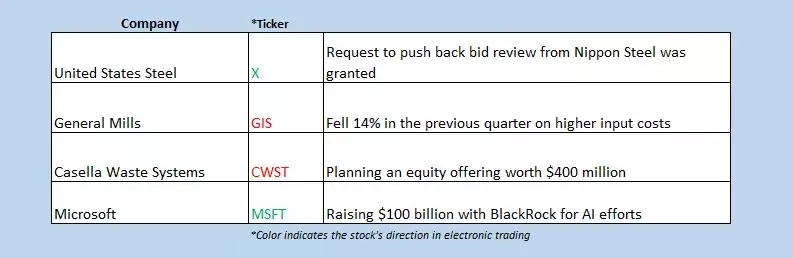

The impending Fed decision has also captured the attention of the options trading community, as evidenced by the significant activity on the Cboe Options Exchange. The exchange saw over 1.6 million call contracts and 829,698 put contracts exchanged on Tuesday, reflecting the heightened level of uncertainty and speculation surrounding the central bank's move.The single-session equity put/call ratio, which fell to 0.51, and the 21-day moving average, which remained at 0.65, provide insights into the sentiment of options traders. These metrics suggest a relatively bullish outlook, with traders potentially positioning themselves for potential upside in the market following the Fed's announcement.However, the implications for individual stocks remain complex and varied. The surge in Intuitive Machines Inc (LUNR) stock, up 51.1% premarket, highlights the potential for significant gains in specific sectors or companies, driven by factors beyond the Fed's policy decision. Conversely, the downgrade of ResMed Inc (RMD) by Wolfe Research, citing increased competition, underscores the need for investors to closely monitor company-specific developments alongside the broader macroeconomic trends.As the market navigates the post-Fed landscape, the options trading activity and the performance of individual stocks will continue to provide valuable insights into the evolving investment landscape and the potential impact of the central bank's actions.