As the world watches with bated breath, the highly anticipated U.S. Presidential election is set to take place tomorrow, marking a pivotal moment in the nation's political landscape. Investors and market participants are bracing for a potentially volatile week, with the Federal Reserve's latest interest-rate decision scheduled for Wednesday adding to the anticipation.

Charting the Course: Navigating the Shifting Tides of the U.S. Political Landscape

Preparing for Potential Volatility

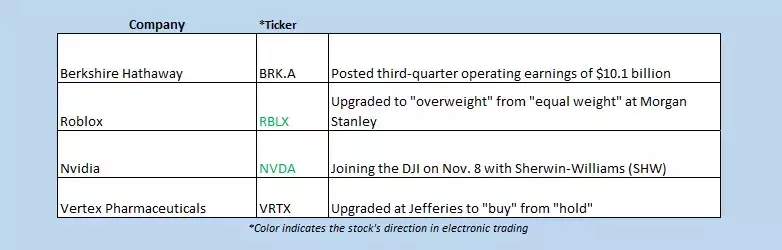

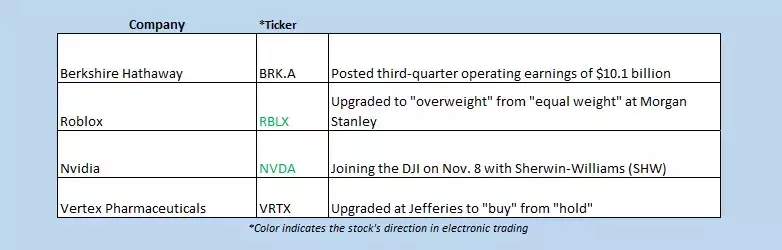

Stock futures are muted this morning, as investors gear up for a potentially volatile week. According to CME Group's FedWatch tool, traders are pricing in a 96% chance of a rate cut, further adding to the uncertainty. Investors will be closely monitoring the Federal Reserve's decision, as it could have significant implications for the broader market.Reshuffling the Dow: Nvidia's Rise and Intel's Departure

Over the weekend, S&P Dow Jones Indices announced a significant change to the 30-stock Dow Jones Industrial Average. Chip manufacturer Nvidia (NVDA) will replace sector peer Intel (INTC) by the end of this week, reflecting the growing importance of the semiconductor industry and the shifting dynamics within the technology sector.Diving into Tech Earnings: Insights and Implications

Investors will also be closely following the latest round of tech earnings, which could provide valuable insights into the industry's performance and future prospects. The rebound in the tech sector has been a key driver of the market's recovery, and the upcoming earnings reports will be closely scrutinized for clues about the sector's continued strength.Walmart's Resilience: A Beacon of Stability in Uncertain Times

Amidst the market's volatility, Walmart (WMT) has emerged as a potential bright spot, with the retail giant's stock poised to continue its upward trajectory. Analysts are optimistic about the company's ability to navigate the challenges posed by the pandemic and maintain its position as a leading player in the consumer discretionary space.Big Tech's Quarterly Results: Navigating the Shifting Landscape

The upcoming earnings reports from tech giants such as Apple, Amazon, and Alphabet will be closely watched, as investors seek to understand the industry's performance and the potential impact of the ongoing pandemic on these companies' operations. These results will provide valuable insights into the broader technology sector and its role in shaping the economic landscape.Intel's Sunny Forecast: A Glimmer of Hope in the Semiconductor Sector

Despite the changes in the Dow, Intel (INTC) has managed to maintain a positive outlook, with the company's recent earnings forecast providing a glimmer of hope for the semiconductor industry. Investors will be closely monitoring the company's performance and its ability to adapt to the evolving market dynamics.You May Like